First the good news – on July 17, 2020, the government announced that the Canada Emergency Wage Subsidy (“CEWS”) will be extended until December 19, 2020 and has released draft legislation to support the extension until November 21, 2020.

And with that, the bad news – no details have been released related to the period from November 22, 2020 to December 19, 2020 and the CEWS calculations for Periods 5 and later are both painful and complicated.

CEWS 2.0 will provide tiered support to businesses that have experienced any degree of decreased revenues and will provide an additional subsidy for those hit hardest by the pandemic. Effective July 5, 2020 (Period 5), the CEWS will now consist of two parts:

- Base subsidy – available to any employer who has experienced a decline in revenues; and

- Top-up subsidy – an additional 25 per cent available to employers who have experienced a 50 per cent or greater decrease in revenues.

It is important to note that the changes summarized below only apply to active employees. The wage subsidy for employees that have been furloughed (i.e. leave with pay) will remain the same for Periods 5 and 6. Thereafter, the CEWS for these employees will be adjusted to align with benefits provided under the Canada Emergency Response Benefit (“CERB”) (see Furloughed Employees below).

Base Subsidy

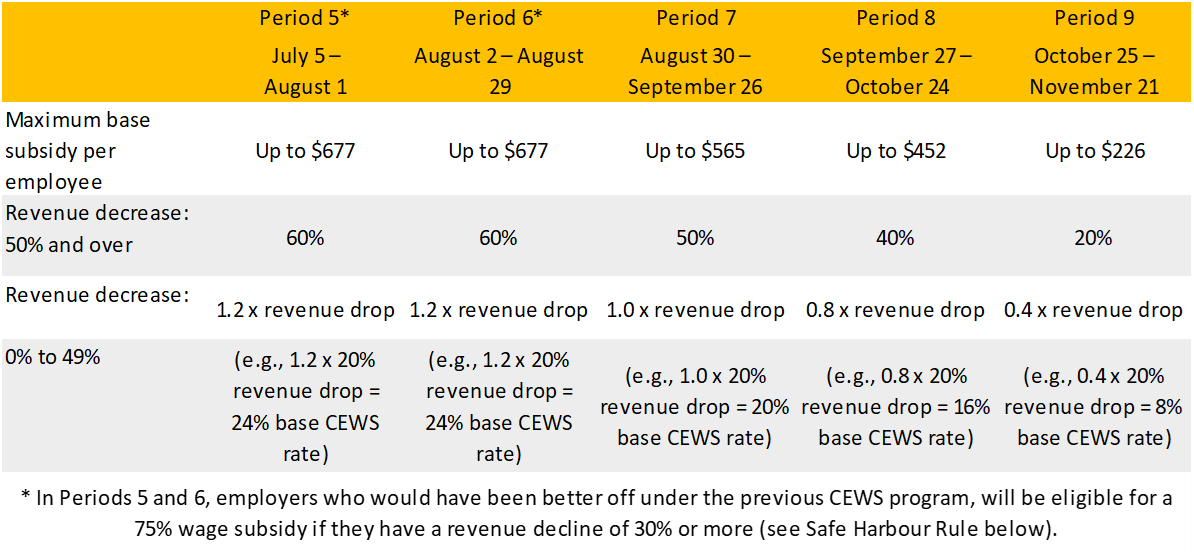

All eligible employers with a revenue decrease will now qualify for the wage subsidy. Those businesses that have experienced a 50 per cent or greater decrease in monthly revenues will be entitled to a flat percentage subsidy of an employee’s weekly wage, whereas businesses that have experienced a less than 50 per cent decrease in monthly revenues will be entitled to a percentage based on a sliding scale. The base subsidy rates will be as follows:

Top-Up Subsidy

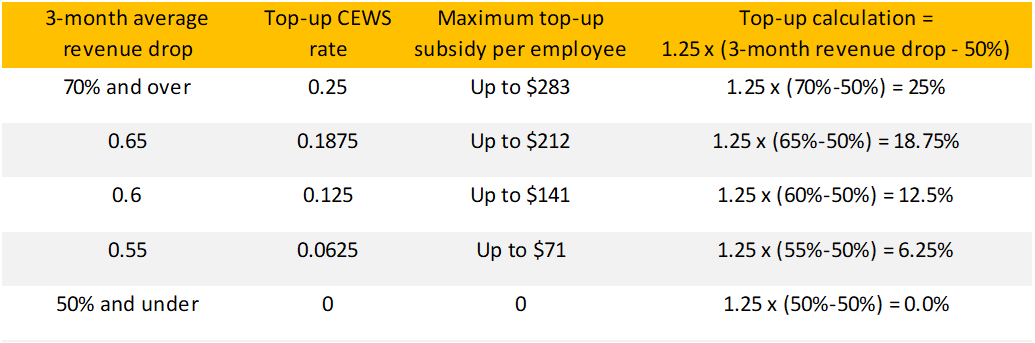

CEWS 2.0 introduces the concept of the “top-up revenue reduction percentage”. The “top-up revenue reduction percentage” will be equal to the average monthly revenues of an eligible employer for the preceding three calendar months over either the average monthly revenues for the same period in 2019 or the average monthly revenues for January and February 2020. For example, for Period 5 of the CEWS (July 5 – August 1), a business will need to look at its average monthly revenues between April and June 2020 and compare it to the average monthly revenues between either April and June 2019 or January and February 2020. While an employer can choose to use the average monthly revenues for the preceding three calendar months in the prior year or the average January and February 2020 revenues, once it makes that decision, it must use the same approach for all remaining periods.

The excess of the “top-up revenue reduction percentage” over 50 per cent will be multiplied by 1.25 to determine the employer’s top-up subsidy rate, providing a maximum additional wage subsidy of 25 per cent to businesses that have experienced a greater than 50 per cent decrease in its revenues. The top-up subsidy rate for selected levels of average revenue drops for the preceding three calendar months will be as follows:

Overall CEWS Rate and Safe Harbour Rule

For Periods 5 and later, the base subsidy rate will be added to the top-up subsidy rate to determine the overall CEWS rate. To determine the overall CEWS 2.0 subsidy amount, this rate is then multiplied, for each eligible employee, by the lesser of:

- The actual remuneration paid in the week to the eligible employee;

- $1,129; or

- For non-arm’s length employees only, the lesser of the actual remuneration paid in the week to the employee or the employee’s baseline remuneration.

The definition of baseline remuneration has also changed under CEWS 2.0. For Period 4, baseline remuneration of an employee will be based on the average weekly remuneration paid to the employee from January 1 to March 15, 2020; from March 1, 2019 to May 31, 2019; or from March 1, 2019 to June 30, 2019. For Period 5 and subsequent periods, the baseline remuneration of an employee will be the average weekly remuneration paid to the employee from January 1 to March 15, 2020 or from July 1, 2019 to December 31, 2019. Employers will be permitted to choose which period to use on an employee-by-employee basis.

The overall CEWS rate calculations for each of the extended periods can be found in the Appendix.

For Periods 5 and 6, eligible employers who have experienced a monthly revenue decrease of 30 per cent or more will be entitled to a wage subsidy equal to the greater of the amount calculated under CEWS 2.0 or the amount calculated by using the original CEWS formulas. In this way, no employer with a 30 per cent or greater decline in revenues will be worse off under CEWS 2.0 for Periods 5 or 6.

Furloughed Employees

The calculation of the wage subsidy for furloughed employees will remain the same for Periods 5 and 6 under CEWS 2.0, including the recovery of employer contributions to the Canada Pension Plan, Employment Insurance, the Quebec Pension Plan and the Quebec Parental Insurance Plan; however, for Periods 7 and later, the amount of the CEWS for furloughed employees will be adjusted to align with the amount provided under the CERB. Similar to active employees, starting in Period 5, the CEWS will be available to employers for the wages of furloughed employees if they have experienced any decrease in revenues.

In other words, employers with furloughed employees will no longer be restricted from claiming the CEWS to the extent they have experienced a 30 per cent or greater decrease in revenues.

Additional Changes Under CEWS 2.0

- For Period 5 and subsequent periods, the definition of an “eligible employee” will no longer exclude employees that have not received remuneration for 14 or more consecutive days in a period.

- For Period 5 and subsequent periods, in calculating its base subsidy rate, an employer will be permitted to use either the percentage revenue decrease in the current month or the previous month, whichever is greater.

- Employers that have or have not used the alternative approach to calculating revenues in Periods 1 through 4 (i.e. average monthly revenues between January and February 2020 versus the same month’s revenues in the prior year) will be able to switch their approach for CEWS 2.0. The switch would lock-in an employer to use that approach for Periods 5 to 10.

Monthly applications for the CEWS, including any for CEWS 2.0, will need to be made before February 2021.

How Can Crowe Soberman Support You?

In these uncertain times, it is essential to remain agile and proactive as the COVID-19 situation unfolds. Having timely access to financial experts, insights and news as quickly as possible is critical—and that’s where we can help.

We have established a dedicated COVID-19 Resource Hub, highlighting areas of business operations that will likely be impacted by coronavirus. Whether you need to discuss your current financial situation and learn what options are available to you, or you want to be guided through the appropriate cash flow management strategies for your business, our team of experts are ready to help you at every step of the way. Please do not hesitate to reach out to your Crowe Soberman professionals for support during these challenging times.

We are in this together.

This article has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.