Current as of April 11, 2020

Additional details related to the 75 per cent wage subsidy, the Canada Emergency Wage Subsidy (“CEWS”), were released on April 11 and 8, 2020. This update, enhanced, expanded, changed and, in certain cases, clarified the CEWS program which was originally announced on April 1, 2020. While the federal government has announced how the CEWS will work and has now tabled legislation in the House of Commons, some of the finer details and atypical situations have still not been addressed.There are many questions still unanswered.

What We Currently Know

Unlike the 10 per cent Temporary Wage Subsidy for Employers (“TWSFE”), all businesses, including corporations, partnerships, and sole proprietors, may be eligible for the CEWS, irrespective of whether the business is a Canadian controlled private corporation and had taxable capital of less than $15M in the prior year (on an associated group basis), is a partnership of individuals or corporations that met the same criteria above, or is operated by an individual.

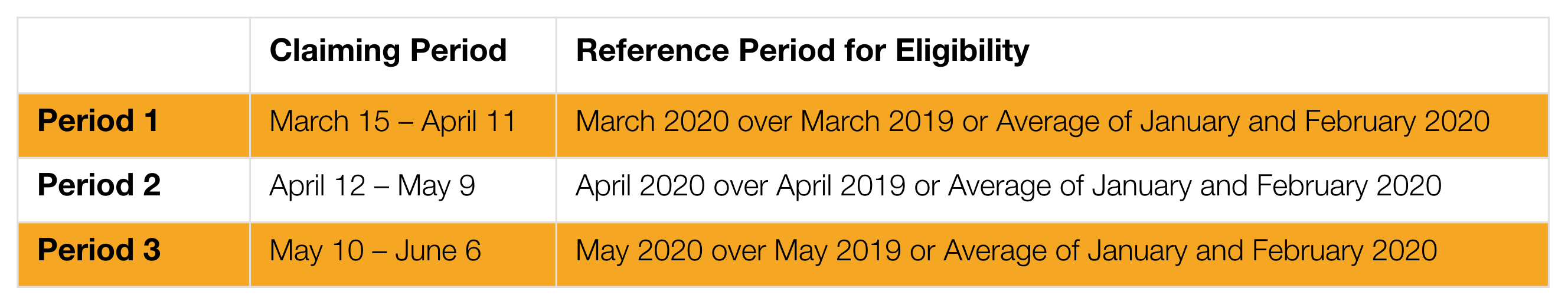

The CEWS will be in place from March 15, 2020 to June 6, 2020, a period of 12 weeks, and eligible employers will qualify if they have experienced a reduction in gross revenues of no less than 15 per cent in March and no less than 30 per cent in April and/or May. In assessing whether an eligible employer meets the required decline in revenue, the benchmark for comparison will be either:

- The same month in 2019 (i.e. March 2019 revenues compared to March 2020 revenues, April 2019 revenues compared to April 2020 revenues, May 2019 revenues compared to May 2020 revenues); or

- The average monthly revenues in January 2020 and February 2020.

An eligible employer must choose one of the comparative benchmarks above for the entire duration of the CEWS program and will not be able to toggle between them.

In addition, each month must be examined independently to determine if the employer qualifies for the CEWS for remuneration paid to an employee in an Eligible Period. For example, if a business suffered a decrease in revenues of 15 per cent or more March 2020, the CEWS would be available for remuneration paid to employees between March 15 and April 11.

If an employer is eligible for a specific period, it will automatically qualify for the next period of the program. For example, an employer with a revenue drop of more than 15 per cent in March will qualify for the first and second periods of the program. An employer with a revenue decrease of 30 per cent in April will be eligible for the CEWS for the second and third periods.

Unfortunately, businesses without comparative revenues for March, April and/or May 2019 will only be eligible for the CEWS by comparing monthly revenues to the average of January and February 2020’s revenue. There will be no “reasonable benchmark” option as originally announced.

For purposes of the CEWS, revenues will exclude revenues from extraordinary items, as well as capital gains and losses. While generally, amounts derived from persons or partnerships not dealing at arm’s length will also be excluded from an entity’s revenues, where 90 per cent or more of an employer’s revenues are derived from persons or partnerships not dealing at arm’s length, the parties can jointly elect to use a complicated formula to determine eligibility.

If 90 per cent or more of the revenue of an eligible entity is in respect of joint venture income, then the employer may use the qualifying revenues of the joint venture itself for CEWS purposes. In addition, affiliated entities can elect to use the consolidated revenues of the group for purposes of qualifying for the CEWS.

Revenues can be calculated on an accrual basis or a cash basis, but not a combination. Again, once a method is chosen, an eligible employer must use that method for the entire duration of the program.

Employers that engage in artificial transactions to reduce revenue for the purpose of claiming the CEWS will be subject to a penalty equal to 25 per cent of the value of the subsidy claimed, in addition to a repayment in full of the subsidy that was improperly claimed.

Eligible employers who qualify for the CEWS will be able to apply for a subsidy for each employee in respect of a week equal to the greater of:

1. The least of:

- 75 per cent of the actual amount of remuneration paid to the employee in respect of a week in the qualifying period;

- $847; and

- Nil if the employee does not deal at arm’s length with the employer.

2. The least of:

- 100 per cent of the actual remuneration paid to the employee in respect of a week in the qualifying period;

- $847; and

- or 75 per cent of the employee’s “pre-crisis weekly remuneration”.

In addition, the CEWS has been expanded to include a 100 per cent refund of the employer paid portion of the Canada Pension Plan, Employment Insurance, the Quebec Pension Plan and the Quebec Parental Insurance Plan for furloughed employees. Furloughed employees will be those on leave, with pay throughout the week, but who do not perform any work for the employer in that week. This portion of the refund will not be subject to a weekly maximum and would be applied for at the same time as the regular CEWS.

Unlike the TWSFE, there will be no maximum subsidy amount that an eligible employer can receive – the amount an eligible employer can receive will be based on the number of employees employed. It is important to note that any amount received will be considered government assistance and will be taxable.

Employers will have to reapply for the CEWS every month and will need to attest to its decline in revenues. The new CEWS will not be tied to employer payroll source deductions, rather these amounts will continue to be required to be withheld from an employee’s pay and remitted to the Canada Revenue Agency (“CRA”).

The government acknowledges the difficulties in determining how to measure a decrease in revenues for a charity or not-for-profit and will be working with them to determine a definition of gross revenues that is appropriate to their circumstances.

Employers can apply for the CEWS through CRA’s My Business Account portal or via a web-based application. It is anticipated that these application portals will be operational in the next three to six weeks, and employers should see the first subsidy payments shortly thereafter.

Employers who do not qualify for the CEWS are still eligible for the TWSFE assuming they meet the specific criteria for that subsidy. Any benefit from the TWSFE will reduce the amount available to be claimed under the CEWS program for the same period. It is not yet clear whether an employer eligible for both the CEWS and the TWSFE must first claim one or the other. For more details on the TWSFE, please visit COVID-19: Temporary Wage Subsidy for Employers.

Eligible remuneration for the CEWS will exclude periods in which an employee has not received employment remuneration for a consecutive period of 14 days. This is intended to prevent employees from claiming the Canadian Emergency Response Benefit for the same period that an employer would claim the CEWS.

Finally, the CEWS will be reduced for any benefit received by an employee under the EI Work-Sharing Program.

How Can Crowe Soberman Support You?

In these uncertain times, it is essential to remain agile and proactive as the COVID-19 situation unfolds. Having timely access to financial experts, insights and news as quickly as possible is critical—and that’s where we can help.

We have established a dedicated COVID-19 Resource Hub, highlighting areas of business operations that will likely be impacted by coronavirus. Whether you need to discuss your current financial situation and learn what options are available to you, or you want to be guided through the appropriate cash flow management strategies for your business, our team of experts are ready to help you at every step of the way. Please do not hesitate to reach out to your Crowe Soberman professionals for support during these challenging times.

We are in this together.

This article has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.