Surplus income is calculated based on the number of members in the household, the net household income, less non-discretionary expenses, such as:

- child and spousal support

- childcare

- medical expenses

- self-employed business expenses and income taxes payable.

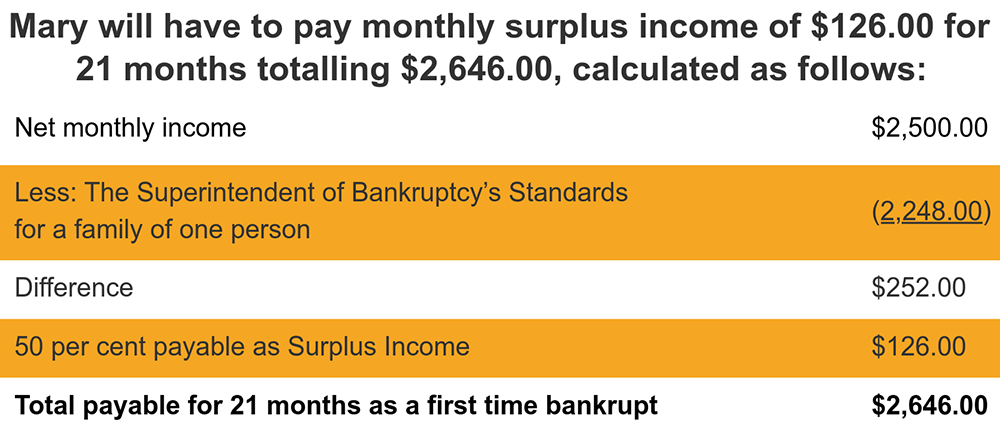

Every dollar that a bankrupt family earns above the level set by the Superintendent of Bankruptcy is subject to a surplus income payment of 50 per cent while a person remains bankrupt.

Let’s look over an example of surplus income:

Mary, who is single, has filed a first-time bankruptcy and earns a monthly net salary of $2,500.00. The Superintendent of Bankruptcy has set the monthly amount of $2,248.00 for a family of one person.

For many individuals today, unmanageable debt is just that: unmanageable. Reaching that point may have taken many years, or it may have happened suddenly because of life’s stresses or COVID-19.

Contact a member of the Crowe Soberman Inc. team for a consultation at no cost to you. We are here to offer support and a solution.

This article has been prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained in this article. Please note that this publication should not be considered a substitute for personalized tax advice related to your particular situation.