One of the first major decisions to be made when starting a new business is determining the type of business structure it will take on. Simply put, a business structure is how you will own and operate the business. Before starting, you must determine which structure is best for your business, and ask yourself whether you wish to work by yourself as a sole proprietor, together with another person or persons in a partnership, or as an incorporated entity. Each of these three structures have unique advantages and disadvantages, especially in regards to legal and tax matters.

Which structure should you choose?

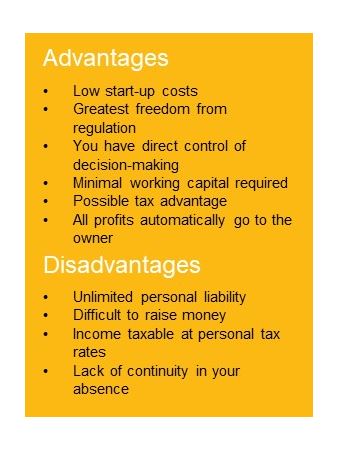

Sole Proprietorship

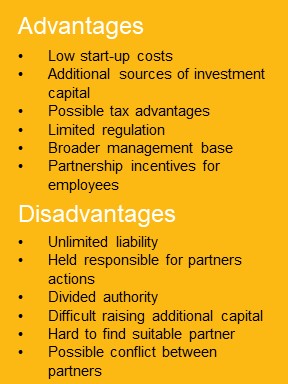

Partnership

A partnership is an alternative business structure that can be beneficial to you if you want to carry on business with a partner without having to incorporate your business. In a partnership, you and other like-minded individuals can pool your collective resources to form a business. With this in mind, there are two type of partnerships: general and limited liability.

In a general partnership, each individual has the ability to exercise authority in addition to having a share of the company’s assets and liabilities. Essentially, each partner is responsible for the actions and consequences of the other partner(s).

In a limited partnership, some partners control and manage the business while others limit their involvement and simply serve to provide capital. As a limited partner takes no part in the control or management of the business, their liability is limited to their investment.

In either case, before you enter into a partnership, it is recommended you draw up a detailed legal agreement to establish the terms of your business and type of partnership so you can be protected in case of a disagreement or dissolution.

A partnership is a legal entity recognized under the law, and as such, it has rights and responsibilities in and of itself.

A partnership can sign contracts, obtain trade credit, and borrow money. However, a partnership is similar to a sole proprietorship in a few regards. Much like a sole proprietorship, each partner’s share of income is combined with their personal income and may need to be reported through a Partnership Information Return.

Corporation

A third option is incorporation whereby you form a corporation. A corporation is a separate legal entity that exists under the authority granted by provincial or federal law. By incorporating, you and others own shares issued by your corporation.

A corporation has all the legal rights of an individual and is responsible for its own debts. It must also file income tax returns and pay taxes on income it derives from its operations. Typically, the owners or shareholders of a corporation are protected from the liabilities of the business; however, when a corporation is small, creditors often require personal guarantees of the principal owners before extending credit. The legal protection afforded to the owners of a corporation can outweigh the additional expense of starting and administering a corporation. This protection can be limited in certain industries, so seeking independent legal advice is important.

A corporation must obtain permission from provincial or federal authorities to use or do business under a registered name. A corporation must also adopt and file Articles of Incorporation and By-laws, which govern its rights and obligations to its shareholders, directors, and officers.

Corporations must file annual federal income tax returns and, in some provinces/territories, provincial/territorial tax returns.

Incorporating a business allows a number of other advantages such as the ease of bringing in additional capital through the issuance of equity, or allowing individuals to sell or transfer their interest in the business. It also provides for business continuity when the original owners choose to retire or sell their interest.

Should you decide to incorporate your business venture, you should seek the advice of competent legal counsel and accountants.

Your professional advisors can help you work through the advantages and disadvantages depending on your personal situation, but ultimately it is your decision.

Additional Tool Kit Chapters