What Are No-Show Fees?

A no-show fee is charged when a customer makes a reservation but does not show up without cancelling. These fees are intended to discourage missed reservations, which penalize restaurant owners.

Tax Implications

Revenu Québec confirms that no-show fees are taxable under both the GST and the QST regimes and are deemed to include tax because they are paid as a result of the modification, cancellation or failure to uphold a contract for a taxable supply.

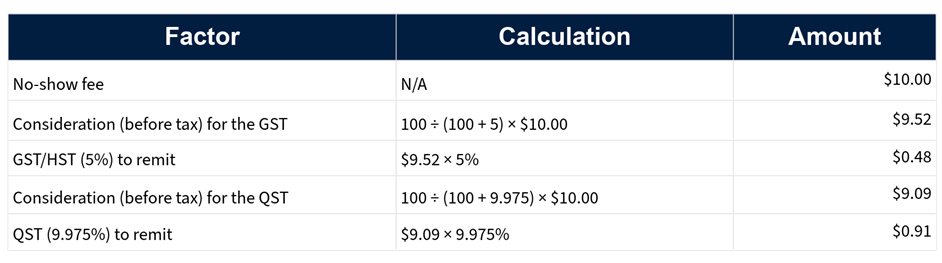

Restaurants registered for GST and QST are required to extract and remit the applicable taxes on no-show fees. The taxable consideration can be calculated using the following formula:

100 ÷ (100 + tax rate) × fee

Revenu Quebec provides the following example to illustrate the exercise:

What This Means for Your Business

If your business charges no-show fees, the $10 fee is really $8.61 for the restaurant, with the rest being amounts on account of GST and QST. Restaurant’s invoicing and accounting systems should be tested to ensure taxes are calculated and reported correctly on this new stream of income.