COVID-19: Effect of Discount for Lack of Marketability on Private Companies Valuation

In valuing private equity investment, there are several valuation parameters which can affect the value of private companies. One of these would be Discount for Lack of Marketability (“DLOM”). DLOM can be defined as “an amount or percentage deducted from the value of an ownership interest to reflect the relative absence of marketability”1. Value of a business is usually sensitive to the magnitude of DLOM applied.

In this article, we discuss about how the current COVID-19 pandemic can affect DLOM and ultimately, the value of private companies.

Economic uncertainties will increase as the COVID-19 pandemic continues to prolong. Huge swings in equity market volatility will also begin to weigh down on the valuation of many businesses. As such, depending on the standard of value that is adopted, one should always take note that certain adjustments on DLOM are required in valuing privately-owned businesses.

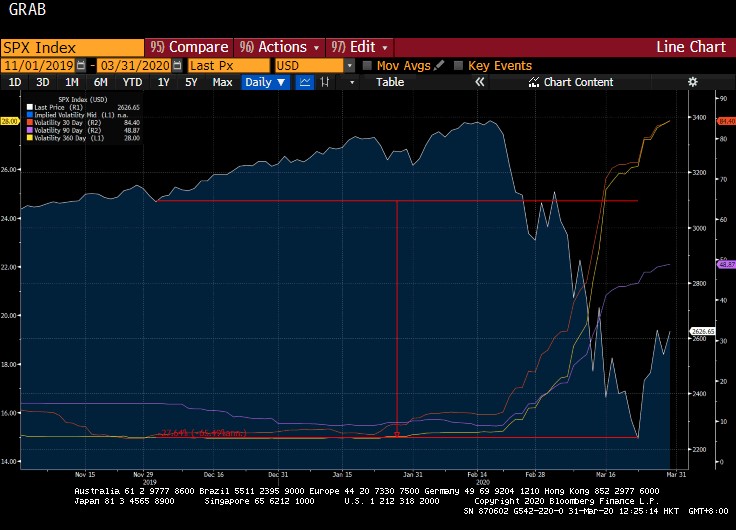

The SPX Index has declined by some 27% over the last few months since the beginning of the COVID-19 outbreak and stock market volatility has increased substantially2, as observed in the following graph:

Figure 1: Bloomberg SPX Index

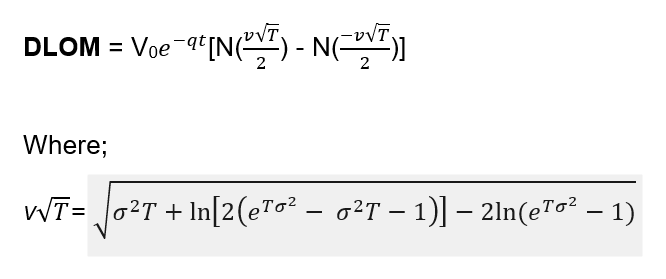

Based on the Finnerty Model3, DLOM can be modelled using an average strike price put option. This model assumes that investors are not able to time the market to buy at its lowest nor sell at its highest and as such, investors will be neutral in exercising this put option.

The Finnerty Model for DLOM is as follows:

According to the AICPA Practice Guide, the strength of such a put-based method is that it appropriately captures the relationship between the duration of the restriction and volatility and have been corelated with limited observable market data.

Therefore, as volatility ![]() increases, and based on the Finnerty Model, we should expect a higher DLOM as a result.

increases, and based on the Finnerty Model, we should expect a higher DLOM as a result.

If we further relate the concept of DLOM to optimal portfolio allocation and economics, and assuming investors are generally risk averse, an investor might not want to invest in an illiquid asset (such as private equity investment) during periods of uncertainty and would prefer to hold onto safer assets such as government bonds. This trend was evident during the Global Financial Crisis, despite US Government bond yield declined4.

Government bonds are usually priced by their yields. Market demand for risk-free fixed income securities will drive the prices of government bond up correspondingly. Given the inverse relationship between bond price and yield, bond yield will eventually be reduced. In short, empirical evidence suggests that safer assets (such as government bonds) would be appealing to investors as compared to risky and illiquid assets (such as private equity investments) during an economic downturn.

We have made a similar observation when US Government bond yield declined over the last few months after the COVID-19 outbreak was first reported in December 20195. With lacklustre equity market sentiment as a consequence of disruptions in business operations, market players had started shifting from equity portfolios to holding on to safer assets. As a result, it becomes less marketable for private equity investments, which gives rise to higher DLOM in valuing these illiquid private equity investments.

Due to high discount rate, private equity holders would therefore expect to see their businesses (some even with strong fundamentals and track records) to be under-valued during COVID-19, hence become less enticed to sell.

In conclusion, one needs to exercise professional judgment in assessing the magnitude of impact brought upon by COVID-19 and through DLOM, make reasonable adjustments to reflect the value of a business in this period of time.

1Source: https://www.appraisers.org/docs/default-source/default-document-library/bv-standards.pdf?sfvrsn=2 and AICPA Practice Guide Glossary.

2Source: Bloomberg SPX Index.

4As an example, sourced from Bloomberg, from mid-2007 to mid-2009, a 2-year US Government bond yield decreased by about 57% (annualized) and a 5-year US Government bond yield decreased by about 29% (annualized).

5Source: Bloomberg.