The Inland Revenue Authority of Singapore (IRAS) has revised the formula for computing car benefits with effect from the Year of Assessment (YA) 2020 to simplify tax compliance, as well as to better indicate the value of the actual benefits enjoyed by employees.

Following the revision, employees are no longer required to log their private mileage travelled arising from the private usage of the cars, except in the case where a driver is provided.

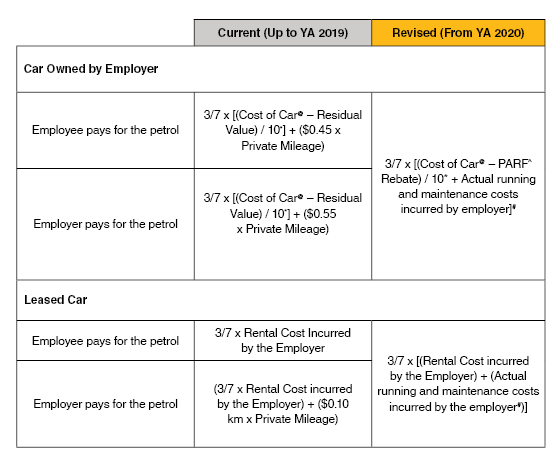

The current formula (up to YA 2019) and the new formula effective from YA 2020 for computing car benefits are as follows:

@ The cost of car refers to the acquisition cost (inclusive of COE, registration fee, ARF, excise duty and cost of additional accessories) paid or payable at the date of purchase for cases where the employer is the first owner of the car or where the employer provides the employee with a second-hand car. For a car with renewed COE, the cost of car refers to the cost of COE and the amount of PARF rebate that the owner would have received on the expiry of his first COE if not for the renewal.

*Or the remaining period from the date of purchase of the car to the date of expiry of the first COE or renewed COE.

^PARF refers to the Preferential Additional Registration Fee Rebate to be granted when the car is de-registered at the age of above 9 but not exceeding 10 years. For a car with renewed COE, PARF rebate shall equal to nil.

#Actual running and maintenance costs, include reimbursements made to the employee by the employer. Examples of such costs include road tax, petrol, car park charge, ERP charge, car insurance, repairs and maintenance, if any.

For further information, please refer to IRAS’ website.

Source: Inland Revenue Authority of Singapore