Opportunities abound in the Canadian gig economy. Yet as many independent contractors can attest, navigating tax season can add stress to the self-employment journey. Here’s where professional support and a stronger understanding of one’s annual tax obligations can bring peace of mind.

At Crowe Soberman, our self-employed clients have some important questions when June comes around.

What are your tax obligations?

Whether you call yourself an influencer, freelancer, content creator, gig worker, free agent, or independent contractor, in the eyes of the Canada Revenue Agency ("CRA"), you are self-employed. Regardless of how many years you have been in business, you are required to use the self-employment form (Form T2125, Statement of Business or Professional Activities) when filing your personal taxes. At this point, you must declare all the income you invoiced for during the tax year and list any write-offs or deductibles you wish to claim.

There are several tax deductions to consider. What you claim depends on the types of products or services you provide and what you spend to run your business. Crowe Soberman’s team of professionals helps gig workers identify the various deductions and write-offs they are entitled to, ensuring they are prepared to defend those claims if the CRA decides to ask for proof (e.g., receipts, statements, etc.)

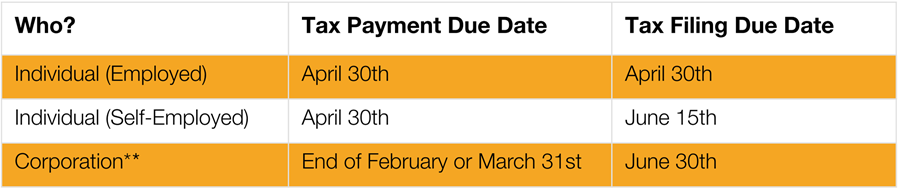

There are key deadlines that independent contractors must keep in mind every tax year. Namely, self-employed Canadian citizens have until June 15 to file their personal tax return, which is longer than the April 30th* deadline imposed on those who work for an employer.

*For the 2022 tax year, the payment/filing date is May 1, 2023.

**Assuming a December 31st fiscal year-end.

At some point, the CRA may instruct you to begin paying tax installments every quarter. In this case, you will receive a letter informing you to pay a certain amount towards your net tax owing on March 15, June 15, September 15, and December 15. The consequences of missing these dates will result in owing interest, which is an area where our business management and tax professionals can help. We make a point of reminding clients of their installments well in advance, avoiding unnecessary payments and relieving you of these urgent financial concerns so that you can focus on building your business.

How much will you have to pay?

You can perform basic calculations on your own to get a ballpark estimate of how much you will owe. Depending on your expected income and expenses for the year, a tax professional can assist you with determining how much tax you should be holding back. However, you ultimately won't know exactly how much you owe until you file your taxes. Consulting with a financial professional upfront will help you optimize your financials over the year, enabling more advanced and accurate forecasting. Our advisors can suggest strategies for saving towards the optimal amount given your revenue levels, while taking any fluctuation into consideration.

What about HST?

If you earn more than CAD $30,000 in revenue during the tax year, you are required to register for Harmonized Sales Tax (HST) and then collect and remit HST on your transactions moving forward. The HST amount varies depending on your home province/territory, and like your income tax payments, you may be asked to submit quarterly instalments if you make above a certain amount. There is also a potential that you may be able to recover HST paid on your business expenses. It's important to note that non-residents of Canada are also beholden to HST obligations when working in Canada.

What are the penalties for late payments?

If a tax deadline is missed, you will pay interest on the amount you owe every month. This can add up over time, which is why we suggest that gig workers take a critical look at payment deadlines and work around the year to ensure the right amount is saved when those timelines approach.

Why is it important to put money aside?

A strategic savings plan will set you up for success come tax time. As an independent contractor, the money you receive from clients might look good in your account, but it's not entirely yours. This can be a tricky mindset to adopt, especially for new freelancers who are used to having their taxes subtracted from their cheques automatically by an employer. Nevertheless, putting aside a portion of the money you receive into a separate banking account or investment is a critical habit to adopt.

Should you incorporate your business?

There are various factors to consider before incorporating your business. In addition to compliance costs relating to incorporating, the structure of the business needs to be aligned with your personal circumstances. At Crowe Soberman, we aim to help guide you through the crucial decisions leading to a more successful business - our team can help you determine whether incorporating is the right step.

Don’t let taxes deter you from following your passion.

We get it. Paying taxes as an independent contractor requires more planning and a deeper understanding of Canada's tax obligations than you may be used to. However, you became self-employed to pave your own path, and taxes shouldn't get in the way. Our expert team of professionals are committed to ensuring your tax affairs are planned optimally and that your business and income streams are structured in a strategic and coordinated manner. Our goal is to take tax preparations and obligations off your plate so you can focus on building your business.