Should I buy or lease a car?

A detailed analysis of the numbers

Initial Factors to Consider

When determining whether to buy a lease a car, there are a few important aspects to first take into consideration before making your decision:

Typical Mileage

In a lease agreement, if you already know that you won’t meet the mileage limits set out in the lease terms, consider the fact that you would likely end up paying for mileage you won't ever use. If that’s the case, financing would be the more fiscally responsible decision.

Warranty

Typically, during the lease or finance term of a vehicle, the car is covered through a warranty. Some individuals prefer to have a car that is always under warranty, so in case something goes wrong, the car is always covered under the agreement. If you purchase a vehicle, you’re generally only able to get a three to four-year warranty, so for the latter half of the life of the vehicle, the owner will be the one responsible for any unforeseen issues, usually out of their own pocket.

For those who want to avoid the risk of dealing with and paying out of pocket for any future vehicle issues, leasing would be the ideal option since the vehicle would remain under warranty for the duration of your lease.

Personal Preference

Some people love to have the latest and greatest when it comes to their vehicle and flip their cars every few years. Others enjoy not having the responsibility of negotiating a trade-in or resale of their car. If that’s the case for you, then leasing is certainly going to be your best option. If you’re the type of individual who likes to own a car for a longer duration and not constantly be negotiating terms of leases, then purchasing or financing the vehicle would make sense for your situation.

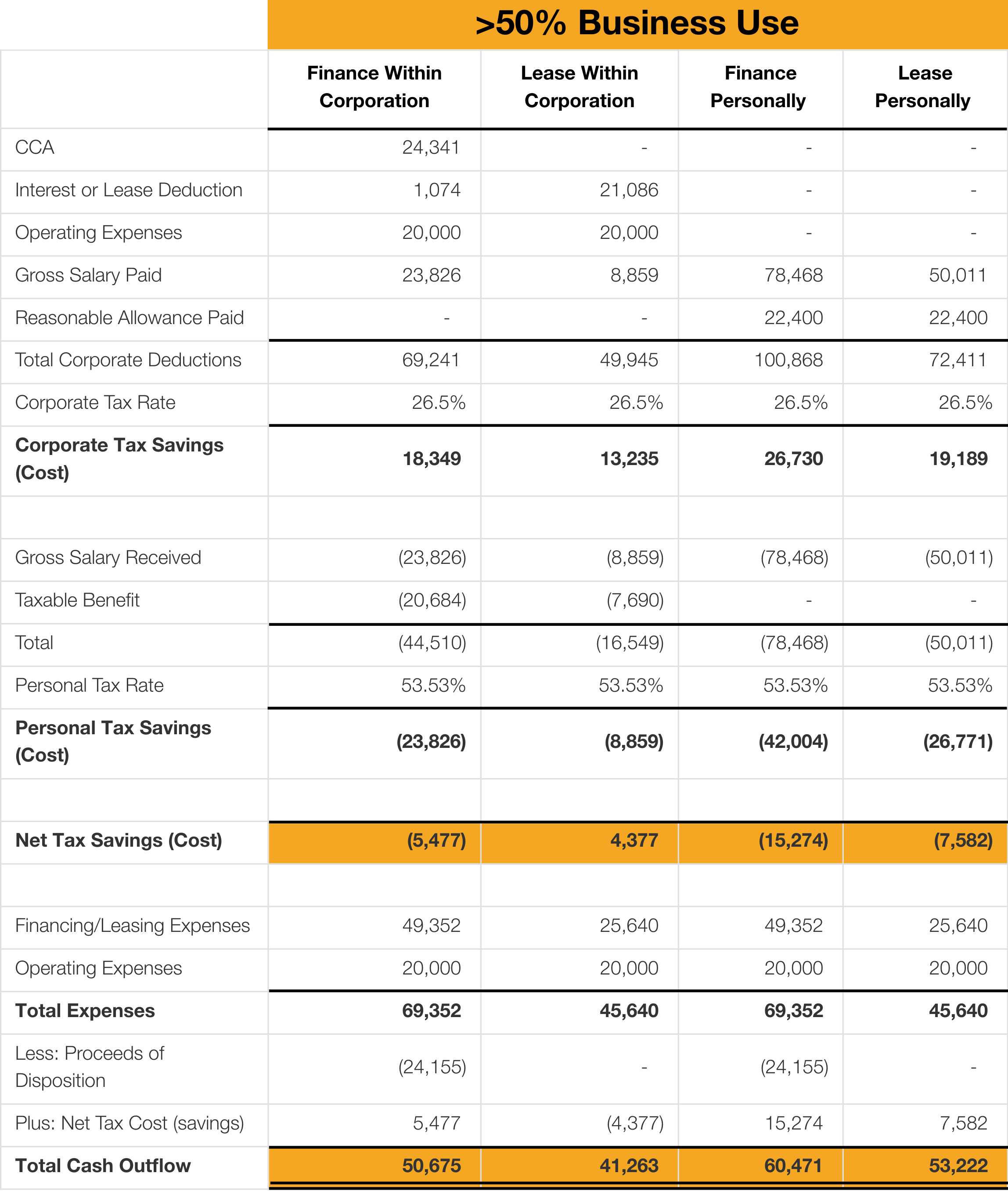

Fig. 1 – Overview of Buy vs. Lease Analysis – business use of car is greater than 50%

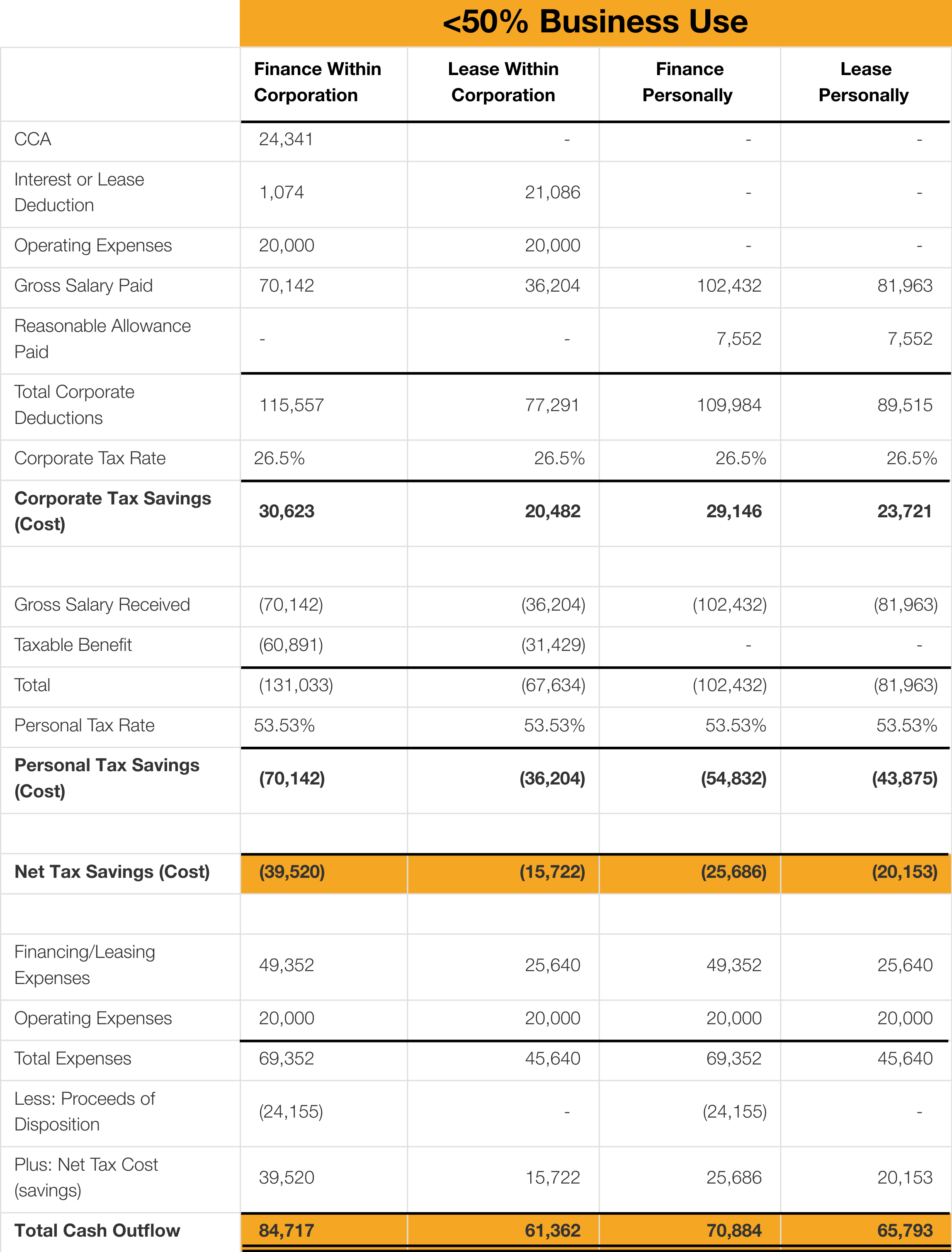

Fig. 2 – Overview of Buy vs. Lease Analysis - business use of car is less than 50%

Notes

- Assuming the company is registered for GST/HST, input tax credits ("ITC") could be claimed on the cost of the vehicle. Therefore, GST/HST on the vehicle is not included as part of the additions to the CCA class.

- CCA rate for Class 10.1 passenger vehicles is 30 per cent. Under the Regulations in the Income Tax Act ("ITA"), during the year of disposition, a deduction equal to half the amount of CCA that would be permitted as if the vehicle were not disposed of before the end of the year is permitted. Therefore, the CCA deductible in Year 4 is calculated at 15 per cent.

- Under the ITA, terminal loss and recapture do not apply to Class 10.1 passenger vehicles. The UCC balance at the end of the year of the disposal is equal to nil, with no terminal loss or recapture applying, regardless of the proceeds of disposition and remaining UCC balance.

- The corporation pays a reasonable allowance to the owner-manager for the business-use of the vehicle. This amount is deductible for the corporation but not taxable to the owner-manager.

Calculations and Assumptions

- Our calculations are based on the following figures:

- Manufacturer Suggested Retail Price (“MSRP”) of the vehicle is $48,495;

- Lease rate is 1.98 per cent APR and finance rate is 0.98 per cent APR;

- Lease kilometer allowance is 16,000 km annually;

- Lease down payment is $5,000, with monthly payments of $430 over a term of 48 months;

- Financing down payment is $5,000, with monthly payments of $924 over a term of 48 months;

- Residual value of the vehicle at end of 4 years is $24,155;

- Annual operating expenses of the vehicle is $5,000;

- In respect of the Fig.1, the total km driven in a year is 16,000 km, with 10,000 km driven for business purposes; and

- In respect of the Fig.2, the total km driven in a year is 16,000 km, with 3,200 km driven for business purposes.

- It is assumed that the corporate income is subject to the current enacted corporate general rate of 26.5 per cent, and that personal income is subject to the highest rate of 53.53 per cent.

- It is assumed the corporation is required to pay an additional salary to the owner-manager to pay the taxes on the taxable benefits received from the personal-use of the vehicle where the vehicle is either financed or leased by the corporation.

- It is assumed the corporation will need to pay a salary to the owner-manager to cover the operating costs of the vehicle.

- Where the owner-manager finances the vehicle personally, the owner-manager will have residual cash flows in year 4 (i.e. upon the sale of the vehicle) as the proceeds received on the sale will be received personally. It is estimated that the cash flows retained by the owner-manager given the above noted situation will be approximately $14,000 where the vehicle is used more than 50 per cent for business purposes and $10,000, in respect of when the vehicle is used less than 50 per cent for business purposes.

Which Option Is Right For Me?

As shown in the analysis, where the vehicle is used more than 50 per cent for business purposes, regardless of whether you are going to lease or purchase a vehicle, doing so through a corporation is much better than paying out a salary to pay for it personally. Where the vehicle is used less than 50 per cent for business use, the same holds true if you intend on leasing a vehicle. However, if you intend on purchasing a vehicle, due to increased taxable benefits from using the company vehicle for personal purposes, it becomes more costly for the corporation to own the vehicle, therefore is more tax efficient for the vehicle to be purchased personally.

The differences between leasing and purchasing within a corporation are insignificant and ultimately come down to the three key considerations discussed above (typical milage, warranty, and personal preference).

The analysis also shows leasing a car tends to be more cost efficient than purchasing a car. The difference between the two depends on the resale or trade-in value of the purchased vehicle.

The decision to buy or lease a car, and whether to do it personally or through a corporation, may seem overwhelming but our team of tax and advisory professionals are ready to help you every step of the way. Our experts will provide strategically tailored advice so that you’re confident in making the right choice for your specific situation.

This article has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.

We are in this together.

Stay up to date with relevant client tools, news items and guidelines.Related Posts

Contact Us