For a more current review, read our follow-up article What has Changed with Inter-corporate Dividends here.

In most cases, a taxable Canadian corporation can pay dividends to another taxable Canadian corporation and such dividends do not attract corporate tax, as long as the recipient corporation is connected to the payor corporation. To be connected, the recipient corporation must own shares of the payor entitling it to more than 10% of the underlying votes and value, or one of the corporations is controlled by the other corporation or by persons not dealing at arm’s length with the other corporation.

This article will focus on the proposed amendments (the “new rules”) to the corporate surplus-stripping anti-avoidance provision contained in subsection 55(2) of the Income Tax Act (Canada) (the “Act”) that prevents a corporate shareholder from converting what would otherwise be a capital gain on the disposition of its subsidiary’s shares into a tax-free, inter-corporate dividend. These new rules, introduced in the 2015 federal budget, apply to any dividends received by a connected Canadian corporation after April 20, 2015. Although these updated rules are not yet law, it is expected they will apply retroactively to April 20, 2015, once they are implemented. To avoid unwarranted tax consequences, the new rules should be examined and considered prior to the payment of inter-corporate dividends and the implementation of corporate reorganizations.

The rules in subsection 55(2) of the Act are complicated. This article will provide a brief and general discussion on the legislation that applied before the proposed amendments (the “old rules”) and will also provide an overview of some of the key amendments proposed in the 2015 federal budget.

The Old Rules

The Purpose Test

Under the old rules, subsection 55(2) applied where one of the purposes of a dividend payment, from one corporation to another, was to effect a significant reduction in the capital gain that would be realized on the disposition at fair market value (FMV) of any shares (of the dividend payor) immediately before the dividend payment. A large dividend payment by a corporation, for example, could significantly reduce the FMV of its shares, as cash has been extracted from (or a liability created on the declaration of the dividend by) the corporation. If subsection 55(2) applies, the otherwise tax-free inter-corporate dividend could be re-characterized as a capital gain on a notional disposition of the shares of the dividend payor and will be subject to tax in that year.

Under the old rules, subsection 55(2) would not apply to the dividend if one of the exemptions below is met.

The Exemptions

1. Dividend paid out of “safe income”

To the extent there is sufficient safe income attributable to the shares on which the dividend is paid, subsection 55(2) would not apply. In simplified terms, safe income is the accumulated retained earnings of the company as computed for tax purposes and that is attributable to the shares on which the dividend is paid.

2. Related party exemption

As long as there has not been a significant increase in the total direct interest(s) in the corporation by an unrelated party, subsection 55(2) would not apply. The inter-corporate dividend can be paid in contemplation of a sale of the shares to related persons without triggering subsection 55(2). For purposes of subsection 55(2), related parties include spouses, children, and parents, but do not include siblings, uncles, aunts, nieces or nephews. This exemption is critical, as it is relied upon in implementing many related party corporate reorganizations.

3. Arm’s-length split-up “Butterfly reorganizations”

These reorganizations allow arm’s-length shareholders in common to “split up” their interests in the underlying assets of a corporation. To effect such a reorganization, strict conditions must be met in accordance with paragraph 55(3)(b) of the Act. Butterfly reorganizations are beyond the scope of this article.

Old Rules Applied: An Example

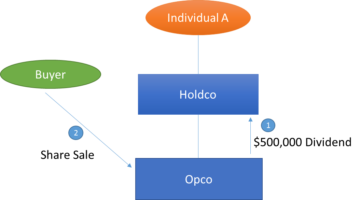

The following example illustrates the application of the existing rules:

Holdco is a holding corporation and is the sole shareholder of Opco, a corporation operating an active business. Individual A is the sole shareholder of Holdco. Prior to the sale of its Opco shares (which shares have an inherent capital gain) by Holdco, Opco pays a $500,000 dividend to Holdco to extract some or all of the underlying Opco value. Since inter-corporate dividends between Canadian corporations are generally exempt from tax, the $500,000 dividend is received tax-free by Holdco.

Holdco then sells its shares of Opco to an arm’s-length buyer. As a result of the pre-sale dividend, the FMV of the Opco shares has decreased by $500,000. Thus, a reduction in the capital gain on the subsequent sale of Holdco’s Opco shares has been effected by the dividend, resulting in the potential application of subsection 55(2). Subsection 55(2) will not apply, however, if one of the following conditions is met:

1. The full $500,000 is paid out of safe income in Opco that is attributable to Holdco’s shares on which the dividend was paid. In other words, Opco has generated and retained $500,000 of cumulative taxable income to cover the dividend payment of $500,000.

2. The buyer of the shares is a “related party” in relation to Holdco. If neither of the above two conditions is met, the $500,000 dividend could be re-characterized into proceeds of disposition on the sale of the Opco shares, giving rise to a capital gain that, but for subsection 55(2), would have otherwise been a tax-deferred inter-corporate dividend.

The New Rules

The new rules have substantially broadened the application of subsection 55(2). Corporations must now exercise more caution when considering the payment of inter-corporate dividends. The new rules expand on the old rules by encompassing an additional two purpose tests. The original purpose test, along with these additional tests, are listed below. If any one of these purpose tests is met, subsection 55(2) could apply.

The Purpose Tests

Under the new rules, subsection 55(2) can apply if one of the purposes of the dividend payment is to effect: 1. A significant reduction in the capital gain that would be realized on the disposition of any shares at FMV immediately prior to the dividend payment [original purpose test]. 2. A significant reduction in the FMV of any share [New Purpose Test #1]. This test does not apply to a dividend that results from a redemption of shares. 3. A significant increase in the cost of the dividend recipient’s property [New Purpose Test #2].Implications of Additional Purpose Tests

Under the old rules, subsection 55(2) only applied to dividends paid on shares that have an accrued capital gain. To the extent the FMV was already at or below the adjusted cost base (“ACB”) of the shares to the dividend recipient prior to the dividend payment, subsection 55(2) would not apply because there was no capital gain inherent in the shares to begin with. Under the new rules, subsection 55(2) now applies to these dividends; notwithstanding the fact that there is no capital gain inherent in the shares. Under New Purpose Test #1, it is sufficient that the dividend causes a reduction in the FMV of the shares without regard to the net gain or loss inherent in the shares.The Exemptions

The same exemptions are available under the new rules as they were under the old rules. However, both exemptions have been given significantly more narrow application:

1. Dividend paid out of “safe income”

As a result of the wording under the new rules, the safe income exemption is not available on shares with an inherent capital loss; notwithstanding that there may be sufficient safe income in the dividend payor company at the time the dividend is paid. This exemption is available only to the extent that the available safe income could reasonably be considered to contribute to the capital gain that could be realized on a disposition (at FMV) of the shares on which the dividend is paid.

2. Related party exemption

Under the old rules, the related party exemption was available on any type of dividends (including regular dividends and deemed dividends resulting from share redemptions). Under the new rules, the related party exemption is only available in respect of dividends resulting from a share redemption. Thus, the payment of regular dividends may no longer be advisable under a related party sale and/or reorganization if such dividends are not attributable to safe income, as the related party exemption would not apply, resulting in the potential application of subsection 55(2) which could convert the otherwise tax-free intercorporate dividend into a capital gain.

Contemplation of Sale of Shares to Third-Party Not Required

Under the old rules, the application of subsection 55(2) was generally only considered when a sale of the dividend-payor’s shares to a third party was in contemplation, or where there was a significant increase in the direct interest of an unrelated person in any corporation as a result of the dividend (ordinary and/or deemed). Under the new rules, however, subsection 55(2) could apply to inter-corporate dividends even though there is no contemplation of a sale of the shares to a third-party.

New Rules Applied

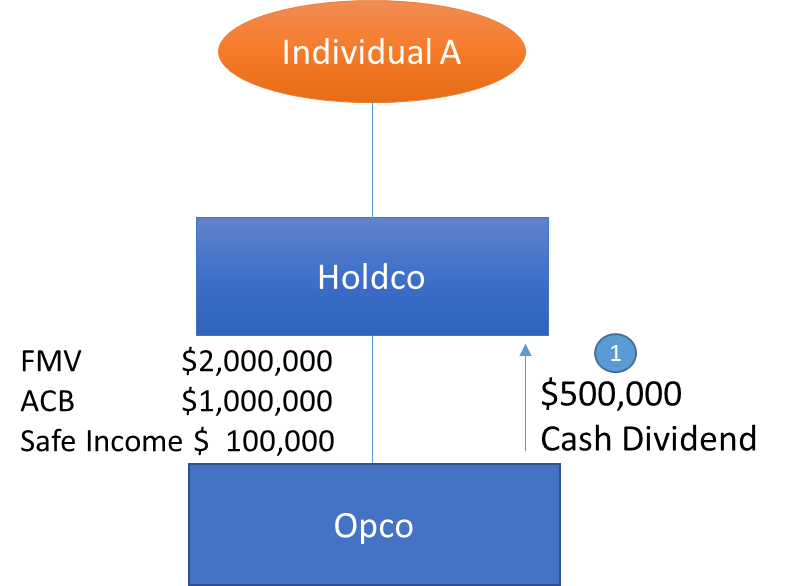

Scenario 1

In this example, Opco pays a $500,000 cash dividend to Holdco, which could be a creditor-proofing strategy. Subsection 55(2) could apply because the $500,000 dividend payment would reduce the FMV of the Opco shares by $500,000 to $1,500,000 (New Purpose Test #1). The safe income exemption cannot be fully relied upon because safe income is less than $500,000. Subsection 55(2) could, therefore, apply in this scenario even though there is no intended disposition of the Opco shares by Holdco. Therefore, $400,000 of the $500,000 dividend could be deemed to be a capital gain

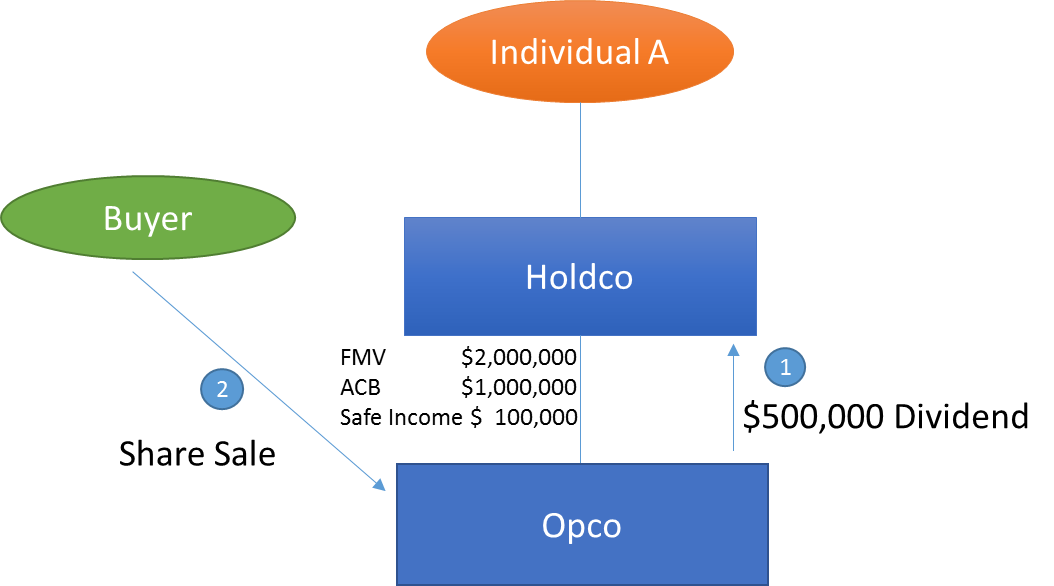

Scenario 2

This scenario is identical to Scenario 1, but the shares are subsequently sold to a related party (Buyer). The related party exemption is not available in this scenario, as the dividend is a regular dividend and not a deemed dividend arising from a redemption of shares. Therefore, subsection 55(2) could apply to deem $400,000 of the dividend that is in excess of safe income to be a capital gain on a notional disposition by Holdco of the Opco shares. In this scenario, it may be advisable (if a deferral afforded by the tax-free intercorporate dividend is desired) to structure the dividend payment as a redemption of shares rather than an ordinary dividend to avail Holdco of the related party exemption, thereby avoiding the application of subsection 55(2).

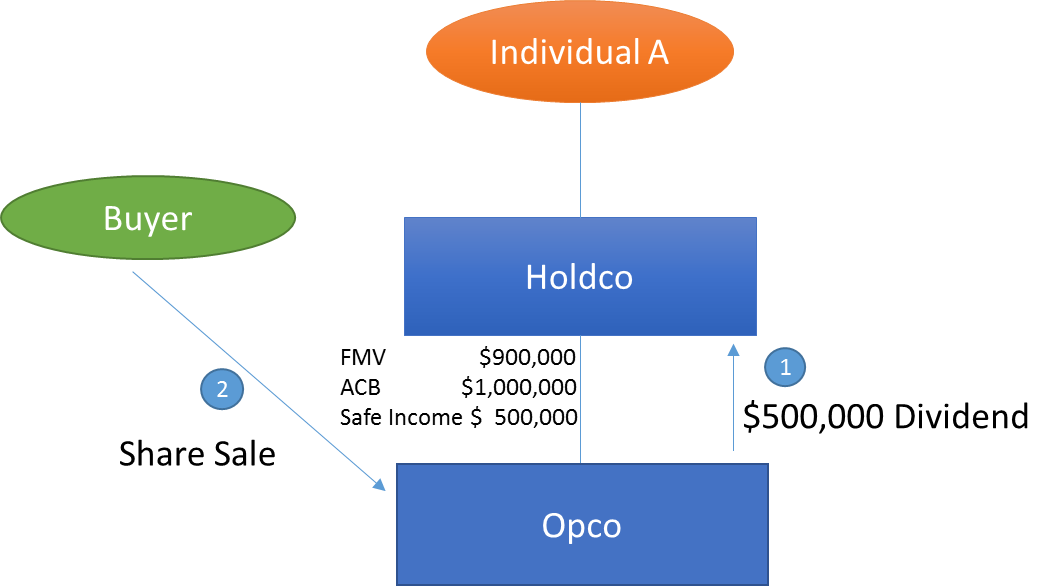

Scenario 3

This scenario is identical to Scenario 2. However, the FMV of the shares is $900,000, and safe income of $500,000 is available. Under the old rules, regular inter-corporate tax-free dividends could be paid from Opco to Holdco without triggering the application of subsection 55(2). Under the new rules, however, the safe income exemption is not available as there is an inherent capital loss in the shares of Opco. Therefore, subsection 55(2) could apply to deem the entire $500,000 dividend to be a capital gain.

Conclusion

This article only provides a brief summary of some of the key amendments to the surplus-stripping anti-avoidance rules in subsection 55(2). New measures will also ensure that stock dividends cannot be used to circumvent the anti-avoidance rule. It is reasonable to conclude that, under the new rules, corporations must now prepare and maintain timely safe income calculations, whereas they may not have been required to do so in the past. We encourage you to contact your Crowe Soberman advisor to assist you in thoroughly assessing the implications of the subsection 55(2) amendments to your business.

This article has been prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained in this article. Please note that this publication should not be considered a substitute for personalized tax advice related to your particular situation.