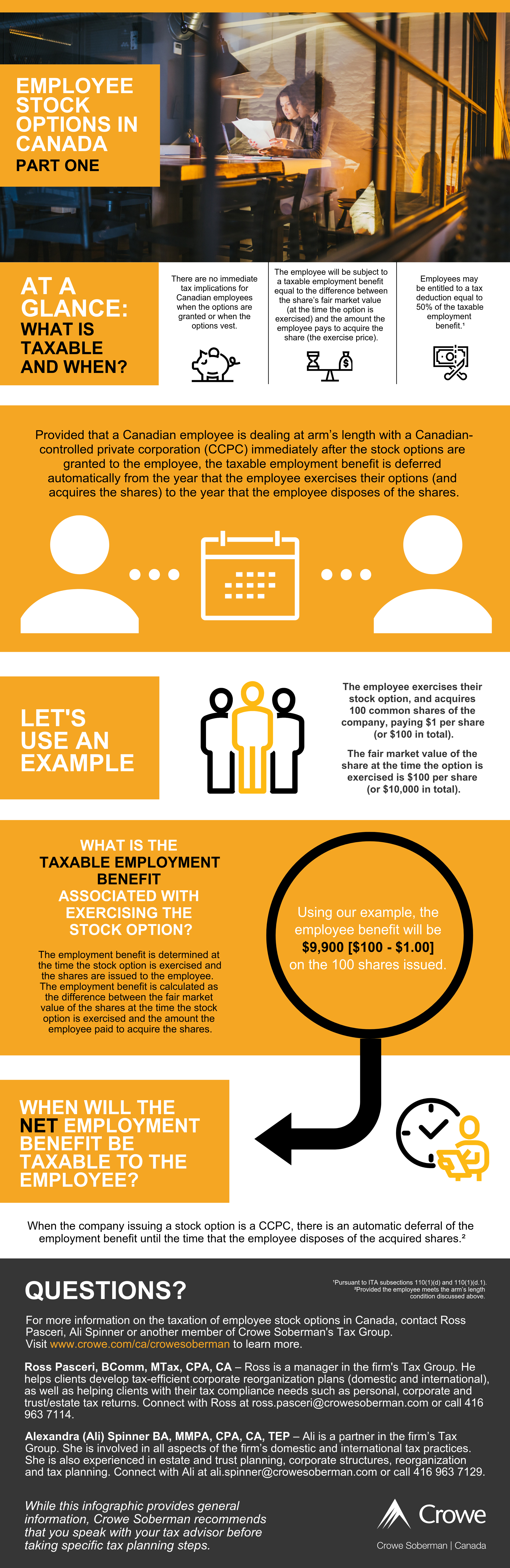

Many companies and start-ups are using employee stock options as a way to compensate and attract employees. While they can be a generous perk on top of an employee’s salary, the potential tax ramifications need to be considered. In our four-part infographic series, our tax experts will cover some of the key considerations employees should keep in mind when exploring stock options issued by Canadian-controlled private corporations.

Stay tuned for Part Two of our employee stock options infographics series where we will take an in-depth look at what criteria is needed to qualify for the 50% deduction. For more information on the taxation of employee stock options in Canada, contact Ross Pasceri, Ali Spinner or another member of Crowe Soberman's Tax Group.