Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Georgia

Germany

Greece

Hungary

Ireland

Italy

Kazakhstan

Kosovo

Latvia

Lithuania

Luxembourg

Malta

Moldova

Netherlands

Norway

Poland

Portugal

Romania

Serbia

Slovakia

Slovenia

Spain

Sweden

Switzerland

Tajikistan

Turkey

Ukraine

United Kingdom

Uzbekistan

Taxing Times

Athletes Face Off Against Canadian Sales Tax

Beyond their team salaries, many athletes earn additional income through endorsements. This income, separate from their playing contracts, may be subject to the Goods and Services Tax/Harmonized Sales Tax (GST/HST). To address common questions about this topic, we've compiled a list of frequently asked questions regarding GST/HST application to endorsement income.

When does an athlete need to register for GST/HST?

Athletes who earn more than $30,000 CAD of endorsement income in Canada (i.e., from sponsors, such as: Upper Deck, Warrior, Bauer), in any 12-month period, are likely required to register for the GST/HST. This includes income earned as an individual, or through a corporation.

When does an athlete need to charge GST/HST?

Once registered for the GST/HST, athletes are required to charge GST/HST on their endorsement income from Canadian sponsors. Athletes, in most cases, are not required to charge GST/HST on their endorsement income from non-Canadian Sponsors.

What rate of GST/HST is charged?

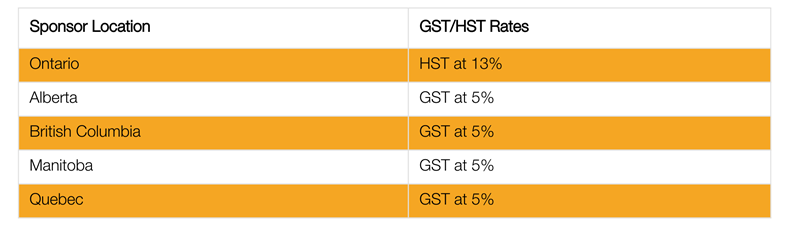

Generally, GST/HST is charged at the rate applicable in the province of the sponsor. Below are some of the most common GST/HST rates:

Do athletes invoice sponsors? What should be on the invoice?

Athletes registered for the GST/HST must issue invoices to their sponsors, and they must contain certain information. Generally, the following information should be included on invoices: name of sponsor, name of athlete, athlete’s GST/HST number, date of invoice, endorsement income amount, GST/HST charged, and currency of invoice.

Can an athlete claim a credit for GST/HST paid on expenses?

Athletes who are registered for GST/HST can claim a credit for the GST/HST paid on expenses related to earning the endorsement income. GST/HST paid is claimed as a credit against the GST/HST charged and collected from the sponsors.

When are GST/HST returns due?

Many athletes file GST/HST returns on a calendar year, resulting in the annual GST/HST return being due by March 31st of the following year (e.g. an annual 2023 GST/HST return is due by March 31, 2024).

Is GST/HST paid in instalments?

Athletes who file GST/HST returns annually and have more than $3,000 CAD of GST/HST owing on their GST/HST return in a year, must pay quarterly GST/HST installments the following year.

We're here to help

The above comments are general and do not provide specific GST/HST or tax advice, and this article does not cover provincial sales tax matters. Should you need information specific to your situation please contact your Crowe Soberman Advisor.

Related Insights

Contact Us

Jeffrey Steinberg

Partner,

Business Management & Transactional Services

Jeffrey Steinberg CPA Professional Corporation

Ananth Balasingam

Partner,

Tax

Ananth Balasingam Professional Corporation