Optimize your annual tax return

As a student or recent graduate, one smart way to pay off your student debt is by utilizing tax credits and income tax refunds. For individuals above the age of 16, tuition fees and exam costs can be claimed as a tax credit and used to increase your income tax refund.

While tuition credits for any year are limited to the total non-refundable tax credits being claimed by the taxpayer, they can be carried forward and applied against tax payable in a future year. Even after graduating, any unused tax credits can be used to reduce your total taxes payable. Through utilizing these credits and maximizing your refund, the full amount can be used to pay down student loan balances.

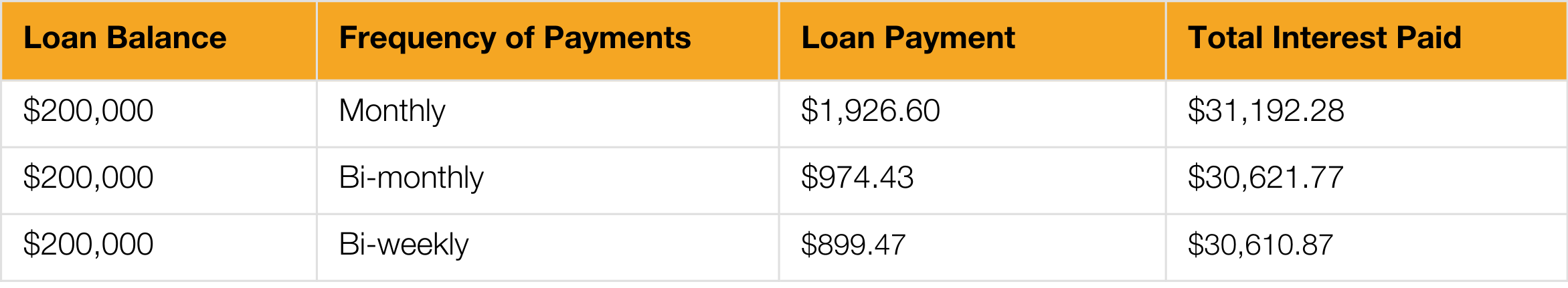

The more frequent, the better

Changing the frequency of your loan payments but maintaining the overall monthly payment amount is a proactive approach to decreasing the total interest paid on your student debt. Even if the number of payments decreases by one or two instances, the benefits of interest savings can result in a favourable outcome.For example, assume an individual has a loan balance of $200,000 with 2.95 per cent interest (prime less 0.25 per cent) to be repaid over 10 years. By splitting the monthly loan repayment in half and paying on a bi-weekly basis, instead of a monthly basis, the individual would be able to cut their overall interest paid over the life of the loan by $581.

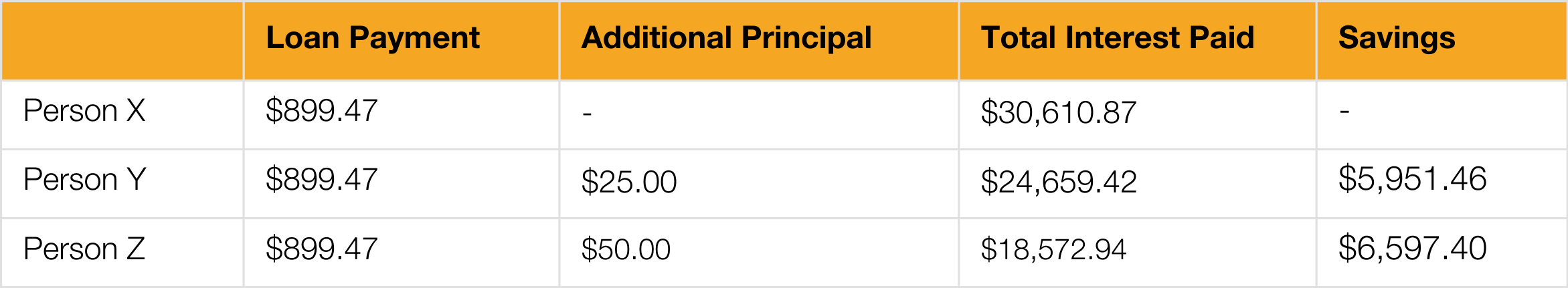

Increase your monthly payments (even if it’s just a little)

Another option to both lower the overall payments and interest paid is to increase the amount of your monthly payments. By adding an extra $25 to $50 per payment, an individual can decrease their overall payments by 27 total payments, and overall interest by approximately $6,600. Bumping your payments up slightly can lead to paying off the loan over a year earlier than expected and decrease the overall cash outflows because amounts paid in excess of a scheduled payment go directly against the principal balance outstanding.

Whichever payback strategies you choose, it is important to ensure all loan payments (bi-weekly, bi-monthly, or monthly) fit within your budget such that the payments being made are manageable and can be altered if necessary.

Connect with the Author

Dylan BenudizSenior Staff Accountant, Audit & Advisory

T: 647 288 2730

E: [email protected]

This article has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.