2017 Saskatchewan Budget

Saskatchewan 2017 Budget

On March 22nd, 2017, Saskatchewan Finance Minister Kevin Doherty announced the 2017 Saskatchewan Provincial Budget. Below is a summary of some of the tax measures that were announced in the Budget.

Personal Income Taxes

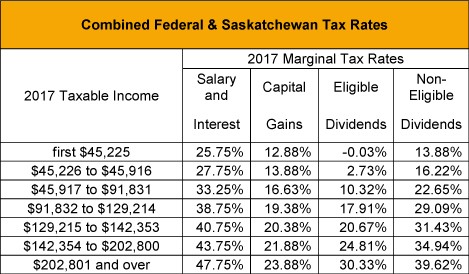

Each of Saskatchewan’s three personal tax rates will be reduced by 0.5% effective July 1, 2017 and by another 0.5% effective July 1, 2019. Summarized below are the combined Federal and Saskatchewan personal income tax rates for 2017 after factoring in the 0.5% reduction.

The tax credits for post-secondary education and tuition expenses are also eliminated effective July 1, 2017 and the Employee’s Tools Tax Credit is also eliminated effective for the 2017 taxation year.

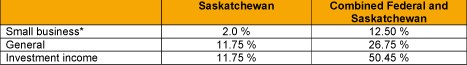

*On the first $500,000 of active business income

Corporate Income Taxes

The general corporate income tax rate will be reduced by 0.5% effective July 1, 2017 and by another 0.5% effective July 1, 2019. Saskatchewan’s 2017 corporate income tax rates are as follows:

The Budget also introduced the Saskatchewan Commercial Innovation Incentive which offers a 6% corporate income tax rate on income earned from the commercialization of qualifying intellectual property in Saskatchewan.

The Research and Development Tax Credit is reformed to better target small and medium-sized businesses as a 10% refundable tax credit for the first $1 million of qualifying expenditures. Qualifying expenditures in excess of this annual limit will still be eligible for the non-refundable Research and Development Tax Credit and the total of refundable and non-refundable tax credits that may be claimed by a corporation will be capped at $1 million per year. These changes are effective as of April 1, 2017.

Provincial Sales Tax (“PST”)

The Budget increases the PST rate from 5% to 6% effective March 23, 2017, to help meet the province’s current financial challenge. Furthermore, several PST exemptions are also eliminated, such as the following:

- Children’s clothing, restaurant meals, and snack foods (effective April 1, 2017).

- For used cars, the value of a trade-in will no longer be deductible in determining the PST on the purchase of new vehicles or on vehicles that have not previously been taxed in the province. This measure is effective April 1, 2017.

- Insurance premiums effective for premium payment due dates that occur on or after July 1, 2017.

The Budget also impacts the taxation of contracts for the repair, renovation or improvement of real property. New contracts entered into on or after April 1, 2017 will be subject to PST on the total contract price to the purchaser. However, contractors are eligible to acquire tax-free building materials to use in carrying out a contract.

The Saskatchewan Lower-Income Tax Credit will be enhanced, effective July 1, 2017, to mitigate the impact of the PST changes to lower-income individuals.

For more information on the 2017 Saskatchewan Budget, please visit the Saskatchewan Government website at the following address: http://finance.gov.sk.ca/budget2017-18.