The Federal Government launched the Canada Emergency Commercial Rent Assistance (CECRA) program to provide financial assistance to small businesses in respect of their commercial rent. The program was administrated by the Canada Mortgage and Housing Corporation (CMHC) on behalf of the Federal Government and its provincial and territorial partners. It offered commercial rent assistance for the months of April through September 2020.

The program was available for application since May 25, 2020, and has now ended.

The New Canada Emergency Rent Subsidy (CERS)

The CERS program would provide simple and easy-to-access rent and mortgage support until June 2021 for qualifying organizations affected by COVID-19. The rent subsidy would be provided directly to tenants, while also providing support to property owners.

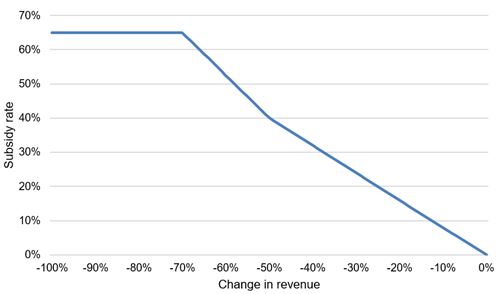

The new rent subsidy would support businesses, charities, and non-profits that have suffered a revenue drop, by subsidizing a percentage of their eligible expenses, on a sliding scale, up to a maximum of 65% of eligible expenses until December 19, 2020.

The subsidy would be available retroactive from September 27, 2020, until June 2021.

The CERS would provide a 25% top-up for organizations temporarily shut down by a mandatory public health order issued by a qualifying public health authority, in addition to the 65% subsidy listed above.

The CERS has been extended by an additional four periods, beginning June 6, 2001 and ending on September 25, 2021.

Learn more on the extended CERS including updated eligibility