New Hybrid Scorecard Slams Carmakers For Loading On Luxury

Automotive Weekly

This information that follows is taken from sources including The Car Connection, Autoweek, Green Car Reports, and other industry sources.

Our advisors are pleased to assist you or your clients. Please do not hesitate to contact us if you require assistance.

Curb On Rare Earth Exports - More Disruptive Than Microchip Shortage

Source: Automotive News

Hyundai Motor Has A Rare Earths Stockpile That Can Last About A Year

Source: Reuters

China’s Rare-earth Export Restrictions Threaten New-car Production

Source: Automotive News

18 To 34 Demographic Challenges

Source: CBT News/S&P Global

Tariff Impacts Now Appearing

Tariff Impacts Begin as Vehicle Shipping Volume Drops by More Than 70%

The volume of cars getting shipped to the U.S. via sea routes has plunged as a result of President Donald Trump’s tariffs on imported vehicles. Maritime import volume for motor vehicles dropped by 72.3 percent in May compared with the same month a year earlier, according to Descartes Datamyne, a trade database. Importers shipped about 9,380 fewer 20-foot equivalent units of vehicles to the U.S. last month. One 20-foot equivalent unit is about one vehicle depending on its size, according to Descartes. The precipitous drop indicates that vehicle tariffs are having a concrete impact on automaker decisions. The 25 percent auto tariffs that took effect in April may have prompted companies shipping completed automobiles overseas to hold off, betting that Trump will eventually pull back the most punishing duties.

Source: Automotive News

Edmunds Data Reveals Tariff Fears Shift Car Buyer Behavior

Tariff speculation is influencing the behavior of American car shoppers as the renewed push for tariffs under the Trump administration creates uncertainty for both shoppers and dealers. A recent survey and market data by Edmunds reveal that consumers are either accelerating or delaying their vehicle purchases even before widespread price hikes take effect. So far, the impact of tariffs hasn’t been as significant as expected. Despite concerns, the average transaction price (ATP) of new vehicles remained stable and aligned with seasonal norms. In April, ATP reached $48,422, representing a 2.7% uptick from March and a 2.2% year-over-year increase. Chief Economist for the National Automobile Dealers Association (NADA), Patrick Manzi, believes that the actual impact of the auto tariffs won’t be fully felt until 2026.

Source: CBT News

New Hybrid Scorecard Slams Carmakers For Loading On Luxury

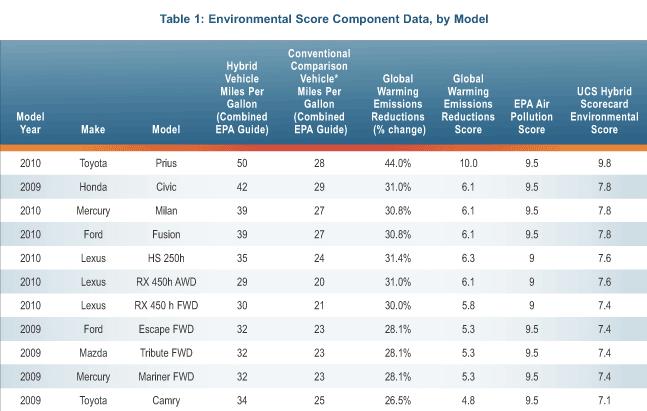

It's long been known that hybrid buyers often choose them over luxury cars, and aren't buying them solely for the payback in gasoline savings. But a new Hybrid Scorecard, launched by the Union of Concerned Scientists, slams carmakers for inflating their prices by loading luxury into fuel-efficient hybrids, putting them out of reach to less affluent buyers. The Hybrid Scorecard is a guide to all 31 currently available hybrid vehicles from five carmakers: Toyota, Ford, General Motors, Honda, and Nissan. It includes ratings on different criteria and an explanation of UCS's methodology in calculating its scores.

“Hybrids don’t have to be luxury vehicles,” said UCS analyst Don Anair, who supervises the guide. “They should be within the reach of all Americans." Car buyers shouldn’t be forced," he continued, "to buy high-end bells and whistles when fuel economy and reducing emissions are their top priority.” Such "unnecessary luxury features" include, according to UCS, not only DVD players and keyless entry systems but even leather interiors.

The top-scoring hybrid this year is the 2010 Toyota Prius, followed by a three-way tie among the 2010 Honda Civic Hybrid, the 2010 Ford Fusion Hybrid, and its twin the 2010 Mercury Milan Hybrid. One reason the 2010 Prius outscored the second-place finishers is that it has fewer "forced features" (roughly $1,600 worth) than the Civic Hybrid and Fusion/Milan twins, which UCS says include $3,000 and $4,000 of unnecessary embellishments respectively.

Not surprisingly, the 2010 Lexus LS 600h L full-size luxury sedan hybrid is the "worst offender," with $17,000 of "forced features" over the base non-hybrid LS 460L model.

Automakers might argue that buyers' willingness to pay higher margins for added features offsets the cost of $3,000-plus for the hybrid hardware, improving the affordability of the overall package. In the end, buyers will decide for themselves. In our view, the more information, the better.

Source: Green Car Reports

Ford Of Canada CEO Says Ev Mandate Should Be Repealed

As GM Authority covered previously, General Motors electric vehicle sales have also nosedived in Canada as a result of the end of the incentive program. “Ultimately, it will have a negative impact, if these mandates stuck, on the industry,” Goodman said. “It will have downward pressure on vehicle sales, it will have upward pressure on pricing, and those are real concerns for consumers and the industry as a whole.”

Meanwhile, in the U.S. market, GM has announced that Chevy has officially overtaken Ford in electric vehicle sales, with Chevrolet posting over 37,000 electric vehicles sold in the U.S. market for the 2025 calendar year through May, as compared to Ford’s 34,000 units during the same time period. GM has also claimed the number-two spot among all electric vehicle manufacturers nationwide, with more than 62,000 electric vehicles sold year-to-date. Tesla remains the number-one electric vehicle manufacturer in the U.S. market.

Source: GM Authority

Subscribe to our Automotive Weekly newsletter

Get the latest report on trends, market conditions, and the most current information in the industry