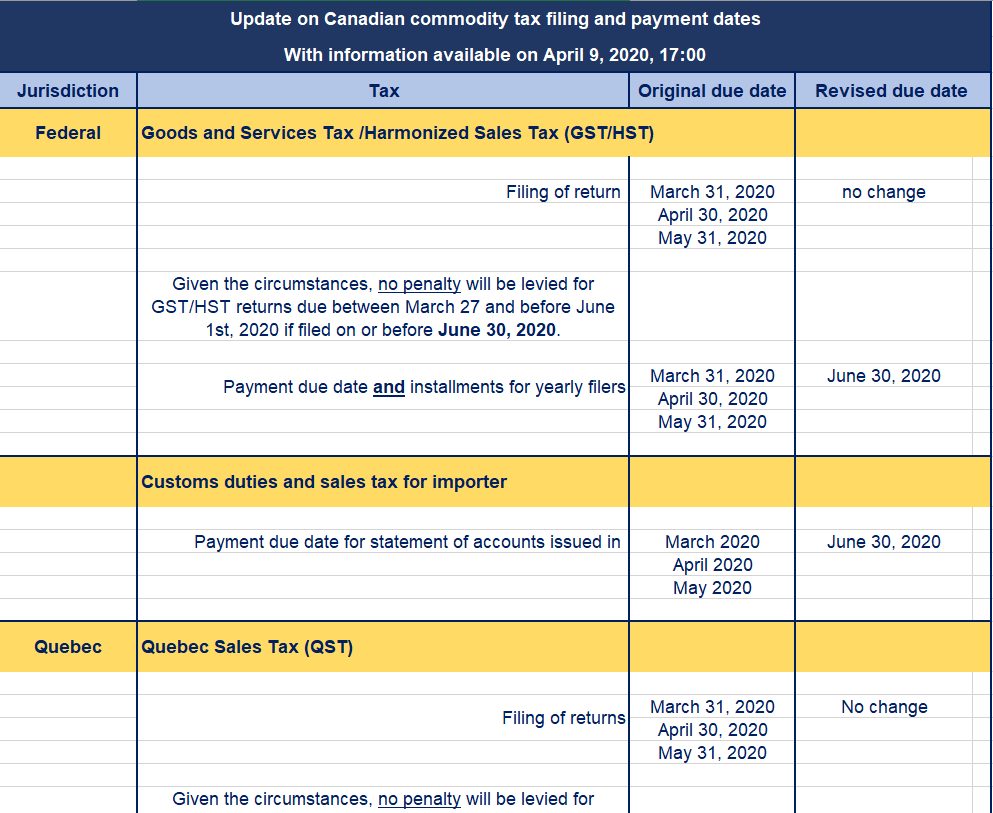

Summary of Canadian commodity tax deferrals in response to COVID-19

The information contained in the below publication was current at the time it was published. The COVID-19 programs evolve continuously, and the relevant information may have changed since publication. Readers are advised to discuss their particular situation with their Crowe BGK advisor.

Memorandum

Date: Updated on April 9, 2020

From: Crowe BGK Sales Tax Group

Subject: Canadian Sales Tax Update

Summary of Deferrals in Response to COVID-19

The Government of Canada and the provincial tax authorities who impose distinct provincial sales tax have announced several measures allowing businesses to defer the filing of sales tax returns and the remittance or payment of the taxes. Here is a summary of the recent announcements.

FEDERAL

The Government of Canada has announced that it will extend the deadline to remit the Goods and Services Tax/Harmonized Sales Tax (“GST/HST”) until June 30, 2020, without interest nor penalties for all the following situations:

- Businesses that file their GST/HST return on a monthly basis and that would have to remit amounts collected for the months of February, March and April 2020 reporting periods;

- Businesses that file their GST/HST return on a quarterly basis and that would have to remit amounts collected for the months of January through March 2020 reporting period; and

- Businesses that file their GST/HST return on an annual basis, whose GST/HST return or instalment are due in the months of March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of their current tax year.

The deadline for the above-mentioned businesses to file their GST/HST returns remains unchanged. The Canada Revenue Agency indicates that businesses that are able to do so should file their GST/HST returns on time. However, given the circumstances, no penalty will be levied when a GST/HST is filed late if it is filed on or before June 30, 2020.

Imported Goods

The Government of Canada has also announced a deferral measure with respect to amounts that are due for imported goods.

Imported goods by businesses are generally subject to the GST, as well as the applicable customs duties, which vary by product and country of origin. While the majority of the imports enter Canada duty-free, some tariffs remain.

Payments owing for customs duties and the GST on imports are usually due before the first day of the month following the month in which the Statements of Accounts are issued.

Payment deadlines for statements of accounts for the months of March, April and May are now deferred to June 30, 2020.

QUEBEC

With respect to the province of Quebec, the government extended the deadline to remit the Quebec Sales Tax (“QST”) until June 30, 2020, without interest nor penalties for all the following situations:

- Businesses that file their QST return on a monthly basis and that would have to remit amounts collected for the months of February, March and April 2020 reporting periods;

- Businesses that file their QST return on a quarterly basis and that would have to remit amounts collected for the months of January through March 2020 reporting period; and

- Businesses that file their QST return on an annual basis, whose GST/HST return or instalment are due in the months of March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of their current tax year.

Revenu Québec has indicated that every registrant in a position to file their GST/HST and QST returns with Revenu Quebec is expected to file on time. However, given the circumstances, no penalty will be levied for GST/HST and QST returns due between March 27 and June 1st if filed with Revenu Quebec on or before June 30, 2020.

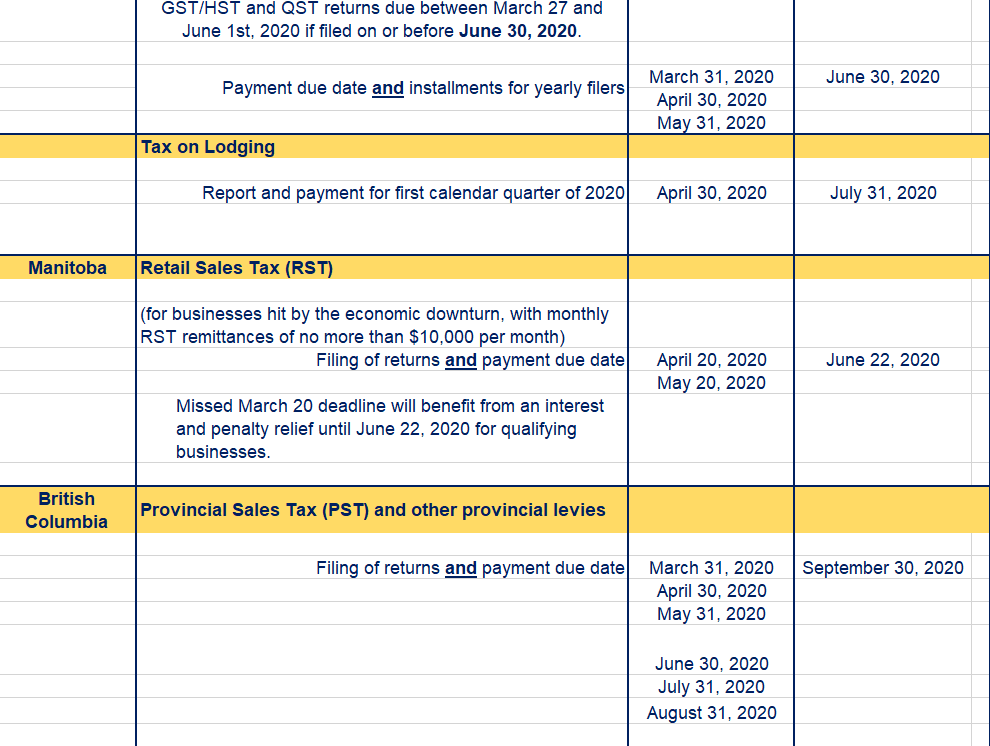

Tax on Lodging

The deadline for reporting and remitting the tax on lodging for the first calendar quarter of 2020 that would otherwise have had to be reported and paid no later than April 30, 2020 is extended to July 31, 2020.

MANITOBA

With respect to the province of Manitoba, the Retail Sales Tax (“RST”) return filing and payments of certain businesses in Manitoba will now be due on June 22, 2020. This measure applies for the following businesses:

- Businesses which file their RST return on a monthly basis and which have remittances due of $10,000 or less per month that would be due on April 20, 2020 or May 20, 2020; and

- Businesses which file their RST return on a quarterly basis and that would be due on April 20, 2020.

In addition, businesses that qualify for this measure and that were not able to file their RST return and remit payments with respect to the month of February period (due latest March 20, 2020) will not be assessed a late filing penalty and interest will not be applied until after June 22, 2020.

BRITISH COLUMBIA

With respect to the province of British Columbia, as of March 23, 2020, the Provincial Sales Tax (“PST”) (and other provincial taxes) return filings and payments deadlines are extended to September 30, 2020.

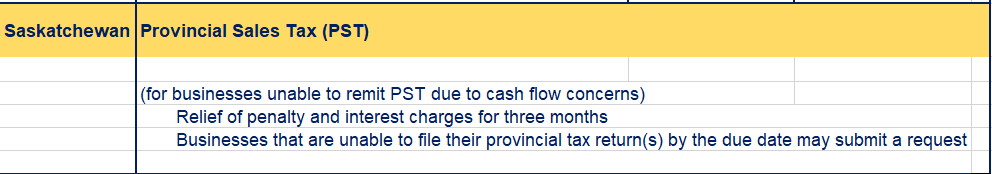

SASKATCHEWAN

With respect to the province of Saskatchewan, businesses which are unable to make a payment for their PST due will be granted a relief from penalty and interest charges for a three-month period.

In addition, businesses which are unable to file their PST return by the due date may submit a written request for relief from penalty and interest charges for a three-month period.

A summary table is attached on the next page.