Live and invest in Andorra

Why set up or relocate a business in Andorra?

The Principality of Andorra has a strategic position on the European continent, as it is located between Spain and France, being close to dynamic cities such as Barcelona, Toulouse or Girona. Nowadays, the Andorran economy has a markedly expansive character, as a result of an oppennes and liberalization process that has increased in recent years. Facts as the liberalization of foreign investments, together with the signing of non-double taxation agreements, have positioned the country to compete on equal terms with neighboring economies, turning the Principality into an attractive destination for new sectors and companies. Therefore, setting up or relocating a business in Andorra has many advantages, among which we highlight the country's favorable

economic scenario, as well as its solid and stable financial system, and also the attractive tax system.

From Crowe Andorra we consider that foreign investments and companies contribute to the economic development of the country, offering a greater diversification of the economy and providing a high added value to the Principality. For this reason, we have a team of professionals highly specialized in the field, who analizes the best alternative for each foreign investor, as well as carry out all the needed procedures to reach the effective incorporation of the foreign investor in the Principality of Andorra.

Set up an Andorran company

Nowadays, there are no limitations for a foreign investor to set up or purchase an Andorran company, other than the provisions contained in the foreign investment regulation. In this context, a foreign natural or a legal person can acquire (either through the subscription of new shares, either the acquisition of shares of an already existing company) up to 100% of the share capital of a company incorporated in Principality of Andorra. However, it should be noted that the Government must authorize foreign investments that exceed 10% of the share capital. Therefore, the foreign investor will have to comply with the provisions contained in the current legislation on foreign investment, apart from the normal requirements and necessary steps for the incorporation of a company.

The process of setting up companies in Andorra by foreign partners is made up of a series of procedures and authorizations that are detailed below:

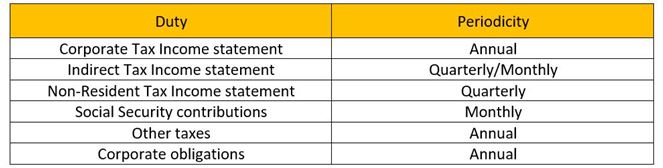

Once incorporated, Andorran companies must fulfill a series of formal obligations, which are indicated below:

Formal obligations of companies

Live in Andorra

These permits allow its owners to live and work in the Principality of Andorra, either as an employee or as a self-employee, temporarily or permanently.

Within the active residences, we distinguish those obtained to work for one's own account, known as self-employee, from those obtained to work as an employee.

- Self-employed residence:

- Self-employed residence as a professional. Residence and work permit conditional on having a university degree, among other requirements.

- Self-employed residence through the incorporation of a company. Residence and work permit subject to compliance of the following requirements:

- Set up a company, after obtaining the corresponding foreign investment authorization.

- Holding more than 34% share capital in the company.

- Be the director of the company

- Deposit with the Andorran Financial Authority (AFA) the amount of €50,000, non-remunerable, with the exception of companies dedicated to the digital economy, entrepreneurship or innovation.

- Employee residence:

- Residence and work permit. It can be temporary or indefinite. It is obtained, among other requirements, by obtaining an employment contract with an Andorran company.

- Border work permit. It can be temporary or indefinite, through a contract with an Andorran company, but residing outside the Principality of Andorra.

- Work permit without residence. For those people who have an employment contract with an Andorran company but work abroad.

- Permit for young people with option to work.

These permits allow its owners to live and work in the Principality of Andorra, either as an employee or as a self-employee, temporarily or permanently.

Within passive residences, we distinguish different types:

- Residence permit without gainful activity. This type of permit is properly known as passive residence. Among other requirements, it is obtained by complying with the following:

- Make an investment in Andorran assets of €600,000, excluding exceptions.

- Make an unpaid deposit to the AFA, for an amount of €47,500

- Establish in the Principality for at least 90 days per calendar year

- Not carry out any professional activity, with the exception of managing one's own assets.

- Residence permit for professionals with international exposure, for reasons of scientific, cultural or sporting interest.

- Residence permit for family reunification. Residence permit for spouses, children, dependents of an Andorran national or holder of a residence and work permit.

- Residence for digital nomads. Residence permit for those people who, in order to carry out their work, do not require a specific geographical location, and use technology. To obtain this type of permit, it is necessary to have the status of digital nomad, granted by the Economy Department of the Government.

- Residence for foreign entrepreneurs. For people who participate in the program for foreign entrepreneurs promoted by the Economy Department of the Government.

How can Crowe help you?