National Development Plan 2021-2030: Investment in social housing

The recently announced National Development Plan

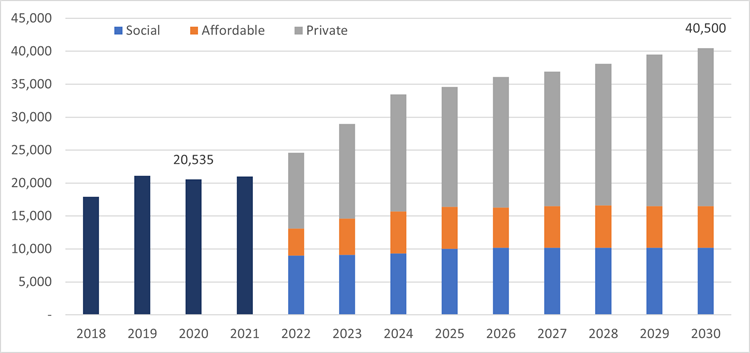

The NDP reinforces the critical goals laid out in the government’s Housing for All strategy, which was launched in September 2021. With Ireland’s population forecast to grow by over 1m in the period from 2016 to 2040, there is a need to accommodate around 600,000 new households by 2040. To achieve this the Department of Housing plans to deliver almost 400,000 new homes in Ireland between 2020 and 2031. This is equivalent to 33,000 new homes per annum. The scale of the task is evident when set against a backdrop of actual new home completions of c. 20,500 in 2020.

The National Planning Framework targets growth in our city population by a minimum of 28% by 2040. Minimum growth of 50% is anticipated in each of Cork, Galway, Limerick and Waterford.

New Home Completion Targets

The NDP identifies a number of key strategic pillars to supporting housing development:

- Social housing: The target is 10,000 new-build social homes per year. There will be more emphasis on new builds by local authorities and an end to long-term leasing of private accommodation, which will be phased out by 2025.

- Approved Housing Bodies (AHBs): AHBs will have a central role in delivering social homes in partnership with local authorities. Increased funding will be made available to AHBs through increases in the budget available for the Capital Advance Leasing Facility (CALF). With this scheme, AHBs can apply for a capital advance of up to 30% from government for the leasing, acquisition or construction of housing. They can then raise the remaining finance from the Housing Finance Agency or commercial banks.

- Affordable housing: 6,000 units per year, amounting to 54,000 affordable homes to be made available for purchase or rent in the period to 2030. This will include an average of 4,000 affordable purchase homes each year, where state investment will support people on lower incomes to buy their own home.

- Affordable purchase scheme: With this new scheme, local authorities will make homes available at a price lower than the market rate, with average prices in the region of €250k. The fund will provide €100k toward the cost of the home, reducing the price from the market value. The state will then retain a 30% equity share in the home, which can be bought out at a later date.

- Cost rental homes: A new form of affordable housing is being introduced where rents are based on the cost of the provision of housing, rather than on purely commercial terms. An average of 2,000 cost rental homes will be provided each year. These will be targeted to achieve rents that are at least 25% below what they would be on the private market.

- Public Private Partnerships (PPPs): Increased use of PPPs to deliver social housing on local authority land. PPP projects will be focused in Dublin in the first instance and likely roll out to other national cities thereafter. PPPs will be delivered in partnership with the National Development Finance Agency with AHBs providing long-term management services.

- Land Development Agency (LDA): The LDA will work with local authorities, state agencies and the private sector and will provide a Centre of Excellence for the delivery of major developments on public land. The LDA will be funded through borrowing and Ireland Strategic Investment Fund investment up to €3.5bn. It has ambitious targets for the delivery of affordable housing. Shanganagh is the first LDA-backed project to be delivered. The scheme is a large mixed-tenure housing development expected to deliver c. 600 residential units of affordable purchase homes, cost rental apartments and social homes.

The LDA and AHBs are some of the main tools for delivering the housing targets. The goal is to increase the number of houses owned by local authorities and AHBs to provide homes for the most vulnerable in society. It is clear that the plans encourage a state-owned housing portfolio, which is a far more economical model of delivery for the Exchequer.

With the wide range of housing needs, there will be significant opportunities for the private sector to support the delivery of housing in the years ahead. From a site development perspective, the various government initiatives provide different options to finance and realise a scheme. For example, units can be sold to a local authority under its social fund and then managed by the AHB.

While historically developers could retain housing stock and refinance construction facilities with investment facilities and collect the annual rental income from the AHB or local authority, this will not be an option in the future. Capital markets will flex to the new systems.

With high costs of developing funding, it is important that developers forward-plan housing sales to allow for efficient use of capital. Having a guaranteed take-out sale to a local authority should underwrite the business case and financial viability of a scheme.

At Crowe, we have vast debt advisory experience for residential and mixed-use development schemes. Our dedicated real estate team can work with you to structure development finance and manage a transaction with a local authority. We will ensure that you receive a high-quality, cost-effective service, tailored to your needs. To find out how Crowe can help your business navigate the opportunities and challenges presented by the changed landscape, please contact a member of our real estate team today.