Tax-Deferred Savings in Canada for Individuals - 2020

Because of the popularity and high visibility of our original article, we have updated this article to reflect certain new limits and new rules set by the tax authorities for the upcoming year.

A question we often get is which type of investment vehicle should someone use in order to optimize their savings and maximize their after-tax earnings. In Canada, there are several tax-advantaged savings vehicles that offer a tax deferral on amounts earned within them. The following is an analysis of the pros and cons of the three most commonly used vehicles.

Tax Free Savings Account (TFSA)

The TFSA is an investment account designed to help Canadians save on a tax-free basis. The main advantage of a TFSA account, as compared to a regular investment account, is that income earned in this account will generally not be subject to tax.

The maximum contribution into your TFSA in 2020 is $6,000 which is the same amount as 2019. If you were 18 and a Canadian resident in 2009, the cumulative amount you will have been able to invest in your TFSA is a total $69,500 in 2020 as 2009 was the year the TFSA measure was introduced by the federal government.

The annual eligible contribution limit is decided upon by the federal government on a yearly basis. Specific criteria need to be met in order to be eligible to contribute and to calculate the total allowable limit of your TFSA contributions.

Taxpayers may withdraw any amount from their TFSA at any point, but will generally only be eligible to redeposit those funds in the following calendar year or later. While making contribution to your TFSA are not tax-deductible, withdrawing funds from it are not taxable.

Registered Retirement Savings Plan (RRSP)

The RRSP is an investment account designed to help Canadians save for retirement. The main advantage of an RRSP account, as compared to a regular investment account, is the ability to defer tax on contribution and earnings.

You can claim a deduction from your income equal to the amounts that you contributed to your personal RRSP or your spouse’s RRSP within certain limits. This deduction reduces your current year’s income. The amounts earned and accrued in your RRSP will generally be tax-deferred until you withdraw the funds (ideally during your retirement), at which point they, along with the capital, become taxable.

The deadline to contribute to an RRSP for 2019 is February 29, 2020. The maximum amount that you are allowed to contribute towards an RRSP for 2019 is the lesser of 18% of your earned income for 2018 and $26,500, plus any unused RRSP contribution room from previous years. Unused RRSP contribution room will appear on your 2018 federal Notice of Assessment.

You may contribute to your own RRSP until the year in which you turn 71. If you turned 71 in 2019, this is the last year that you can contribute to your RRSP. However, if your spouse is under the age of 71, you may make RRSP contributions to your spouse’s plan up to the end of the year in which he or she turns 71.

An individual may also benefit from two separate incentives to withdraw from his/her RRSP account without any tax consequences. The Home Buyers’ Plan (”HBP”) allows first-time home buyers to withdraw up to $35,000 ($25,000 before March 19, 2019) from their RRSP for a down payment, tax-free. The HBP is considered a loan, and must be repaid over 15 years beginning in the second year after the year in which it is withdrawn. It should be noted that a couple buying their first home after March 19, 2019 will be eligible to withdraw up to $70,000 from their RRSP (up to $35,000 each). The Life-Long Learning Plan (”LLP”) allows participants to finance their education or their spouse’s education by withdrawing up to $10,000 per calendar year up to a maximum of $20,000 in total from their RRSP, tax-free. The LPP is also considered a loan and must be repaid within 10 years beginning in the second year after the year in which it is withdrawn.

Registered Education Savings Plan (RESP)

The RESP is an investment account designed to help Canadians save for their children’s post-secondary education. The main advantage of a RESP account, as compared to a regular investment account, is that the income and subsidies (see below) earned in the RESP account will be taxable in the child’s hands in the year that the funds are withdrawn, resulting in tax savings if the child is in a low tax bracket at that time. Anyone (grandparents, parents, uncles, aunts) can create and contribute into a child’s RESP.

Canada Education Savings Grant (CESG)

The Federal government wishes to encourage Canadian youth to pursue their post-secondary education, and on a yearly basis the federal government will match 20% of the annual contribution for a total amount up to $500 per child, up to a lifetime maximum of $7,200.

Québec Education Savings Incentive

The Quebec government has also an incentive program, and on a yearly basis, Quebec will match 10% of the annual contribution for a total amount up to $250 per child, up to a lifetime maximum of $3,600. An additional $50 per year will be contributed by the provincial government for low-income and middle-income families. In order to receive the government subsidies, each program has their own requirements that need to be met.

If the child for which a RESP account was created decides not to pursue a post-secondary education, the contributions invested in the RESP account will not be lost. You may either transfer your RESP account to another child or to the contributor’s RRSP account if the contributor has eligible contribution room. If the RESP account is transferred over to the contributor’s RRSP, the received government subsidies must be reimbursed.

Summary Table

|

TFSA |

RRSP |

RESP |

|

|

Annual contribution limit? |

$6,000 (2020) |

18% of earned income, max $26,500 (2019) |

None, annual lifetime limit of $50,000 per beneficiary |

|

Forced maturity? |

No |

Last day of year turned 71 |

No |

|

Tax-deductible contributions? |

No |

Yes |

No, eligible for subsidies by federal and provincial governments |

|

Tax on withdrawals? |

No |

Yes, except if used for HBP and LLP (reimbursement intended) |

Yes, only on the earnings and subsidies received from governments |

|

Contribution room restored after withdrawals? |

Yes (in year following year of withdrawal) |

No |

No |

|

Carry forward unused contribution room? |

Yes |

Yes |

N/A |

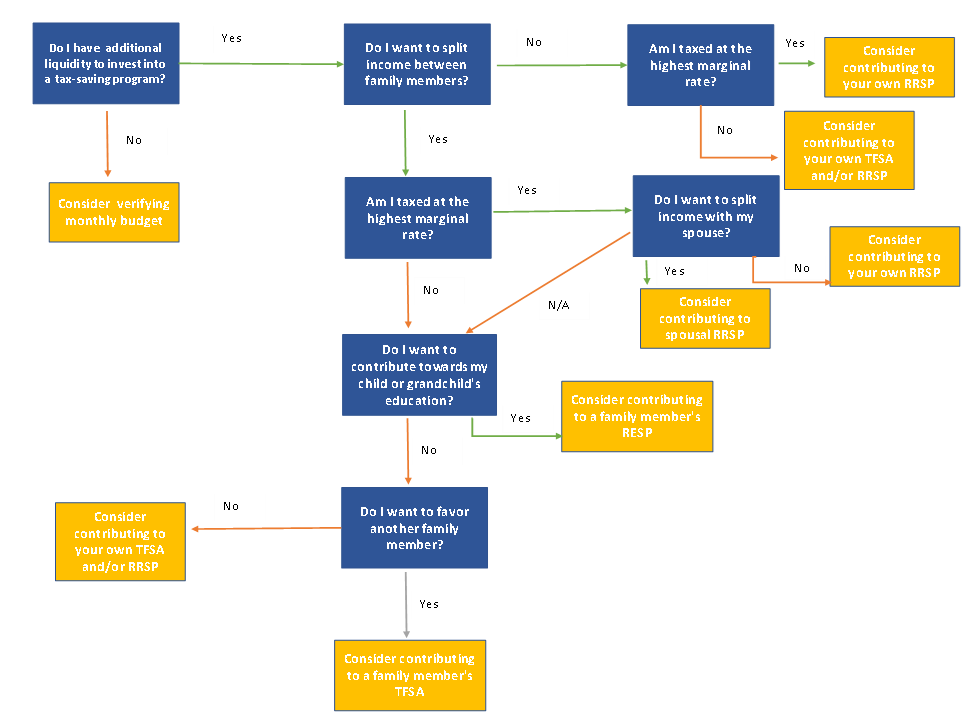

Decision Tree

Please refer to the following decision tree for an overall idea of which vehicle to use to invest your money. The decision tree is a tool to help identify opportunities. However, please contact your Crowe BGK advisor prior to acting, as your overall situation and circumstances need to be considered prior to making a decision.

Additionally, these investment vehicles are designed for Canadian residents. A United States (“US”) citizen who is also considered a Canadian resident for income tax purposes should speak to his/her Crowe BGK US tax advisor prior to investing, as investments in these types of vehicles may have certain tax consequences in the US and may result in additional US compliance requirements.

About the Authors:

Aaron Patrick Belcher, CPA, CGA, is a Tax Specialist at Crowe BGK

Connect with him: [email protected]

Jianyi Li, is a Tax Specialist at Crowe BGK

Connect with him: [email protected]