2020 - 2021 Quebec Budget Summary

The Minister of Finance, Mr. Eric Girard, tabled his second budget on March 10, 2020. Here are the highlights of the 2020-2021 budget.

Introduction of the tax credit for investments and innovation

The tax credit for investments and innovation (C3i) will be granted to a qualified corporation that acquires, after March 10, 2020 and before 2025, manufacturing or processing equipment, computer equipment or certain management software packages.

The tax credit rate will be 10%, 15% or 20%. It will be determined according to the location and the economic vitality index of the area where the investments are made.

The C3i will be fully refundable for SMBs and non refundable for large businesses. In certain situations, the C3i will be partially refundable. The non-refundable portion of the tax credit of a taxation year may then be carried over to another taxation year.

Eligible expenses for property will be those exceeding $12,500 for the acquisition of manufacturing and processing equipment. The threshold will be set at $5,000 for computer hardware and management software packages.

The C3i will replace the tax credit for investments. A corporation may nevertheless, on certain conditions, elect to receive the tax credit for investments according to its current terms and conditions.

Eligible companies

The tax legislation will be amended so that the expression “qualified corporation” means a corporation that carries on a business in Québec and has an establishment in Québec, except excluded companies.

A qualified corporation that is a member of a qualified partnership may, on certain conditions, receive the C3i in respect of its share of the specified expenses incurred by the partnership for the acquisition of a specified property.

Specified property

A specified property will include:

- manufacturing and processing equipment (classes 43 or 53);

- computer hardware (class 50);

- management software packages (part of class 12).

Specified expenses

The specified expenses in respect of which the tax credit for investments and innovation is claimed must have been paid at the time the application for the tax credit is filed. Where the specified expenses are paid more than 18 months following the end of the taxation year in which they were incurred, those specified expenses will then be specified expenses of the qualified corporation for the taxation year or of the qualified partnership for the fiscal period, as applicable, in which they were paid.

Rate of the tax credit

Businesses in all regions of Québec will be able to claim the C3i. Those established in the Montréal and Québec metropolitan communities will benefit from a rate of 10% on their eligible investments.

To further support businesses outside these metropolitan communities, the government will raise their C3i rate to 15%.

To take into account the particular economic challenges in certain regions, the government will increase the tax credit rate to 20% in territories where the economic vitality index is among the lowest 25% in Québec.

Application date

The tax credit for investments and innovation will apply in respect of the specified expenses incurred after March 10, 2020, but before January 1, 2025, for the acquisition of a specified property after March 10, 2020, but before January 1, 2025.

Introducing the incentive deduction for the commercialization of innovations

To be eligible for the incentive deduction for the commercialization of innovations (IDCI), a business must have an establishment in Québec, commercialize intellectual property (IP) there and have incurred R&D expenses in Québec.

The qualified IP will mean a legally protected incorporeal property that is:

- an invention protected by:

-a patent or a certificate of supplementary protection,

-plant breeder's rights; or

- software protected by copyright.

Also, to qualify as a qualified intellectual property asset, the property must result from R&D activities carried out in whole or in part in Québec.

Revenues from the commercialization of such IP, including revenues from the sale or rental of goods, services and royalties, will be eligible for the IDCI.

These revenues will be taxed at an effective rate of 2.0%, a reduction of 9.5 percentage points compared to the general rate.

In addition, to facilitate application of the IDCI, a simplified calculation method will be offered, which will encourage its uptake, particularly by SMBs.

Moreover, as of January 1, 2021, the IDCI will replace the deduction for innovative corporations (DIC), which has been in force since January 1, 2017. Businesses currently eligible for the DIC will be eligible for the IDCI.

Application date

This new deduction will apply in respect of a taxation year of a corporation beginning after December 31, 2020.

Elimination of the exclusion threshold for R&D tax credits fostering collaboration with research entities

Under the expenditure exclusion threshold, no tax assistance is granted for a taxpayer's or partnership's otherwise qualified R&D expenditures that are below a threshold applicable to the taxpayer or partnership for a taxation year. This threshold corresponds to an amount of $50,000 that increases linearly to $225,000 where the assets of the taxpayer or partnership, as applicable, vary between $50 million and $75 million.

The tax legislation will be amended to eliminate the exclusion threshold for qualified expenditures relating to a university research contract, an eligible research contract entered into with an eligible public research centre, a pre-competitive research project carried out in private partnership, or fees or dues paid to an eligible research consortium.

The elimination of the expenditure exclusion threshold will not apply to the “R&D salary” refundable tax credit. However, for the purposes of calculating that tax credit, the rule providing for the splitting of the exclusion threshold among the various R&D tax credits will continue to apply as if the definition of reducible expenditures still applied to the other refundable R&D tax credits.

Application date

These changes will apply to expenditures incurred by a taxpayer or partnership for a taxation year or fiscal period, as applicable, that begins after March 10, 2020 relating to R&D work carried out after that day.

Introduction of the synergy capital tax credit

This tax credit aims to encourage established businesses to invest in the share capital of Québec SMBs.

Main parameters of the measure

Businesses that invest in an eligible SMB will be able to claim a non refundable tax credit equivalent to 30% of the value of their investment in eligible shares and can be, for a corporation, up to $225,000 annually. Eligible investments will therefore be limited to $750,000 per investor per year.

The eligible SMBs will mean the Canadian-controlled private corporations with a permanent establishment in Québec, with paid-up capital of less than $15 million and gross income of less than $10 million and the corporations operating in an eligible sector for at least one year.

The eligible sectors will be those working in green technologies, information technologies, life sciences, the innovative manufacturing sector and artificial intelligence.

The eligible investors will mean the business corporations with an establishment in Québec and dealing at arm's length with the eligible SMB and the corporations not primarily engaged in financing or investing in businesses.

The eligible investments will be those in capital stock, limited to:

- equity participation that does not result in control of an eligible SMB;

- $750,000 per year per investor;

- $1 million per year per eligible SMB.

Obtaining this tax credit requires a minimum holding period of 5 years.

Application date

The synergy capital tax credit will apply in respect of a share subscription carried out after December 31, 2020.

Changes to the compensation tax for financial institutions

The tax legislation will be amended so that the compensation tax rates as well as the maximum amount subject to tax applicable to independent loan corporation, independent trust corporation and independent corporation trading in securities is reduced compared to similar entities associated with a bank, savings and credit union or insurance corporation.

The tax rates as well as the maximum amount subject to tax applicable to independent loan corporation, independent trust corporation and independent corporation trading in securities will be those applicable to “other persons” effective on April 1, 2020.

Strengthening corporate transparency

To continue its efforts to strengthen corporate transparency, the government will:

- require businesses to declare information on beneficial owners to the Registraire des entreprises du Québec (REQ);

- make it possible to do searches in the enterprise register using the name of a natural person;

- prohibit the issue of subscription warrants or stock options in bearer form.

The government will optimize corporate transparency while protecting privacy and personal information. Legislative amendments will be required for this purpose.

Introduction of a refundable tax credit for SMEs for persons with a severely limited capacity for employment

This refundable tax credit will be granted to qualified corporations that employ individuals with a severely limited capacity for employment. The refundable tax credit will be equal to the amount of the employer contributions paid by the corporation in respect of such an employee. The employer contributions include the contribution to the Health Services Fund, the Québec Pension Plan, The Québec Parental Insurance Plan and the Commission des normes, de l’équité, de la santé et de la sécurité au travail.

A qualified corporation that is a member of a qualified partnership can also claim this refundable tax credit in respect of its share of the employer contributions paid by the partnership regarding an employee with a severely limited capacity for employment.

Changes to the refundable tax credit for Québec film or television production

Change to the definition of a film adapted from a foreign format

A film, including a television program, that is not developed from a foreign format benefits from a higher base rate than a film adapted from a foreign format.

So that the tax assistance provided by means of the tax credit will continue to prioritize original Québec productions, the Act respecting the sectoral parameters of certain fiscal measures (hereinafter, the “sectoral act”) will be amended so that the conditions defining a film adapted from a foreign format in the case of a film whose primary market is the television market also apply to a film whose primary market is the online broadcasting market.

This change will apply to a film or television production for which an application for an advance ruling, or an application for a qualification certificate if no application for an advance ruling was previously filed for the production, is filed with the Société de développement des entreprises culturelles (SODEC) after March 10, 2020.

Change to the requirements for application of the higher rate for a French-language film

The refundable tax credit for Québec film or television production includes several base rates.

The sectoral act will be amended so that, like films whose primary market is television broadcasting, certain French-language films whose primary market is online broadcasting will benefit from the higher base rate for French-language film productions.

This change will apply to a film or television production for which an application for an advance ruling, or an application for a qualification certificate if no application for an advance ruling was previously filed for the production, is filed with SODEC after March 10, 2020.

Increase in the refundable tax credit for sound recordings

The tax legislation will be amended to raise the limit on labour expenditures eligible for the refundable tax credit for sound recordings to 65% of the production costs of a qualified property.

This amendment will apply in respect of a qualified property for which an application for an advance ruling, or an application for a qualification certificate if no application for an advance ruling was previously filed, is filed with SODEC after March 10, 2020.

Increase in the refundable tax credit for the production of performances

The tax legislation will be amended to raise the limit of the qualified labour expenditures for the refundable tax credit for the production of performances to 65% of the production costs of the performance.

The maximum amounts of the tax credit in respect of a qualified performance, whether it is a musical comedy, a comedy show or any other show, remain unchanged.

This change will apply in respect of a performance whose first eligibility period ends after March 10, 2020 and for which an application for an advance ruling, or an application for a qualification certificate if no application for an advance ruling was previously filed for that period, is filed with SODEC after March 10, 2020.

Change to the notion of interactivity for the purposes of the refundable tax credits for multimedia titles

For a multimedia title to be an eligible multimedia title for the purposes of the tax credit – general component or the tax credit – specialized component it must be published on an electronic medium and controlled by software allowing interactivity.

However, a multimedia title may have different levels of interactivity. To specify the level of interactivity required for a multimedia title to be recognized by Investissement Québec as an eligible multimedia title for the purposes of both the tax credit – general component and the tax credit – specialized component, an amendment will be made to the Act respecting the sectoral parameters of certain fiscal measures.

A title may thus be considered to be controlled by software allowing interactivity if the conditions respecting the user's participation in the action of the title are met for all or substantially all of the action.

Application date

This amendment will apply, in respect of both the tax credit – general component and the tax credit – specialized component, to an application for a certificate filed with Investissement Québec after March 10, 2020 for a taxation year beginning after that day.

Change in activities eligible for the tax credits for the development of e-business (TCEB)

The tax legislation will be amended so that an activity involving the design or development of e-commerce solutions allowing a monetary transaction between the person on behalf of whom the design or development is carried out and that person's customers (for example design and development of websites) will no longer be an eligible activity for the purposes of the TCEB.

However, such an activity involving the design or development of e-commerce solutions may be an eligible activity if it is incidental to an eligible activity relating to the development or integration of information systems or of technology infrastructures.

Application date

This change will apply to a taxation year of a corporation beginning after March 10, 2020.

Measures pertaining to individuals

Introduction of a refundable tax credit for caregivers

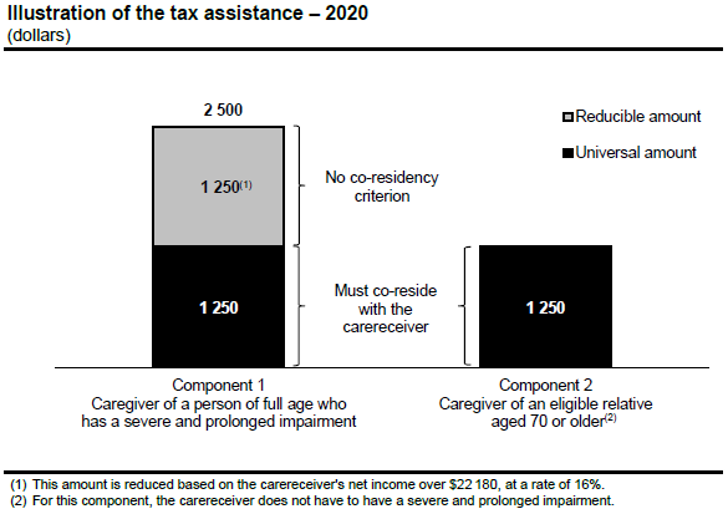

In 2020, the four existing components of the tax credit for informal caregivers of persons of full age will be replaced by the new refundable tax credit, called the “tax credit for caregivers,” comprising the following two components:

- component 1: universal basic tax assistance of $1,250 (in the case of coresidency) and reducible assistance of $1,250 (no co-residency requirement) for a caregiver providing care to a person aged 18 or older who has a severe and prolonged impairment and needs assistance in carrying out a basic activity of daily living;

- component 2: universal tax assistance of $1,250 for a caregiver who supports and co-resides with a relative aged 70 or older.

The following graph illustrates the two components of the new credit.

Amounts of the tax credit according to the new components

For the purposes of both component 1 and component 2 of the new tax credit, a caregiver will be entitled to a non-reducible universal amount of $1,250 where the caregiver co-resides in the same self-contained domestic establishment as the eligible carereceiver, provided the caregiver meets the other criteria giving rise to the tax credit.

Under component 1 of the new tax credit, the caregiver of an eligible carereceiver aged 18 or older who has a severe and prolonged impairment in mental or physical functions and who, according to certification by a health professional, needs assistance in carrying out a basic activity of daily living will receive additional assistance of up to $1,250 for the year, thereby raising the potential assistance under component 1 to $2,500 if the caregiver co-resides with the eligible carereceiver.

However, if the caregiver does not co-reside with the eligible carereceiver, the only assistance to which the caregiver is entitled will be a reducible amount of up to $1,250 under component 1 of the tax credit.

The $1,250 amount will be reduced in the same way as is done currently, according to a rate of 16% for each dollar of the eligible carereceiver’s income that exceeds the reduction threshold applicable for the year. For 2020, the reduction threshold is $22,180.

Notion of “eligible carereceivers”

As of 2020, the tax credit will henceforth be open, under component 1, to caregivers providing assistance to the following eligible carereceivers:

- a spouse at least 18 years old, but under age 70, who has a severe and prolonged impairment in mental or physical functions and needs assistance in carrying out a basic activity of daily living;

- family member aged 18 or older who has a severe and prolonged impairment and needs assistance in carrying out a basic activity of daily living, even if he or she is able to live alone;

- a person aged 18 or older who has a severe and prolonged impairment and needs assistance in carrying out a basic activity of daily living, but has no family relationship with the caregiver, provided a professional of the health and social services network certifies that the caregiver is genuinely involved with the eligible carereceiver by providing the person with ongoing assistance in carrying out a basic activity of daily living.

More specifically, for the purposes of both component 1 and component 2 any person who is one of the following persons during the minimum co-residency or assistance period applicable for a year will be considered an “eligible carereceiver” of a caregiver throughout that period:

- the father, mother, grandfather, grandmother, uncle, aunt, great-uncle or great-aunt of the caregiver or of the caregiver's spouse; or

- any other direct ascendant of the caregiver or of the caregiver's spouse.

Also, for the purposes of both component 1 and component 2 of the new tax credit, the eligible carereceiver cannot be a person living in a dwelling located in a seniors' residence or in a facility of the public network.

Clarifications concerning the notion of “eligible carereceivers” according to the components

For the purposes of component 1 of the new tax credit, the following persons of full age will also be included among eligible carereceivers under component 1: the spouse as well as the child, grandchild, nephew, niece, brother and sister of the caregiver.

For the purposes of component 2 of the new tax credit, the eligible carereceiver must be aged 70 or older and cannot be the caregiver's spouse.

The table 1 in appendix presents the main parameters of the two components of the new refundable tax credit for caregivers.

Advance payment of the universal basic amount under components 1 and 2 of the refundable tax credit for caregivers

The government will allow the basic universal amount of $1,250 under component 1 or component 2 of the tax credit to be paid by advance payments, on a monthly basis, as of 2021.

Furthermore, the reducible amount under component 1 of the new tax credit for caregivers cannot be paid in advance to the caregiver.

It can be claimed only when the income tax return is filed.

Application date

The new refundable tax credit for caregivers comprising two new components replaces the four components of the tax credit for informal caregivers of persons of full age as of January 1, 2020.

Changes to the other tax credits relating to informal caregivers

As of 2020, a caregiver who paid respite expenses in respect of a carereceiver having a severe and prolonged impairment in mental or physical functions can claim an additional amount under the refundable tax credit for caregivers. This assistance for respite expenses will be equal to 30% of total qualifying expenses up to $5 200 and will no longer be reducible.

The various changes made to the refundable tax credit for caregivers will provide more tax assistance to most of the people who claimed the refundable tax credit for volunteer respite services or the refundable tax credit for respite expenses of informal caregivers. Consequently, these two tax credits will be eliminated as of 2021.

However, for 2020, an individual will not be able to claim, in respect of the same eligible carereceiver, both the refundable tax credit for caregivers and the refundable tax credit for respite expenses or refundable tax credit for volunteer respite services.

Simplification of payment of the refundable tax credit for solidarity to the surviving spouse

This tax credit is granted on a family basis and is paid to only one of the spouses.

If the spouse who claimed the tax credit dies, the tax credit for the household ceases to be paid as of the payment following the death.

Currently, the surviving spouse can receive the payments to which the deceased spouse would have been entitled on behalf of the household for the remainder of the year. However, the surviving spouse must claim the tax credit by completing Schedule D of the income tax return again and filing it with Revenu Québec.

To reduce the administrative burden following a death and enable the surviving spouse to quickly receive the amounts to which he or she is entitled, the solidarity tax credit will henceforth be paid automatically to the surviving spouse as soon as Revenu Québec is informed of the other spouse's death.

Application date

Automatic payment will apply in respect of deaths that occur on or after July 1, 2020.

Other measures

Rebate program for the acquisition of an electric vehicle

The government is ensuring the continued financing, until March 31, 2021, of rebates of up to $8,000 on the purchase of an electric vehicle and $4,000 on the purchase of an all-electric used vehicle.

To support Quebecers' energy transition, the government is extending the Roulez vert program until March 31, 2026.

The parameters of the rebates for the acquisition of an electric vehicle that will apply after March 31, 2021 will be specified at a later date. These rebates will provide financial support in line with market developments.

Plan to ensure tax fairness

Continuation of the action plan

The government is continuing its efforts to collect tax revenues that escape it.

The Tax Fairness Action Plan is the strategy being implemented by the government to fight tax evasion and tax avoidance and to ensure the integrity of the tax system.

Collection of the QST by suppliers outside Québec

The Québec government is reiterating its determination to see the QST collected on corporeal property from abroad, and it intends to require that foreign suppliers collect the QST when they sell, in Québec, corporeal property to Québec consumers.

To that end, Québec would like to proceed in a harmonized and coordinated manner with the federal government. In fact, the latter has also expressed its intention to require that “international digital corporations whose products are consumed in Canada collect and remit the same level of sales tax as Canadian digital corporations.”

Given the shared determination of both governments, Québec will work with the federal government to implement in 2021 harmonized rules for the collection of the QST and the GST/HST by foreign suppliers.

Stepping up actions to fight tax evasion and tax avoidance

Tightening regulations in the personnel placement agency sector

The government provides that personnel placement agencies that hold this licence will be required to have a valid Attestation de Revenu Québec at all times. This will enable businesses to regularize their tax obligations with Revenu Québec.

Other measures

1) The government will identify targeted measures in the residential renovation sector to simplify tax compliance.

2) The funding granted to the Régie du bâtiment du Québec will be increased to step up criminal history checks on the guarantors, directors and shareholders of construction companies.

3) The government will increase interventions in the financial sector and the new economy, particularly by the followings actions:

- increasing the number of inspections of money-services businesses;

- continuing to develop expertise in the cryptocurrency sector;

- enabling suppliers that are active on collaborative economy platforms to comply more effectively with their tax obligations.

Application date

These changes will apply after the date on which the bill implementing these measures is assented to.

Prepared by:

Isabelle Nadeau, B.C.L., LL.B., LL.M. Tax, is a Partner at Crowe BGK

Connect with her: [email protected]

Jean-François Senécal, LL.B., D. Tax, is a Senior Tax Manager at Crowe BGK

Connect with him: [email protected]

Jianyi Li is a Tax Specialist at Crowe BGK

Connect with him: [email protected]