Suspension of employer’s obligation on redundancy payments lifted

Many businesses face high redundancy costs as the temporary suspension of redundancy payments gets lifted.

One of the government’s emergency measures during COVID-19 included the temporary suspension of an employee’s right to claim redundancy pay. This temporary provision, introduced in March 2020 to help support firms already facing liquidity challenges, was extended six times and finally finished on 30 September 2021.

This now means that an employee may be entitled to apply for a redundancy payment if the employee qualifies for redundancy and the employee has been on temporary lay-off or short-time in accordance with Section 12 of the Redundancy Payments Act for a period of:

- 4 continuous weeks; or

- 6 non-continuous weeks within a 13-week period.

To qualify for statutory redundancy, an employee must have 104 weeks of reckonable service with the employer. Periods while on the TWSS and EWSS is counted towards reckonable service.

Any period spent on Jobseeker's Payments or COVID-19 Pandemic Unemployment Payment is considered a temporary lay-off and is not considered towards reckonable service.

Redundancy and the COVID-19 Pandemic Unemployment Payment (PUP)

The PUP benefit is for employees and self-employed people who have lost all their employment due to the COVID-19 pandemic.An individual does not qualify for the PUP if they voluntarily leave employment or self-employment.

Employers should be aware that if a worker is on PUP and an offer of employment is made to return to work but they refuse to take up the offer, then there is a risk that the employer could be left open to entitlement for redundancy unless the employment is terminated.

As a means of limiting this risk, the Department of Social Protection should be notified of any workers on PUP who refuse to return to work at [email protected]

Funding redundancy

At the end of September, the Cabinet agreed that employers who need to pay statutory redundancy to those who lost their jobs over the last 18 months and are unable to meet the cost could borrow funds for the payments from the Social Insurance Fund at favourable terms. A flexible and discretionary approach will be taken in relation to recovery of the redundancy debt and in many cases the debt can be repaid over a number of years.It also announced that payments of up to €1,860 would be made available to workers made redundant who have lost reckonable service while in receipt of the PUP or another jobseekers payment over the pandemic. This payment will come from the Social Insurance Fund and will ensure workers won’t be left short of their redundancy entitlements.

Redundancy payments

The statutory redundancy payment is a lump sum payment based on the employee's pay. All eligible employees are entitled to:- Two weeks' pay for every year of service they have (since they were 16 years old) and

- One further week's pay

The amount of statutory redundancy is subject to a maximum earnings limit of €600 per week (€31,200 per year).

The statutory redundancy payment is tax free.

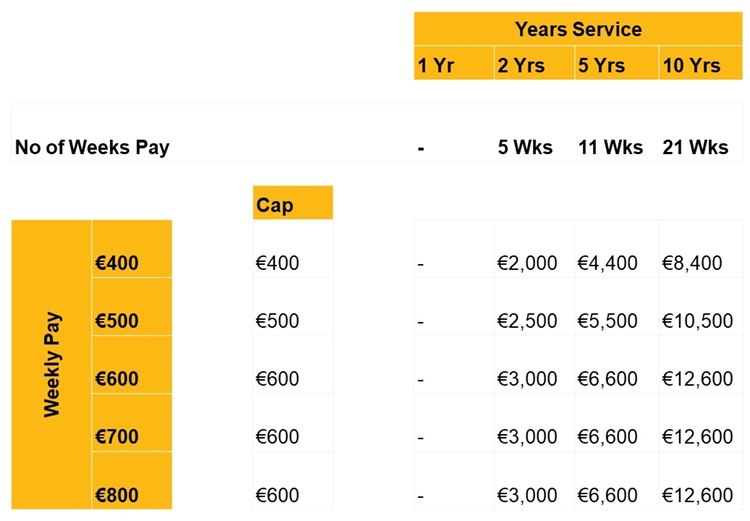

The table below shows the redundancy amount for a range of weekly pay amounts and lengths of service.

Pay refers to current normal weekly pay including average regular overtime and benefits in kind, but before tax and PRSI deductions. If an employee is paid monthly, your normal monthly pay is divided by 4.33 to calculate the weekly pay. Where an employee does not have regular hours or regular pay, an average of the last 52 weeks worked is used.

If an employee agreed to reduced hours temporarily due to COVID-19 and got paid through the Employment Wage Subsidy Scheme (EWSS) or the Temporary Wage Subsidy Scheme (TWSS), the lump sum redundancy payment should be calculated on the individual’s normal weekly pay.

If your business has been forced to make staff redundant due to COVID-19 and is struggling to fund its cash flow obligations, please contact a member of our restructuring and insolvency team in confidence to arrange a no-obligation consultation.