Crowe 2020 Irish Hotel Sector Sentiment Survey

Crowe recently carried out a COVID-19 impact and outlook sentiment survey for the Irish hotel market. With the Irish hotel sector facing one of the most challenging years in its history, we wanted to highlight the impact the pandemic is having on hotels and how it is affecting hoteliers’ outlook for the sector. The survey was carried out online, from 4 to 15 June 2020.

The majority of hotels closed in March 2020, at the end of the off-peak season. At this time, hotels would typically be carrying higher debts in the expectation that these would be paid down during the busier summer trading period. While there is seasonality in the tourism sector, most Irish hotels maintain year-round viability. Without the normal high season expected this year, due to a collapse in international demand, and with the impact of higher operating costs due to COVID-19, there is little probability that hotels will generate a profit over the summer months.

By October 2020, the hotel sector will be facing difficulties as they enter another low season with reduced demand, higher costs and potentially carrying higher levels of debt accumulated during the shutdown period earlier in the year.

Our aim with this survey is to represent the collective thoughts of the industry and report on the scale of damage inflicted by the pandemic on trading levels. We hope it will act as a reference point to articulate the challenges and types of stakeholder supports needed.

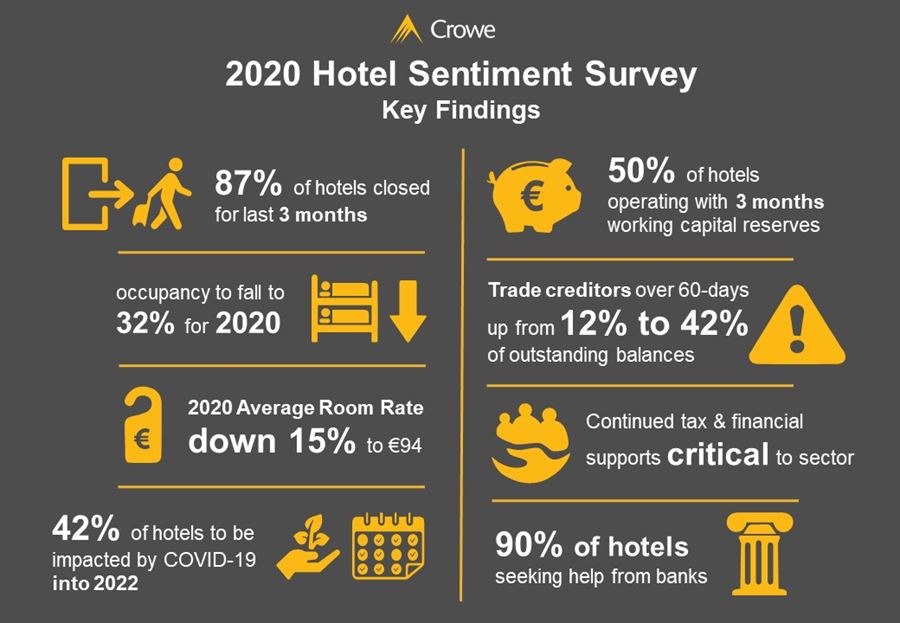

The sentiment survey revealed a number of key points:

- 87% of hotels were fully closed for the last three months, with all hotels expected to re-open

- For the respondents sample, 2019 occupancy of 73% is set to fall dramatically to 32% for 2020 and their average room rate of €111 in 2019 is set to fall to €94 for 2020

- 53% of hotels are operating with just three months’ working capital reserves, highlighting the need to reopen and trade profitably

- Extended temporary work scheme supports, reduced VAT rate, extension to rates waiver and other grants are seen as critical to support operations until demand levels allow for revenue and profit recovery

- 42% of hotels believe that COVID-19 will continue to have a negative impact on their business into 2022 and so the demand from domestic source markets is seen as critical to underpin hotel performance

Crowe partner and hospitality specialist, Aiden Murphy, believes there are three key elements required for Irish hotels to sustain their operations:

- Continuous cost control

- Working with their banks and financial institutions

- Ongoing government supports until demand starts to rebound

To receive a PDF of the sentiment survey results, please email Sinead O’Rourke.

To find out more about the range of specialist hotel, tourism and leisure (HTL) services Crowe offers, visit our HTL sector webpage or contact a member of our HTL team.

Our hotel, tourism and leisure service brochure

Download our brochure outlining our specialist HTL services.