7 steps to business recovery

The outbreak of COVID-19 has caused disruptions for many SMEs in Ireland. During periods of lockdown, many businesses that rely on foot traffic and in-person transactions struggled to stay afloat.

While the COVID-19 crisis was impossible to predict with conventional wisdom and forecasting tools, businesses in financial difficulty can show many symptoms, and it is crucial that the management team spot the signs of decline, assess the causes, and take action early during a crisis.

It can be overwhelming for business owners to keep up with the new laws, rules and regulations, let alone work out an action plan for your business during this time of COVID-19. Therefore, the sooner you consult an insolvency practitioner to deal with the present challenges, the more likely that there will be options available to you and your business. It will leave the business owner in control and hopefully lead to a successful recovery.

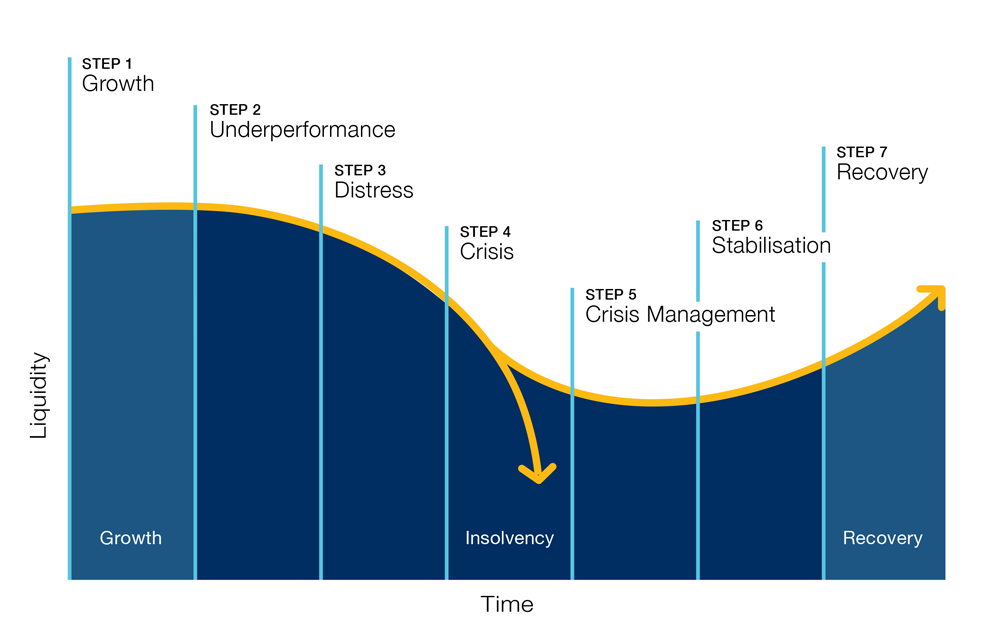

Here are the seven steps to business recovery, outlining the decline and recovery curves and giving guidance on what to expect at each stage.

1. Growth

It may seem counter-intuitive to think about failure at a time of growth. However, in periods of economic growth, and especially during the recovery from recessions, many business owners look for assistance from an insolvency practitioner to adjust the business for a full recovery and manage business continuity.

Businesses that have struggled to make sales but have survived can find themselves inundated with orders. This can lead to a loss of financial discipline and liquidity issues as cash is sucked out of the business to fulfil orders well before payment is received.

2. Underperformance

Early signs of underperformance can be difficult to spot. Unless there is a sudden and catastrophic disaster (a sudden loss of key staff, loss of market share to competitors or a pandemic), it is possible for a business to trade apparently successfully while things go wrong under the surface.

Businesses in financial difficulty can show many symptoms, but the most significant is a cash flow crisis, when a cash-generative company loses profitability because of weaknesses in its business.

The management team need to remain alert to spot these initial signs of decline and take action as soon as possible in order to avoid a negative impact on business performance.

3. Distress

In this stage a business cannot fund any activity outside its immediate operations and has difficulty meeting commitments to lenders and trade creditors.

An underperforming business can quickly slip into distress if no remedial action is taken, entering what is sometimes known as “the zone of insolvency”. Remember that this is a distress situation and not yet a crisis.

At this stage, it is far from certain that a business is bound to fail or indeed destined to enter any formal insolvency process. If owners haven’t already acted to restructure or resolve potential problems, then this is the time to do so.

There are several options for a business when it finds itself in a distressed situation. It is represented graphically by the decline curve – the further up you are in the decline curve, the more options you are likely to have, because you have more time and assets and so are better able to afford the changes the business will need to make.

Having entered into a situation of distress, it is more likely than not that some external agency will be required for the business to survive and get back to performing as it should.

4. Crisis

A business that ignores signs of distress will eventually hit a crisis point. The business may get into extreme difficulties due to a lack of liquidity that makes it impossible to meet overheads, cover staff costs, pay taxes and fines or simply finance the running of the business.

Without cash and with very limited options to recover, it is fair to assume that any business will seize up, stagnate, and eventually die. Unless the company takes action to address the difficulties it faces, the pace of its decline will accelerate and the options available to the business will narrow, making a successful rescue or restructuring less likely.

However, even at such a late stage, it is better to seek help and advice than to ignore the problem.

5. Crisis management

There are usually several routes out of a crisis, but not all lead to the same outcome in the long term. For most business owners there are two clear options – save the business or just let it collapse. For those business owners who are interested in saving the business, some of the options available are:

- Consensual restructuring of liabilities

- Scheme of arrangement

- Examinership

Further details on these options can be found here. The proposed introduction of the Small Company Administrative Rescue Process (SCARP) will also provide an additional formal rescue and restructuring option for SMEs and it is hoped this will be operational later in 2021. Further details on this process can be found here.

6. Stabilisation

Having acted in time and averted a crisis, an insolvency practitioner or other adviser can work towards a longer-term plan to put the business on a more sustainable footing.

This may mean bringing in a new senior management team, depending on the ownership model and actions taken to date.

This stage is the time for business owners to work through what is required to manage business continuity and to look for opportunities to reflect, restart and revitalise the business.

7. Recovery

The business is now adjusted and recovering from the crisis period.

Every decision made at this stage could impact a business’s ability to thrive in the future. This will require extraordinary flexibility, coordination and resilience during what may be a protracted period of recovery in times of COVID-19.

Please contact a member of our restructuring and insolvency team if you wish to confidentially discuss any challenges your business may face and receive a no-obligation consultation.

What's your next move?