Cryptocurrencies and taxes

Firstly, we need to clarify what the cryptocurrencies actually are. The Czech legal system does not know this concept at all. However, according to information published by the Financial Administration, cryptocurrencies are considered to be inventories of their own kind; thus, in principle they can be regarded as goods (in case of purchase) or products (in case of sales) of an intangible nature. From the point of view of the Czech Income Tax Act, it can be said that this is a so-called other thing.

Let's take a look below at when, what and how to proceed with taxation in the case of cryptocurrencies.

When?

The purchase and subsequent holding of a cryptocurrency does not constitute taxable income, even if the value of the cryptocurrency increases significantly during the holding.

Taxable income arises only in the following cases:

- cryptocurrency exchange for FIAT currency, i.e. sale of cryptocurrency;

- exchange of one cryptocurrency for another cryptocurrency (in this case it is important to realize that it represents a sale of one cryptocurrency and at the same time purchase of another cryptocurrency); and also

- obtaining cryptocurrency free of charge, e.g. in case of incentives for a future purchase or gift.

Conversely, taxable income does not arise from the transfer of cryptocurrency from one wallet to another without exchange or from the cryptocurrency mining. Even in this case, the taxable income occurs only at the moment of sale.

In principle, it is therefore necessary to proceed with taxation in the calendar year in which the above facts occurred.

What?

The amount of taxable income must be determined in relation to the FIAT currency. In case of the so-called sale of cryptocurrency, it is quite easy to determine. However, it is much more difficult in the latter two cases. Therefore, it is very important to ensure that the virtual wallet or cryptocurrency exchange (online marketplace) provides this information, and that the taxpayer is able to obtain it (e.g. via exports of individual transactions). Another option is to keep information about the value of the cryptocurrency on a given day, ideally from several virtual exchanges. Without this information, it will not be possible to effectively determine taxable income.

Subsequently, the tax base is calculated as the taxable income reduced by expenses demonstrably incurred to achieve it. Such costs are primarily the cost of acquiring the cryptocurrency sold, i.e. the price form which the cryptocurrency was acquired, as well as the fees associated with both its purchase and sale. But how to calculate these costs correctly?

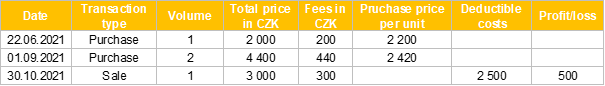

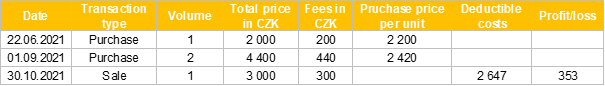

According to the Financial Administration, it is possible to use either the FIFO method ("first in, first out") or the weighted arithmetic average method to determine the acquisition costs. How these methods work can be seen in the tables below.

- FIFO method

- Weighted arithmetic average method

The chosen method will apparently have to be used continuously for a particular cryptocurrency and it will not be possible to change it easily over time. We therefore recommend considering its choice carefully.

How?

Revenues from cryptocurrencies represent so-called other revenues in accordance with the provisions of Section 10 of the Czech Income Tax Act.

However, as mentioned above, it is a kind of residual category and therefore, is be covered by the exemptions specified by the Czech Income Tax Act for the sale of securities (including shares). Therefore, the limit of CZK 100,000 for tax exempt income does not apply here, nor can it be said that cryptocurrencies that have been held for more than 3 years are exempt from tax. In principle, the only exemption that could be applied here would be in case of acquiring a cryptocurrency as a gift from a closed person.

If the taxpayers generate income from the sale of cryptocurrencies, they are obliged to file a personal income tax return. It needs to be emphasized here that we are talking about revenues, not profits; thus, submission of the tax return may be necessary even if the taxpayer has suffered a loss.

Generated profits are subject to the personal income tax of 15%. However, if the total income (including those from employment and business activities) exceeds the statutory limit (CZK 1,701,168 for 2021 and CZK 1,867,728 for 2022), a tax rate of 23% will apply.

All theory is grey, but forever green is the tree of life…

Within the framework of the taxation of cryptocurrencies, it is crucial to have all the necessary information. If these are not available, even the best tax advisor will not calculate the tax burden correctly.

The ideal variant is when for each cryptocurrency traded, there is a statement showing all transactions in chronological order, both purchases and sales or exchanges as well as other types of acquisition of the given cryptocurrency. For each transaction, it is necessary to know its date, the volume of cryptocurrency, the corresponding amount in FIAT currency (or the exchange rate of a specific cryptocurrency to FIAT currency on a given day / moment) and the amount of fees.