Corporate Compliance

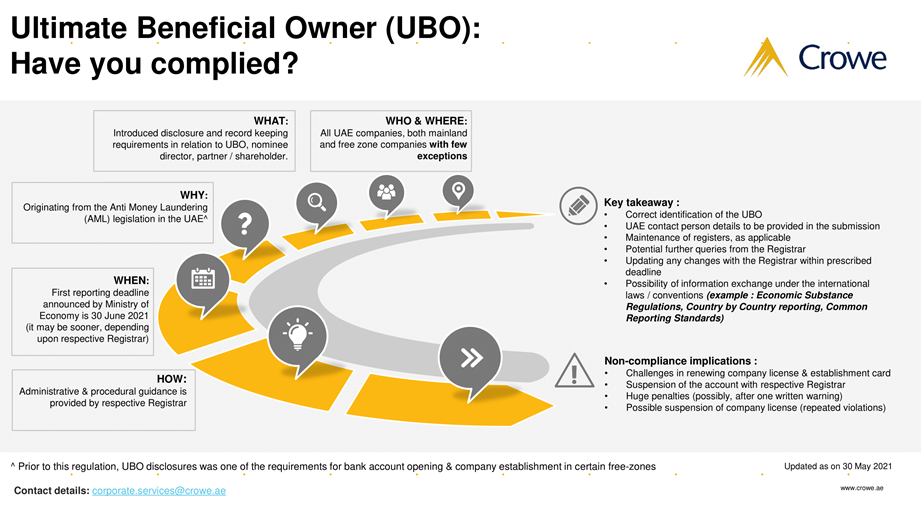

Beneficial Owner (UBO) procedures and compliance - Compliance Alert UAE Cabinet Decision No: ( 58 ) of 24 August 2020

At the outset, and trust that you all are staying safe and doing well.

Most of us will agree that its already been a very busy but very satisfying last few months, with the economy slowly opening up across business sectors with cautious optimism, post the lifting of lockdown despite the ongoing health pandemic. Hence we have seen various tax and other regulatory compliance changes been introduced across the region especially in Oman, UAE, Bahrain and KSA covering VAT, CbCR, Customs, Transfer Pricing, ESR and now UBO regulations. Implementing and following on these changes, are on the top of the agenda for all the government, authorities, industry, banks, investors and other stakeholders.

We are thus pleased to share an important reminder alert for the benefit of all as received from the DMCC authority. This document is equally relevant to other mainland and other free zones entities. Based on this, we have compiled the following guidance note with possible next steps for your easy reference and the benefit of all our esteemed clients.

Back drop Legislation: Federal Cabinet Decision 10 of 2019 on the Implementing Regulation of Federal Decree-Law 20 of 2018 on the Criminalisation of Money Laundering (AML) and Combating the Financing of Terrorism (CFT)and the Financing of Unlawful Organisations (the Cabinet Decision) requires all UAE licensing authorities to identify the ultimate and real beneficial owners (UBOs) of all UAE businesses (ie., for all Main land and Free Zone Entities) that are licensed by them.

With this backdrop, the United Arab Emirates (UAE) has thus recently issued Cabinet decision No. (58) of 24th August 2020 concerning Regulation of Procedures related to Real Beneficiary (‘UBO Regulations’). The UBO regulating procedures thus replace Cabinet Resolution No. 34 of 2020, issued earlier this year.

The main aim of the new Cabinet Decision 58 is targeted to achieve the following objectives( Article 2) :-

- Contribute to the development of the business environment, capacities of the state and its economic position in accordance with the international requirements, by regulating the minimum obligations of the Registrar and legal persons in the state, including the licensing or registration procedures, regulating the Register of Beneficial Owners and the Register of Partners or shareholders for all the companies in the mainland and also non-financial Free Zones (i.e Registrants) i.e (excluding DIFC/ ADGM) for preparing, maintaining and reporting ultimate beneficiary owners, including relevant details; and

-Develop effective and sustainable executive and regulatory mechanisms and procedures for the real beneficiaries and or nominee director data by all the companies.

Definition of a UBO ( Article 5) A Beneficial Owner refers to:

- A natural person who ultimately owns or controls the legal person, whether directly or through a chain of ownership or control or any-other indirect means, and also the natural person on whose behalf the transactions are being conducted or who exercises ultimate control over a legal person.

- It thus refers to any individual person that ultimately owns or controls 25 per cent or more of a Free Zone Entity, whether directly as a shareholder( in the equity or as voting power or similar influence over directors), and or indirectly via control of companies, other entities or structures that control the Free Zone Entity, is thus an UBO.

The definition of the UBO is also wide enough to be traced through any number of legal persons or any trust and or any other similar arrangements of whatsoever kind. As a consequence, all the senior management, authorized signatories, any other management representatives, nominees and or manager as per the Trade license may also be covered and may have to be traced and disclosed and their details will have to be submitted to the authorities.

Scope Exclusion: The Regulations do not apply to the following entities

- Companies wholly owned by the Federal or local government or any other companies wholly owned by these companies; and

- Companies licensed or registered in Financial Free Zones of UAE (Dubai International Financial Centre and Abu Dhabi Global Markets).

Next Steps for UBO tracking and reporting of compliance through a declaration:-

1. Initial tracing and Identification of UBOs :-

All the registered entities are required to file a declaration with personal particulars ( e.g name, Nationality, address, passport, date of birth, extent of shareholding etc.,) relating to identification and authentication of their shareholders/Partners and or their ultimate beneficial owners with the Registrar and the licensing authorities ( e.g Ministry of Economy, DMCC, DAFZA, JAFZA etc) registered in the UAE. The expected date is by 27 October 2020 (*TBC) or at the time of incorporation/ registration of new companies.

Note : The Registrar may also require the submission of their passport copy, proof of residential address, share certificates, MOA etc, and any other relevant documents in relation to the UBOs and possibly senior management and or nominee board members as well.

The affected entities are thus required to take adequate steps to compile and maintain relevant and up-to-date accurate data on their real beneficiaries and maintain the same in the future including any subsequent changes.

2). Prepare company secretarial records:-

All the companies are thus required to maintain the following registers:-

1. A Shareholder and or Partner’s Register;

2. A Register of Beneficial Owners( e.g even may include relevant details of local sponsors based on side / Trust / Mudaraba / Foundation agreements etc, and

3. A Register of Directors and Nominee Board members/Directors.

4. Any changes to such information shall have to be updated within the fifteen (15) days from the date of the change.

3). Submission of a UBO declaration to the competent authorities:-

1. There will possibly be severe consequences for non-compliance and the Minister of Economy or the Licensing Authority may impose sanction(s) from the list of administrative sanctions, that may be issued in due course.

2. The method of submission of the UBO declaration offline/ online are currently still not available as yet and further details are awaited.

Some UBO declaration forms have been issued by DMCC, Rakez and DDA authorities already. Others will follow soon.