Quantifying ideas: Valuing Startups

Times are changing and nothing is constant except change. In today’s ever dynamic world where new ideas are being conceptualized at an alarming rate, startup valuations are becoming a very common phenomenon.

Startup valuation is unique and quite different from a mature business valuation. Lack of data makes it imperative for the valuer to give more importance to qualitative factors like quality and network of management team, market viability of product and so on.

Valuing a Startup has its own challenges. They, more often, don’t have a track record of revenues and EBITDA. To add to the complexity, the promoter has Business Plans which seem over optimistic to a financial analyst. In the recent past we have seen many tech start-ups and giants being valued at unprecedented multiples. They are usually valued at multiples of revenues (or projected revenues) since they do not have positive EBITDA for several years to come. Investors have become keener on investing in startups looking at the success stories of Class Pass, Alibaba, and not so old Careem and Souq. Irrespective of whether the Investors are Angel investors, Incubators or Venture Capitalists, the starting point for all of them is the Business model and the Valuation. The technical methodology of valuations like using comparables of similar deals, relying on appropriate betas and risk premiums pose a higher challenge due to unavailability of data.

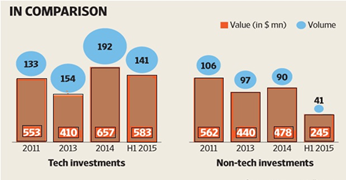

Over the past couple of years, we have seen Startup funding being injected more into tech than non tech companies. With no geographical limitations, tech companies have access to a larger audience and hence there is a further challenge in projecting the revenues and predicting market demand.

Source- Venture Intelligence

Furthermore, a major task is to arrive at an appropriate discount rate/ required rate of return due to higher failures. If the business idea seems very novel, a call has to be taken whether it will work and get market acceptability and accordingly the WACC/Business Plan needs to be adjusted. The valuer has to ensure that business plan makes sense. Here the experience of valuer plays a major role.

To conclude, valuation models need to be flexible as an everchanging market demands valuations to be ever dynamic and impermanent.