Why you should adopt IFRS for SMEs

Majority of the Companies registered under the Companies’ Act (10/96) and Business Profit Tax Act (5/11) of the Maldives, follows the International Financial Reporting Standards in the preparation and presentation of their statuary financial statements.

In July 2009, the international accounting standard board (IASB) issued international reporting standards designed for SMEs, as a move towards SME harmonization. In the Maldives, more than 80% of the registered businesses are SMEs, providing jobs as well as playing a major role in nation building. Despite IFRS for SMEs being more relevant, simple and less costly for adoption, only few companies in Maldives have adopted these standards in the preparation of their financial statements.

IFRS is more relevant to large enterprises and companies listed on the stock exchange. The SMEs standard reduces the burden of producing information that is not likely to be of interest to stakeholders of a small or medium company. Users of financial statements of SMEs are more focused on assessing short term cash flow, liquidity and solvency. The IFRS standards for SMEs will be updated approximately every three years.

Compared to full IFRS standards, IFRS for SMEs is less complex. In IFRS for SMEs;

- Significant time and cost are saved due to its simplifications, particularly with the regard to the disclosures

- All the standards are in one document resulting in easy accessibility in obtaining the information required

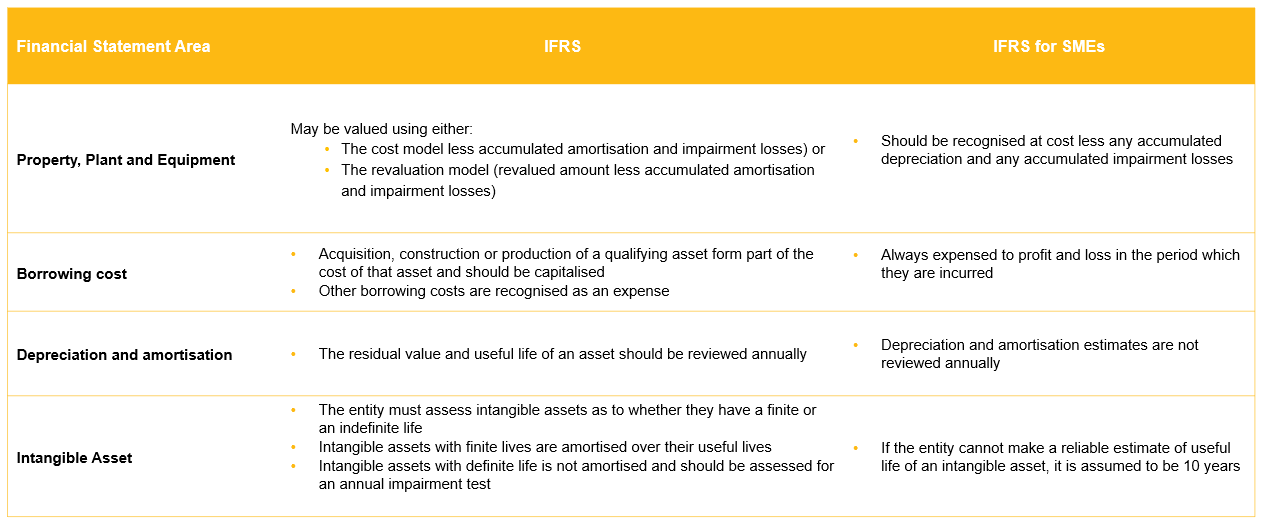

The IFRS for SMEs has simplifications that reflect the needs of users of financial statements. Key simplifications which may be applicable to SMEs in Maldives are as follows:

IFRS for SMEs are highly convenient for small and medium sized enterprises where businesses are usually small-scale. The benefits of adopting IFRS for SMEs in the Maldives would be significant due to the relaxed reporting requirements, reducing the burden on the accountants to comply with the full IFRS, and making the financial statements easier to read for the stakeholders involved.