Proposed Tax Law Changes in 2013

We summarized below some of the major proposed tax law changes announced by the Ministry of Strategy and Finance on August 8 to keep you updated. We classified tax law changes into 4 categories based on the intended purpose of tax revision. The proposed tax law changes below would be applied for the fiscal year starting on or after January 1, 2014 unless indicated otherwise.

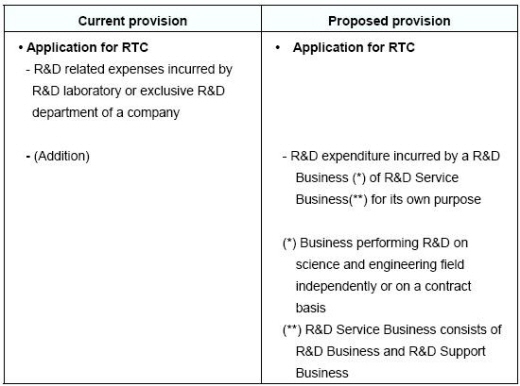

Ⅰ. Securing economic growth engine and supporting Small and Medium-Sized Company

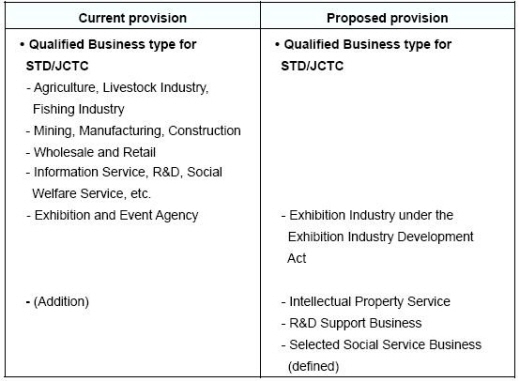

■ Expanded application of Special Tax Deduction (“STD”) for Small and Medium-sized Company (“SMC”) and Job Creation Investment Tax Credit (“JCTC”) by allowing Knowledge Property Service Business etc. to be entitled to STD and JCTC

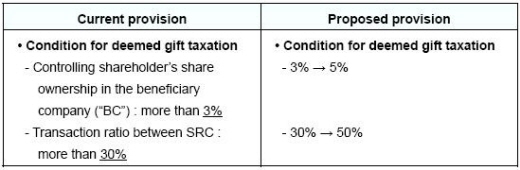

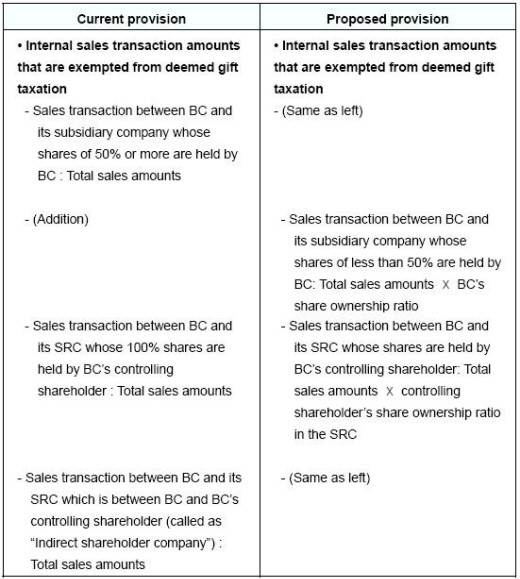

■ Reduced scope for deemed gift taxation on sales transaction between specially related companies (“SRC”)

- Ease for SMC by increasing share ownership from 3% to 5% and normal transaction ratio from 30% to 50%

- Expanded tax exemption on internal sales transactions between SRC

- Rationalized adjustment of double taxation between Gift Tax and Personal Income Tax

- Pharmaceutical Quality Control Improvement Facilities Investment Tax Credit

- Environment Conservation Facilities Investment Tax Credit

- Energy Saving Facilities Investment Tax Credit

- R&D Facilities Investment Tax Credit

Ⅱ. Improvement of fairness of taxation and expansion of tax revenue base

■ Conversion of income deduction into tax credit

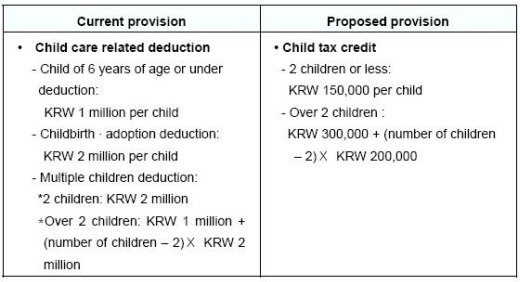

- Child care related deduction (child care deduction for having a child of 6 years of age or under, childbirth ∙ adoption deduction, multiple children deduction) will be combined into Child tax credit :

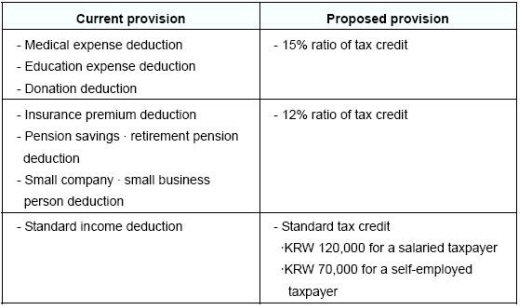

- Special deduction will be converted into tax credit

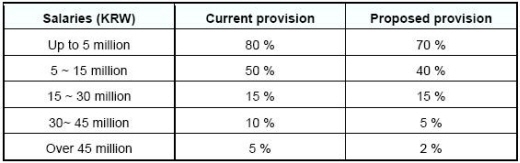

- Changes in earned income deduction rate

<news-content>Ⅲ. Support for culture and art promotion</news-content>

■ Expanded tax deduction limit for entertainment expenses related to cultural activities

(*) CEE: Cultural activities related entertainment expense

(*) EE: Entertainment expense

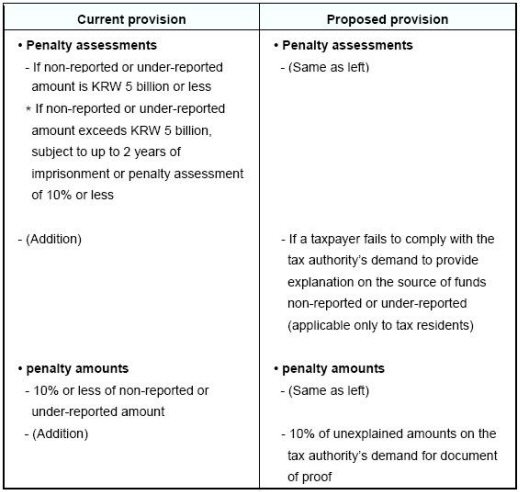

Ⅳ. Measures toward underground economy

■ Introduction of additional penalty in relation to the reporting requirements on the information of overseas financial accounts (*)

(*) A resident Individual or a domestic company should report information of overseas financial accounts in case its financial account balance is over KRW 1 billion.

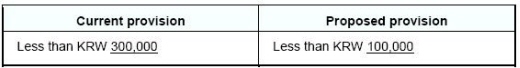

■ Reduced threshold for compulsory issuance of Electronic Receipt Slips for cash transactions