Interim corporate income tax return filing by September 2, 2013

An interim corporate income tax return can be filed using either (i) the 1/2 method (that is, paying 1/2 of the corporate tax paid in the prior year or (ii) the book-closing method (by closing the books of accounts of the corporation for the first six month period and calculate interim corporate tax amount based on such six-month financial results). When a corporation had not paid the corporate income taxes in the prior year due to tax loss or having no taxable income, only option (ii) above should be applied. The calculation formula of interim corporate taxes by using the book closing method is as follows:

Taxes payable = [taxable income for interim period Ⅹ12/6]Ⅹtax ratesⅩ6/12

- (tax exemption/withholding taxes paid/occasional assessment taxes paid for interim period)

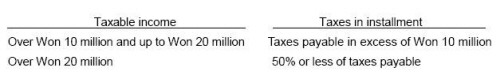

If interim corporate income taxes payable exceeds Won 10 million, such taxes can be paid in 2 installments, the second installment payment due within 1 month (2 months in case of small and medium corporation) from the end of the payment period.

Unlike annual corporate income tax return, there is no additional local income tax assessed on interim corporate income tax liability.