2012 Tax Law Changes/Korea

We summarized below some of the major tax law changes for 2012.

1. Corporate Tax Law

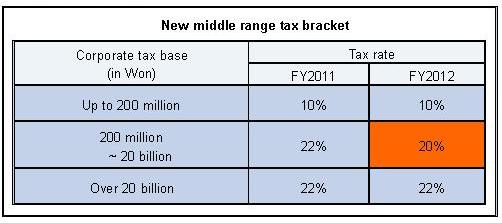

1) Maintaining top corporate tax rate at 22% and creating middle range tax bracket [Article 55(1)]

(Note) Local income tax will be additionally imposed at 10% of the corporate tax liability.

The National Assembly of Korea passed the proposed tax law changes which will maintain the top corporate tax rate at 22% for the company whose tax base is over 20 billion Won, and create a middle range tax bracket for the company whose tax base is between 200 million and 20 billion Won. The company with tax base up to 200 million Won will continuously remain at the 10% corporate tax rate. These changes made for improvement of fiscal stability and for development of small and medium-sized businesses are effective from the fiscal year starting on or after January 1, 2012.

2) Introduction of a new penalty regulation on submission of shareholders’ list [Article 76(3)]

In order to secure submission obligation of the shareholders’ list at the time of establishing a company, a new penalty clause has been introduced under which a penalty on non-submission will be imposed at a rate of 0.5% on the total amount of shares owned by each shareholder at issue.

The regulation is effective from the fiscal year starting on or after January 1, 2012.

3) Submission of withholding application form is now required in connection with applying reduced withholding tax rates for beneficial owner under the relevant tax treaty [Article 98-6]

In case a foreign (non-Korean) company applies a reduced withholding tax rate(s) allowed under the relevant tax treaty concluded between Korea and the concerned foreign country, the foreign company is now required to submit an application form for applying the reduced withholding tax rate(s) for the beneficial owner to the withholding agent paying the income.

The regulation will be effective for the payment to be made on or after July 1, 2012.

2. Individual Income Tax Law

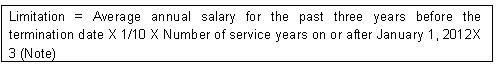

1) Introduction of a limitation on severance pay for directors [Article 22(3)]

In order to prevent excessive accumulation of severance pay for directors, which is subject to a lower tax rate than the tax rate for wage and salary income, a limitation on severance pay for directors will be in place according to the following formula on or after January 1, 2012.

(Note) The severance pay liability for the service years before January 1, 2012 can be accrued in accordance with previous rules (without limitation in accordance with the company’s regulation prescribed in the Articles of Incorporation or approved by the shareholders’ meeting).

Excess severance pay over the limitation will be classified as wage and salary income, which may be subject to higher income tax rates.

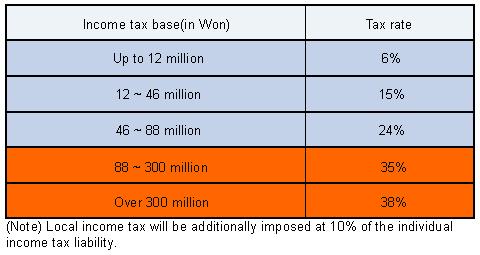

2) Cancellation of proposal for reduction of top marginal individual income tax rate to 33% and creation of a higher tax rate at 38% [Article 55(1)]

The reduction proposal for the top marginal individual tax rate from 35% to 33% was canceled by the lawmakers. The reduction proposal was brought in for the individuals earning over 88 million Won. However, to improve the fiscal soundness and secure sufficient budget to expand welfare benefits to the middle class and low income earners, the lawmakers declined the reduction proposal and instead, created a new tax bracket for the individuals whose income tax base is over 300 million with higher tax rate at 38%.

The amended individual income tax rate brackets are as follows:

3) Submission of withholding application form is now required in connection with applying reduced withholding tax rates for beneficial owner under relevant tax treaty [Article 156-6]

In case a non-resident applies a reduced withholding tax rate(s) allowed to the beneficial owner under the relevant tax treaty, he/she is now, same as a foreign company, required to submit a withholding application form to the withholding agent paying the income.

The regulation will be effective for the payment to be made on or after July 1, 2012.

3. Value Added Tax Law

1) Introduction of a regulation imposing VAT on free of charge rental transactions between related parties [Articles 7(3) and 13(1)]

In an effort to maintain the equity with the low priced rental transactions which are currently subject to VAT, VAT will also be imposed on free of charge rental transactions between related parties defined under the tax laws. The tax base for assessing VAT will be calculated based on ‘market price’ as determined pursuant to the tax laws.

2) Unifying the VAT return due date of local companies and foreign companies [Article 18 and Article 19]

The government unified the VAT return due date of foreign companies (e.g., a branch or a permanent establishment in Korea of foreign companies) the same as the local companies within 25 days from each quarter end. Previously, foreign companies were allowed to file the VAT return within 50 days from each quarter end.

The above revisions are effective from the quarter starting on or after January 1, 2012.