Disclosure of a calculation model for the arm’s length price of the fee for payment guarantee provided to a foreign (non-Korean) subsidiary

When a foreign subsidiary of a Korean company borrows money from the financial institutions in the foreign country, usually the foreign subsidiary receives payment guarantee from the Korean parent company and pays a fee for payment guarantee to the Korean parent company. Under the Korean tax law, fee for payment guarantee received from the foreign subsidiary is treated as taxable income and subject to the Korean transfer pricing rules.

However, as it is not clear how to determine the arm’s length price of the fee for payment guarantee, unfairness on taxation practice existed among Korean companies. Accordingly,National Tax Service (“NTS”) has developed a calculation model for the arm’s length price of the fee for payment guarantee and announced it recently.

■ Detailed contents of a calculation model for the arm’s length price of the fee for payment guarantee

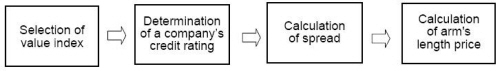

The calculation model for the arm’s length price of the fee for payment guarantee is a credit evaluation model and according to the formula of the model, the arm's length price of the fee for payment guarantee is determined by the spread difference for the Korean parent company and the foreign subsidiary based on their standardized credit rating.

a. Selection of suitable financial ratios as value index ;

NTS selected 63,000 companies as samples and divided those companies by normal companies and bankrupt companies, and verified the objectiveness by selecting suitable financial ratios as value index, which makes it easy to determine symptoms of corporate bankruptcy.

b. Determination of a company’s credit rating ;

NTS calculated scores of the model by putting statistical weights on the financial ratios computed based on the financial data for the recent two years and determined a company’s credit rating by comparing with the scores of the model with the standardized 13 grades.

c. Calculation of spread ;

NTS calculated a company’s spread based on the 'probability of default' of the Korean parent company and the foreign subsidiary calculated by the NTS credit evaluation model.

d. Calculation of the arm's length price of the fee for payment guarantee ;

The arm's length price of the fee for payment guarantee is determined by the spread difference for the Korean parent company and the foreign subsidiary based on their credit rating.

- Considerations given to complement limitations of NTS' model

- Upgrading the credit rating of the Korean parent company and the foreign subsidiary by 1 grade each to reflect measurable non-financial factors (brand value, country risk, etc.) from the conservative point of view.

- Putting a ceiling on the arm’s length price by applying the 9th grade as the lowest credit rating.

- Producing the arm’s length price as certain ranges of average price.

- If a company’s actual spread is reported based on the company’s credit rating confirmed by the main bank, it will be deemed as the arm’s length price of the fee for payment guarantee.