Proposed Tax Law Changes for 2012

We summarized below some of the major proposed tax laws changes of the government that would be an interest or relevant to foreign companies and foreign invested companies in Korea.

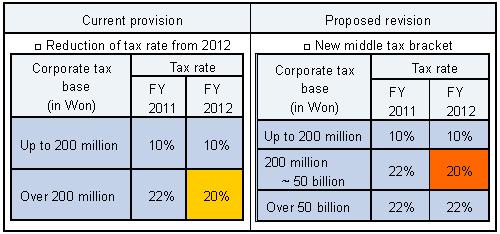

1. Maintain top marginal corporate tax rate of 22% and create a new middle tax bracket

The Korean government planned to reduce the top marginal corporate tax rate to 20% from 2012 for companies whose tax bases are over 200 million Won. However, to improve fiscal soundness and secure sufficient budget to expand welfare benefits for middle class and low income earners, the government and the ruling party agreed to maintain the 22% corporate tax rate and create a new corporate tax bracket for companies whose tax bases are between 200 million Won and 50 billion Won and reduce the tax rate to 20% for this middle tax bracket.

The proposed revisions above will be applied for the fiscal year starting on or after January 1, 2012 if the proposed tax law changes are passed by the National Assembly.

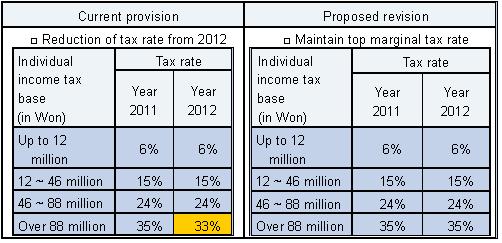

2. Maintain top marginal individual income tax rate of 35%

The proposed revisions above will be applied for the income to be earned on or after January 1, 2012 if the proposed tax law changes are passed by the National Assembly.

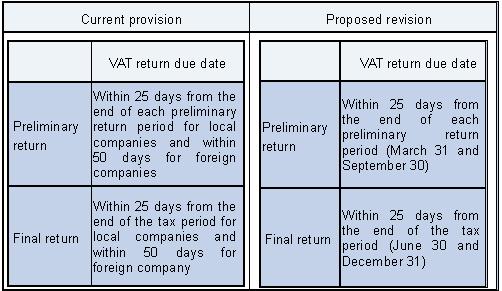

3. Unified the VAT return due date of local companies and foreign companies

The government proposes to unify the VAT return due date of foreign companies (e.g., a branch or a permanent establishment in Korea of foreign companies) the same as the local companies as within 25 days from each quarter end. Currently, foreign companies are allowed to file the VAT return within 50 days from each quarter end.

The proposed revisions above will be applied for the transactions to be made on or after January 1, 2012 if the proposed tax law changes are passed by the National Assembly.