About

CEO Message

About us

A growth strategy built on foresight and control

In today’s rapidly changing environment, companies need a growth strategy that balances foresight for strategic growth with control for risk management — one that is essential for sustainable success.As a consulting firm with a team of professionals who bring both deep expertise and strong execution capabilities, we support corporate growth through corporate finance, global strategy, and risk consulting.

Service

We provide services of global standards in corporate finance, global strategy, and risk consulting.

Corporate Finance

As a partner supporting critical decision-making for corporate growth and transformation, we provide hands-on execution support across both financial and strategic dimensions— including due diligence, valuation, private equity support, and corporate restructuring. In a time of constant change, we deliver practical solutions that help enhance corporate value and drive sustainable growth.

- Executive Officer

-

After gaining experience at a general trading company and a consulting firm affiliated with an audit corporation, Mr. Nagai joined the company in 2008.

Since then, he has been engaged mainly in M&A financial advisory, due diligence, and valuation (corporate value assessment), as well as business revitalization and IPO/internal control support.

He holds an MBA in Financial Strategy and Corporate Finance from Hitotsubashi University Graduate School.

He provides advisory services to a wide range of clients, from companies listed on the Tokyo Stock Exchange Prime Market to small and medium-sized enterprises.

- Our Core Service Areas

- Due diligence (corporate investigation)

- Valuation (business value assessment)

- Private equity support (capital raising via equity)

- Corporate restructuring

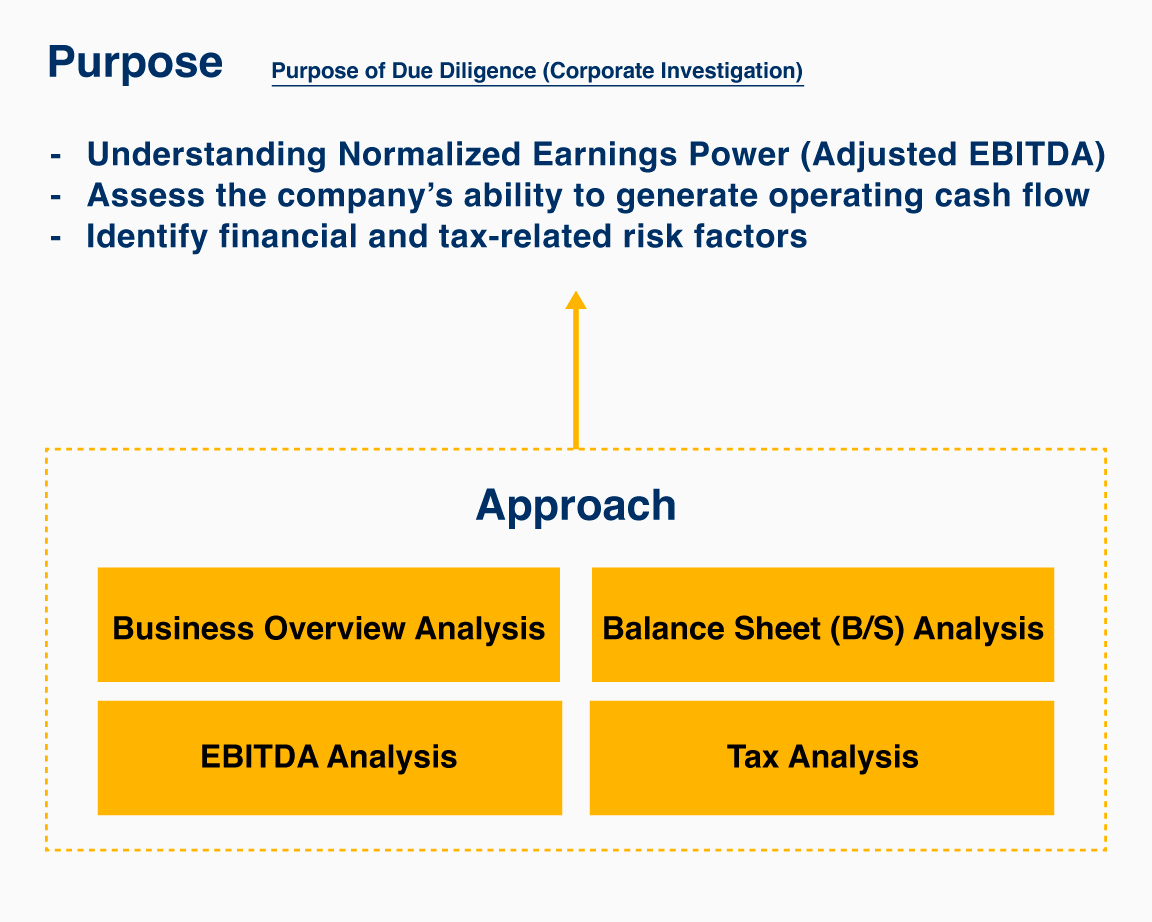

Due Diligence (Corporate Investigation)

A comprehensive investigation conducted to objectively understand a company’s actual condition and future prospects in the context of M&A or investment.

Due diligence is a comprehensive investigation designed to objectively assess a company’s current situation and future potential. It is an indispensable process for making informed decisions in M&A, investments, and new business relationships, aimed at identifying potential risks and accurately evaluating corporate value.

At our firm, we conduct due diligence from multiple perspectives — including financial, business, legal, human resources, and IT — to provide management with complete and actionable information.

This enables the formulation of appropriate transaction terms and post-merger integration (PMI) plans, supporting sustainable growth and enhanced competitiveness.

Due diligence is not merely a verification task, but a critical process for shaping future strategy.

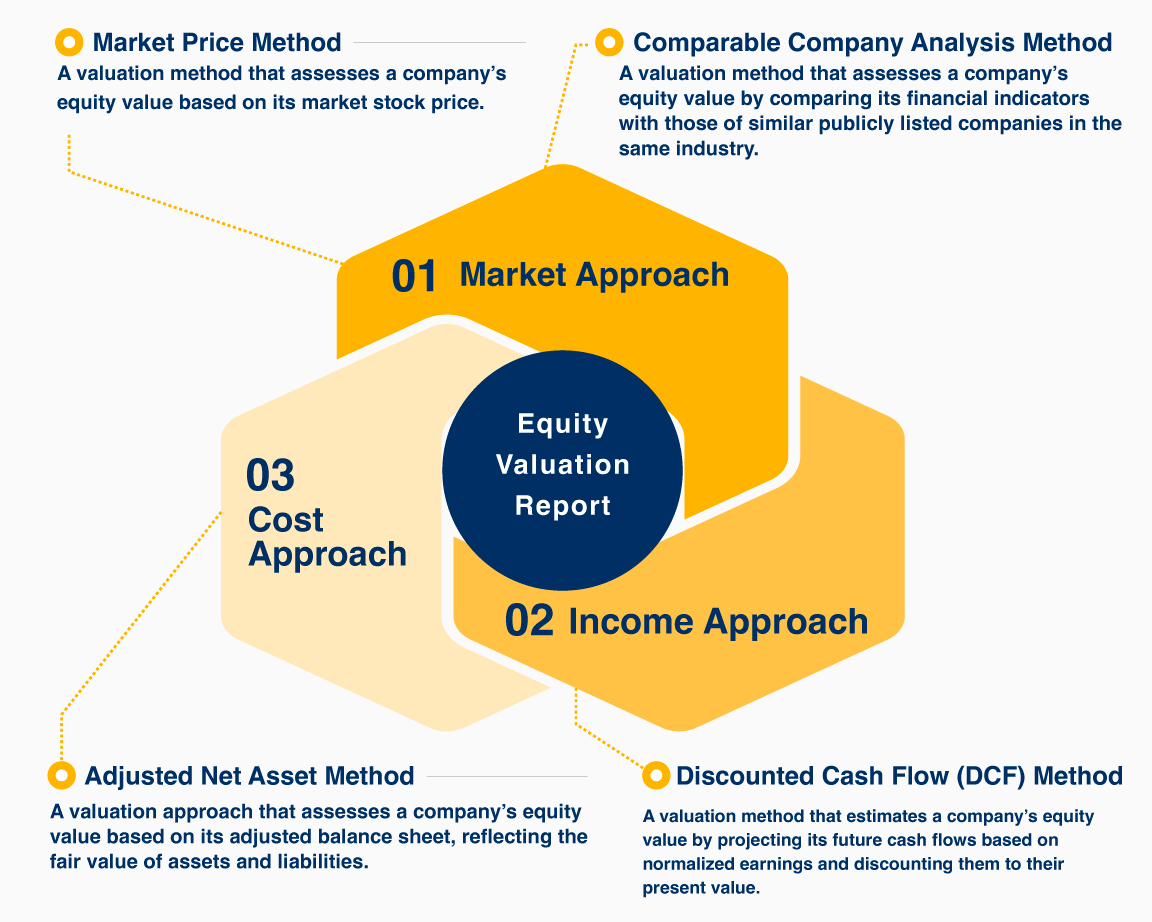

Valuation (Corporate Value Assessment)

Quantifying a company’s current and future value, and examining the fairness of its equity value.

Valuation is the process of quantifying a company’s present and future value — an essential indicator for major management decisions such as M&A, fundraising, IPOs, and new business ventures.

At our firm, we go beyond analyzing financial data by also evaluating market conditions, competitive landscapes, and growth potential from multiple perspectives to determine an appropriate corporate value.

Our approach extends beyond numerical calculation: we conduct valuation in alignment with the company’s management strategy, providing insights that support sound and strategic decision-making.

Global Corporate Advisory

We support a wide range of corporate transactions — including domestic and cross-border M&A — from strategy to execution and integration, driving global growth.

- Executive Officer

-

Mr. Okajima has engaged in statutory audits, IPO preparation consulting, and financial due diligence at an audit firm.

Subsequently, he has provided a wide range of consulting and advisory services to foreign companies—particularly Japanese corporations—based in Singapore and Malaysia.

-

Mr. Yamahara began his career in 2008 at a tax accounting firm and holds a certified tax accountant qualification.

He joined Crowe Watanabe Consulting Co. in 2009 and, after a secondment to a major securities company, has supported numerous business succession and carve-out M&A projects for both listed and owner-managed companies.

Appointed as Executive Officer in 2021 and Director in 2023, he is dedicated to providing tax and financial advisory services that enhance corporate value and promote sustainable growth.

- Key Areas of Support

- Comprehensive support for domestic and cross-border transactions including M&A:

- Strategic planning

- Execution

- Post-merger integration

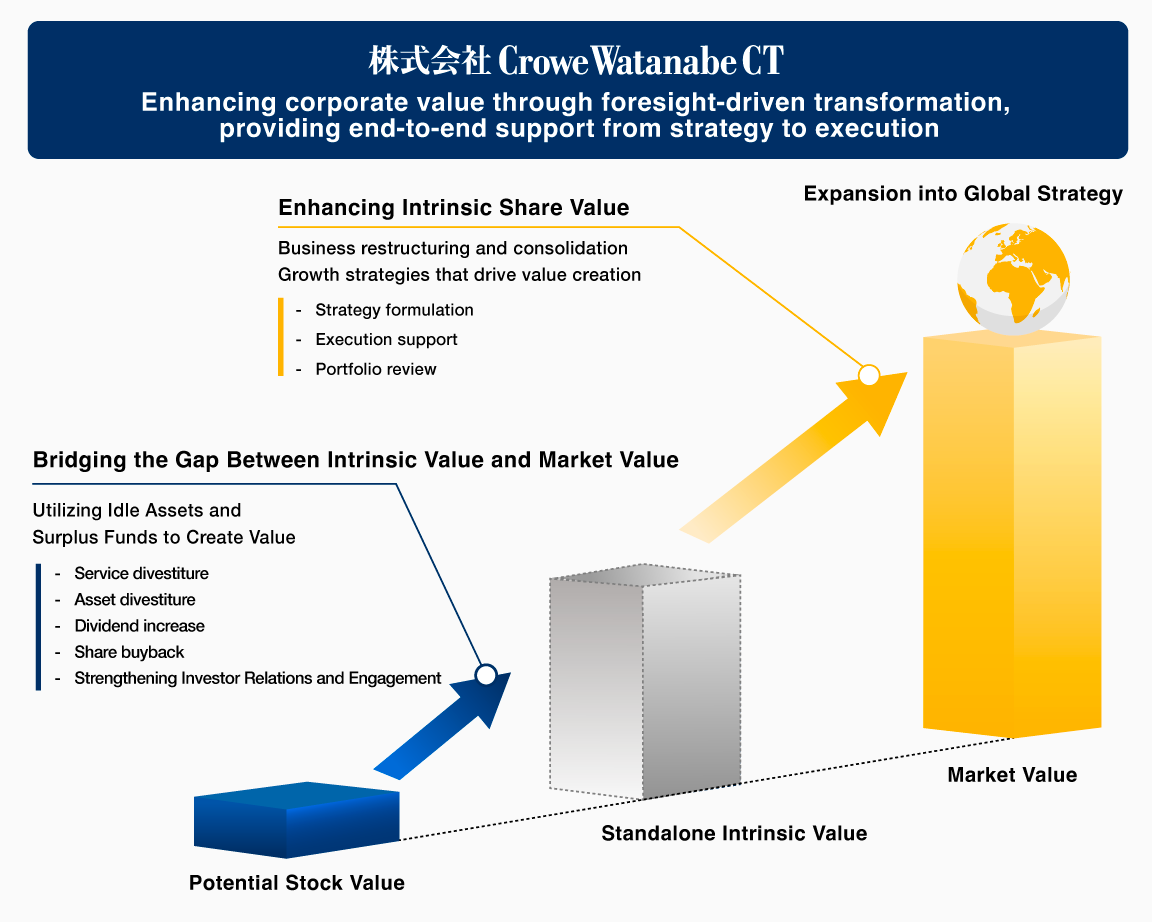

Share Price Enhancement Advisory

To enhance corporate value, foresight-driven transformation is essential.

In addition to implementing initiatives to close the gap between a company’s market value and intrinsic value, we help elevate intrinsic value itself through business restructuring, consolidation, and growth strategy formulation.

Our support goes beyond short-term measures such as asset divestitures and share buybacks — we provide comprehensive assistance from strategic planning and execution to portfolio review, helping to unlock and realize latent corporate value.

By integrating foresight into every phase of corporate transformation — from domestic initiatives to overseas expansion and global development — we aim to achieve sustainable growth and strengthen international competitiveness.

Through forward-looking and proactive transformation, we empower management to drive future-oriented value creation.

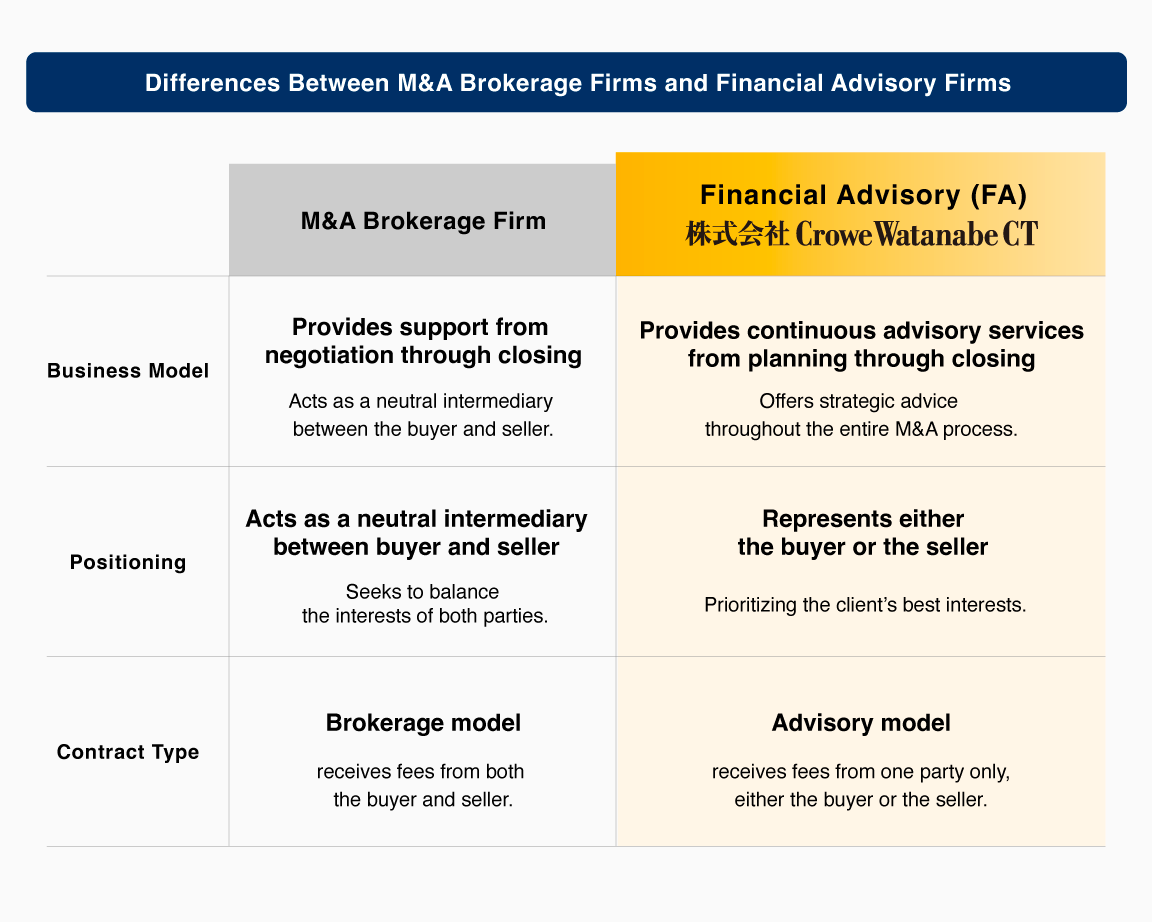

M&A Deal Advisory Services

Providing professional support for domestic and cross-border transactions based on the global financial advisory (FA) model.

In Japan, two main approaches to M&A are often seen: brokerage and financial advisory. While brokerage firms mediate between both buyer and seller, financial advisors represent only one side—either the buyer or the seller—acting solely in the client’s best interest.

At Crowe Watanabe CT, we adopt the global FA model, providing specialized support throughout every stage of the deal. We emphasize objectivity and transparency, delivering accurate valuations and facilitating fair, effective negotiations to achieve the best outcomes for our clients.

Our advisory services, grounded in international standards, help ensure fair and value-creating M&A transactions in both domestic and cross-border contexts.

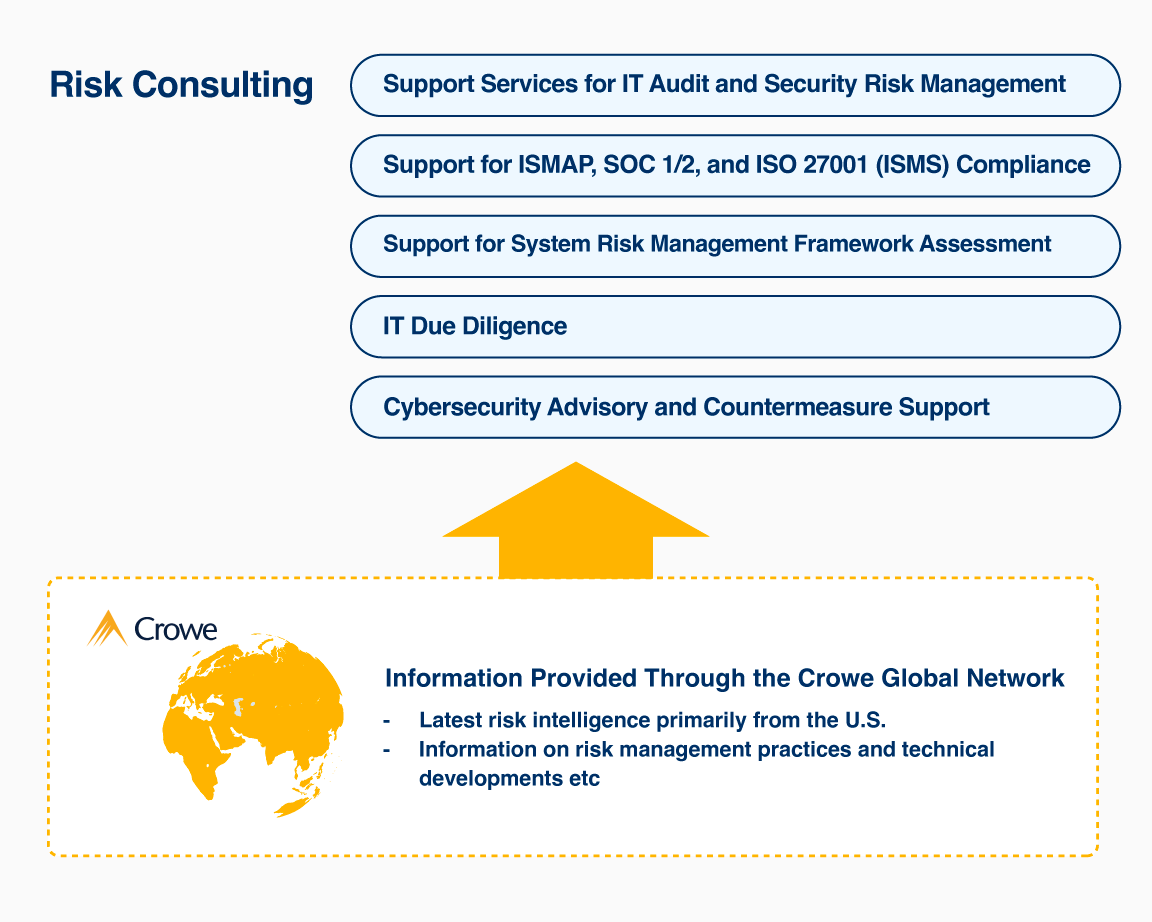

Risk Consulting

We provide strategic and practical support for diverse risks—including cybersecurity, IT governance, and internal controls—through a proactive, forward-looking approach that drives growth.

- Executive Officer

-

Mr. Ichiyanagi has extensive experience providing consulting services for business process improvement and core system implementation for a wide range of companies, including listed corporations. He later served as an IT Audit Partner at an audit firm, engaging in audit-related work.

Currently, he provides consulting services focused on strengthening IT governance and risk management.

- Key Areas of Support

- Support for managing security risks related to IT audits

- Assistance with ISMAP, SOC 1/2, and ISO 27001 (ISMS) compliance

- Assessment support for system risk management based on FSA guidelines

- Cybersecurity enhancement support

- IT due diligence

“Control” in Practice: Risk Management Supporting Sustainable Corporate Growth

While foresight—proactive strategic initiative—is essential for sustaining corporate growth, companies also need a growth strategy that integrates control, the disciplined management of risk. Starting with an inventory of information assets and risk assessment, Crowe Watanabe Consultin provides integrated risk management that combines foresight and control.

Our Risk Consulting services offer comprehensive support covering cybersecurity and IT audit readiness, system risk management assessments in line with the Financial Services Agency’s requirements, ISMAP, SOC 1/2, and ISO 27001, as well as IT due diligence for M&A and IPOs. We accompany clients from strategy to execution across policies, organizational structures, systems, and governance.

In collaboration with the Crowe Global Network, we also utilize the latest overseas risk information to provide globally informed support.

CroweGlobal Network

By working with member firms in 150 countries and 800 offices worldwide, we deliver services with a deep understanding of international business environments.

Crowe Global is a top 10 global consulting network, comprising over 200 independent member firms and 800 offices across more than 150 countries.

Our team of professionals—including Japanese experts—supports Japanese companies in their global business expansion.

Company Profile

| Company Name | Crowe Watanabe Consulting Co. |

|---|---|

| President and CEO | Yoshiki Watanabe (CPA, Certified Public Accountant) |

| Established | December 2000 |

| Staff Count | 30 Persons |

| Office Locations |

|

Contact

A global consulting partner that contributes to corporate growth strategies

We leverage the Crowe Global Network to design and implement growth strategies built on foresight and control, offering comprehensive support for business expansion both in Japan and overseas.Feel free to contact us for more information.