E-Invoicing and E-TCC policy on VAT taxpayers

ELECTRONIC-VALUE ADDED TAX (E-INVOICING)

Background

The Government of Ghana concurrent with the Ghana Revenue Authority (GRA) digitalization agenda announced in April 2022 the introduction of Electronic Invoicing of Value Added Tax (VAT) transactions. Consequently, the Government in its mid-year budget review on 25 July 2022 further entrenched this position and gave a timeline for the implementation of the electronic invoicing to 1 October 2022. Parliament gave effect to this policy by the promulgation of Act 1082 which specifically amended Section 41 (2) of the Value Added Tax Act, 2013 (Act 870) as amended to provide for the electronic invoicing of Value Added Tax through a Certified Invoicing System.

The system was officially implemented by the Ghana Revenue Authority on 1 October 2022.

Electronic Invoicing or E-Invoicing

This is a system that transforms manual invoice issuance process into an electronic process and allows for such invoices, including debit and credit notes to be exchanged electronically between buyers and sellers. This enables the Ghana Revenue Authority (GRA) to validate and authenticate the issuance of invoices by taxpayers in real time.

The electronic invoicing is to curtail the forgery of invoices by taxpayers, carding of these invoices, overstatement of input VAT, understatement of output VAT, huge cost of tax audit by the Revenue Authority and lack of data for effective tax compliance.

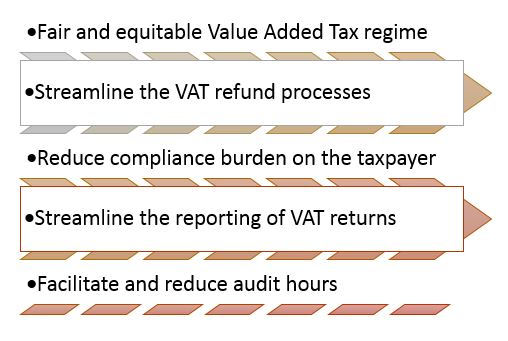

Benefits of Electronic invoicing

The electronic invoicing, amongst others, is intended to achieve the following benefits to both the taxpayer and the Revenue Authority:

Architecture for electronic invoicing

The design for electronic invoicing involves the following:

- A Ghana Revenue Authority free software to be installed for manual invoices issuers. The software can be installed on e-invoicing software, e-invoicing mobile system, online e-invoicing and virtual certified invoicing system.

- System integration:

Taxpayers who already have their own software in place will undergo system integration. This includes integration with enterprise resource planning software (ERP), point of sales (POS), accounting software, cash register and gaming or e-commerce.

Implementation guidelines

In pursuit of the Revenue Authority to implement the electronic invoicing for all taxpayers who qualify for registration for VAT, the Revenue Authority has rolled a roadmap which is to ensure that by 2024, all taxpayers would be migrated onto the system and therefore fade the manual invoicing from the system.

In achieving this, Large Taxpayers are required to be migrated onto the system before the close of the year 2022. Medium Taxpayers are also required to be migrated on to the system by 2023 and Small and Other Taxpayers would be migrated onto the system by close of year 2024. Though this is the intended roadmap, taxpayers in any of these categories may voluntarily apply for them to be migrated onto the system before the end of 2024.

The Authority is also engaging the various stakeholders to sensitize them in the implementation of this new Certified Invoicing System.

Application for installations

- A taxpayer shall apply to the Ghana Revenue Authority to be registered or migrated onto the Certified Invoicing System.

- Where an application is approved by the Commissioner, the software would be installed on the taxpayer’s computer or laptop or integrated into the already existing server or software of the taxpayer.

- When installation and integration is completed, the taxpayer will be required to start issuing the electronic invoice using the Certified Invoicing System which comes with added features of the invoice issued such as GRA name and logo, the Commissioner-General signature and Quick Response Code (QR Code) for authentication of invoice.

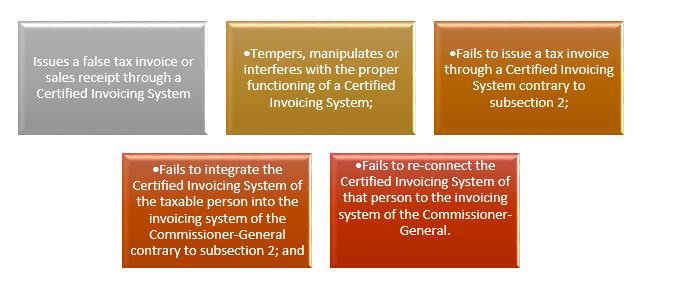

Offences under the Act

Section 41(11) of Act 1082 prescribes the following as offences under the Certified Invoicing System, where a person:

A person charged with any of these offences, in addition to penalties for non-filing and payment of the tax, is liable to pay a penalty of an amount of not more than five hundred (500) currency points or three times the amount of tax involved, whichever is higher.

Other commentary

- With the introduction of the Certified Invoicing System, the manual and electronic invoicing (Certified Invoicing System) would continue to operate together until the implementation deadline of 2024. This means that where the taxpayer is registered for the Certified Invoicing System, he can file his VAT returns with both the manual invoices and the electronic invoices as provided by the system.

- A taxpayer who has registered for the Certified Invoicing System (e-invoicing) cannot issue a manual VAT invoice again.

- A taxpayer shall ensure that the Certified Invoicing System is always online or accessible by the Commissioner-General and where the Certified Invoicing System goes offline or becomes inaccessible by the Commissioner-General, shall within twenty-four (24hrs) hours inform the Commissioner-General and ensure that the Certified Invoicing System is restored online and becomes accessible by the Commissioner-General. That is, a person is required to login to the system every 24 hours to be given a token based on which he can start issuing invoices and failure to do that, he must inform the Commissioner-General about it.

- Where electronic invoices are received by the taxpayer together with manual invoices, both will be used to enable the filing of tax returns with the Commissioner-General at the end of the month.

- The electronic invoices have security features like a QR Code which can be scanned to determine the authenticity of the invoice received or issued.

- All invoices issued to the taxpayer or in the name of the taxpayer using the TIN through a Certified Invoicing System would automatically be reflected in the taxpayer portal as input VAT and its subsequent reduction in the VAT payable at the end of the month.

- Where the taxpayer needs to update or upgrade its software, server or accounting system, he shall seek approval from the Commissioner-General before upgrading or updating these systems. Failure to seek approval from the Commissioner-General constitutes an offence. That means, a taxpayer who integrates the Certified Invoicing System into its system no longer owns the system and therefore cannot upgrade the system without the Commissioner-General’s approval.

ELECTRONIC TAX CLEARANCE CERTIFICATE – E-TCC

The electronic tax clearance certificate has been introduced to the taxpayer’s portal which makes it easy for the issuance of tax clearance certificate (TCC) and with minimal human intervention. The introduction of the electronic tax clearance certificate is to comply with Section 26 of the Revenue Administration Act, 2016 (Act 915) as amended.

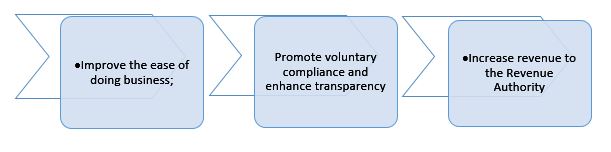

Benefits of the electronic tax clearance certificate

This, among others, is to achieve the following:

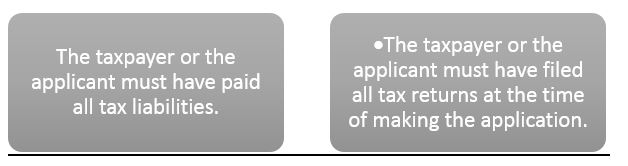

Requirements for getting a tax clearance certificates (TCCs)

Where these two conditions are satisfied, the taxpayer’s portal would indicate “green” but where there is default in the filing or payment of taxes, the taxpayer’s portal would indicate “red”. A “green” depicted on the taxpayer’s portal would make the application process easier and even for subsequent future applications. Where the taxpayer’s portal indicates “red”, then the taxpayer has to file and pay those taxes indicating non-compliance and where any of these situations persist, he may contact the tax office for resolution.

Application of electronic tax clearance certificate using the taxpayer’s portal

- For successful application, the taxpayer should have the following information at his disposal:

- The reason for applying for the Tax Clearance Certificate (TCC) or what the Tax Clearance Certificate (TCC) is intended to be used for; and

- The requesting organization’s TIN and where in doubt contact can be made at the taxpayer’s tax office.

- Where this information is available:

- Logon to the taxpayer’s portal and search for Tax Clearance Certificate (TCC) button.

- Follow the process, which includes using the apply for Tax Clearance Certificate (TCC) button.

- Using the print button, view earlier certificate issued to the taxpayer or print a current certificate; and

- Using the check button, verify the authenticity of the certificate issued or received.

Security features of the Electronic Tax Clearance Certificate

The electronic tax clearance certificates come with added security which the taxpayer can authenticate through scanning of the QR Code, checking the certificate number using a USSD and searching for it from the taxpayer’s portal under the Tax Clearance Certificate (TCC) button.

|

Partner

Anthony Danquah

+233 24 467 7184 / +233 30 222 3810

Senior Tax Consultant

Jonathan Ewusi

+233 24 124 3426