Modern, simple and accommodating taxes– reality or a mere marketing move?

Changes in the deadlines for submission of corporate as well as personal income tax return

One of the most significant changes - brought by the Tax Code - is the change in the deadlines for submission of proper income tax return.

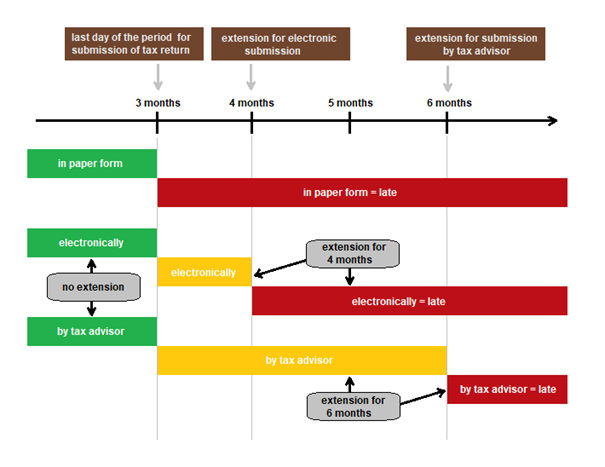

The basic deadline for submission of a tax return is no later than 3 months after the end of the tax period, i.e. for the tax year 2020 it will be 1 April 2021. If the tax return is submitted by the tax subject electronically after the basic deadline or through the application called "MoJe daně", this period is newly extended by 1 month, i.e. until 3 May 2021 for the tax year 2020. No application, neither notification to the tax administrator needs to be submitted for an extension this period. If the tax subject is subject to the statutory audit of financial statements or the tax return is submitted by a tax advisor after the expiration of the basic three-month period, the submission period, including that one for submission of the relevant power of attorney, is up to 6 months, i.e. for the tax year 2020 it will end as of 1 July 2021. However, if such a submission occurs within the basic three-month period, it will be treated as if it had been submitted on the first working day of April.

In the graphic below, we can clearly see the terms for different routes of administration.

Source: Explanatory note to Act No. 283/2020 Coll. (translation to English: Crowe)

The deadline for submission of a tax return also overlaps with the deadline for payment of tax liability, resp. affects the time limit for recovery of eventual tax overpayment (30 days from the deadline if the return is submitted in time). Therefore, we recommend considering all the above options also in terms of cash flow.

The situation is becoming less clear in the case of individuals who are obliged to submit also overviews on social security and health insurance. The obligation to submit these overviews remains within the month following the deadline for submission of the tax return. In the case of electronic submission, the deadline for submission is 1 working day in June. Unfortunately, health insurance companies do not yet have adapted overviews regarding this change, and therefore it will be necessary to prove the submission of a tax return within an extended period (e.g. by a confirmation from the EPO or a report from the data box). If an individual is represented by a tax advisor, the taxpayer must also keep in mind that it is necessary to send cope of the relevant power of attorney to the health insurance company by the end of April.

Advance payment for VAT refund

In connection with the amendment to the Tax Code, a new institute of advance payment for VAT refund was introduced. In the past, many disputes between tax subjects and the financial administration have arisen precisely because if the tax administrator initiated an examination of the VAT refund claimed within a procedure to remove doubts or in the framework of a tax inspection, even just for some specific tax documents, it automatically meant suspending pay-out the VAT refund claimed in full amount and the tax subject could not use the funds concerned until the tax was finally assessed.

Newly, if there is such part of the VAT refund which the tax administrator has no doubts about (and thus, the claim to this VAT refund is proven and recognized by the tax administrator as problem-free), such an undisputed amount will be paid to the tax subject in the form of an advance payment. However, the claim to an advance for excessive deduction arises only if this amount exceeds at least CZK 50,000.

The tax administrator is then obliged to pay-out this amount within 15 days after being prescribed in the tax record without unnecessary delay. In that case, the tax subject does not have to submit any application or request, the tax administrator should inform the tax subject of the advance payment in an appropriate manner at the same time.

Modern and simple taxes (“MoJe daně” in Czech)

The General Directorate of Finance is also launching a new "online tax office" for citizens and entrepreneurs, which will allow taxpayers to communicate with the tax office electronically. Through this portal, it is possible to submit tax returns for all taxes. In addition to that, the tax subject will receive an individual approach in the form of a personal tax calendar, which will alert him to the approaching deadlines and obligations, and will also allow him to pre-fill tax forms, submit the tax return electronically or pay the tax.