Doing Business in “CzechoSlovakia” – webinar summary

Below, we have prepared a brief summary of the topics discussed during this webinar.

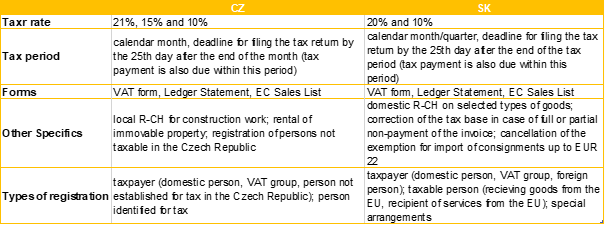

Value Added Tax Act

The first part of the webinar dealt with the topic of VAT, both from the Czech and Slovak perspective. In the table below you can find a summary of the basic information concerning VAT in the case of the Czech Republic and Slovakia.

Apart from the above, the webinar also shortly covered the registration and VAT refund processes.

Permanent establishment

In the second part of the webinar, the area of income taxes, namely of permanent establishment and its basic principles were discussed. A permanent establishment is a place or facility for the performance of a business activity through which an enterprise performs its activities wholly or partially. The basic principle of a permanent establishment institute is the determination of the right of the particular state to tax income generated through it.

A permanent establishment may be created:

- based on the local legislation, namely in the territory of a country in which the entity is not tax resident but performs business activities in that territory;

- in the case of Contracting States, a double taxation treaty applies.

If both the statutory and treaty conditions are met, the obligation to tax income from sources within the territory of the other country arises in such other country.

Actually, this area is more and more discussed from the side of our clients, especially due to the changes in employees’ mobility during the pandemic. Similarly, it becomes more and more interesting point of investigation of the tax administrator.

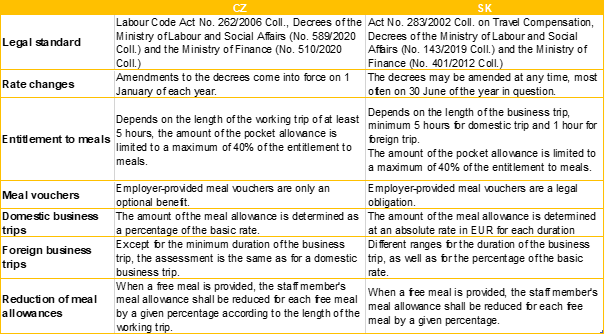

Travel allowances

The last part of the webinar was focused on travel allowances and their differences between the Czech and Slovak Republic. Please find below again a table summarizing the most important information.

Should you have any uncertainties or questions on this subject, we will be happy to assist you.