The importance of reserves in effective financial management for not-for-profits

In recent years, there has been increasing awareness in the not-for-profit sector of the importance of holding the right level of reserves and having an appropriately considered and supportable reserves policy.

Not-for-profit entities often operate in a difficult funding environment. They sometimes have to match unpredictable income with fixed costs. This means they need to have reserves to act as a buffer and to allow necessary expenditure when required.

With little guidance available and no one-size-fits-all yardstick for not-for-profit reserves, it is easy to see why this is a difficult area for Boards to navigate.

When developing an effective and carefully thought-out reserves policy, Boards must ensure they link it with the organisation’s risk management strategy and their appetite to take risks.

Understanding reserves

The term ‘reserves’ has a variety of technical and ordinary meanings, depending on the context in which it is used. In the case of not-for-profit entities, it generally describes that part of income funds that is freely available.

This definition of reserves therefore normally excludes:

- Permanent endowment funds;

- Expendable endowment funds;

- Restricted funds;

- Any part of unrestricted funds not readily available for spending, specifically, income funds which could only be realised by disposing of fixed assets held for operational use and programme related investments.

Individual entities may have more or less reserves available to them than this simple calculation suggests, for example:

- Expendable endowments may be readily available for spending; or

- Unrestricted funds may be earmarked or designated for essential future spending and reduce the amount readily available.

In synopsis, reserves can be seen as unspent income freely available for spending.

Reserves are necessary for a variety of reasons, including:

- To meet ‘working capital’ requirements (e.g. to allow expenditure to be made ahead of the receipt of grant or contract income);

- To cover unexpected increases in expenditure, such as project overruns or uninsured losses from unplanned events, which cannot be funded from income;

- To provide a fund to take advantage of upcoming opportunities for expanding public benefit or to launch some new fundraising initiative as and when they arise; and

- To resource specified new or expanded future or prospective spending projects and ‘capital expenditure’ plans (e.g. an intention to move premises).

Ultimately, a reserves policy is an essential part of good financial management for any not-for-profit entity. Management information should be provided regularly to give Board members the maximum amount of time to react to events as they occur. This way, reserves can be kept to a minimum, whilst providing Board members with the comfort they need to run the organisation in a sustainable fashion.

Duties of ‘those charged with governance’

In the not-for profit environment ‘those charged with governance’ (TCWG) can be referred to in several ways - Directors, Committee Members, and Trustee’s.

Regardless of the title, TCWG are responsible, amongst other things, for ensuring the organisation uses its funds and assets reasonably to deliver the activities of the organisation to its beneficiaries. To do this, a not-for-profit entity needs to have sufficient reserves to meet its known liabilities and commitments. Failure to maintain sufficient reserves is likely to make the organisation vulnerable to insolvency.

Long term financial stability is the target if the organisation has ongoing public benefit commitments for perhaps some years ahead and therefore sufficient reserves need to be held to cover known liabilities and contingencies, absorb setbacks and to take advantage of change and opportunity. However, there is a risk that too high a level of reserves may result in TCWG being criticised for holding reserves unnecessarily. This may impact fund raising, as potential funders of current projects/activities will want to see their money put to good use without undue delay.

Of particular concern to TCWG should be the organisation’s ability to identify the status of any restricted funds, so they can be confident that such funds are not being used to make good a deficit in unrestricted funds. Management information can often be lacking in this regard, particularly in organisations that receive a large number of restricted donations.

Without regular and accurate information, TCWG run the risk of allowing a potentially insolvent position to remain undetected as it is masked by surpluses in restricted funds. The consequences for the TCWG may be severe. TCWG are well advised to seek to negotiate, if possible, sufficient ‘standby’ overdraft facilities in these circumstances to avoid any potential personal liabilities which may follow.

Maximising levels of reserves

Under normal circumstances, reserves represent a surplus of unspent unrestricted income and ‘free’ (uncommitted) reserves would normally be held in the form of cash or liquid assets. However, there are alternatives for organisations in situations where such reserves cannot easily be generated or maintained. This includes access to loans and/or overdraft facilities (including an unused ‘standby’ facility) to provide the organisation with the short term ability to withstand unexpected expenditure (temporary reserves).

In these circumstances, TCWG need to be clear as to how and when any loans or overdraft facilities are to be repaid. Certain fixed assets which are ordinarily for the ongoing use of the organisation may be treated as reserves if they are realisable for value as part of a cessation of certain services.

Alternatively, it may be possible to borrow from a permanent endowment within the organisation, for example. Again, TCWG will need to be confident as to the manner and timing of repayment, and they would be well advised to take legal advice.

Or an organisation with an ongoing trading activity may have a ‘full order book‘, which allows the TCWG to be confident as to its ability to generate surplus funds quickly and to maintain financial viability with little or no ‘free’ reserves.

For organisations such as membership organisations, there may be an understanding that increased subscription income may be necessary in the event of a need to call on reserves and there may be some kind of ‘supporters’ club‘ capable of providing funds at short notice.

Developing a reserves policy

A reserves policy should be seen as an integral part of an effective financial management process and should not be developed in isolation. It should be considered in the light of the organisation’s strategy and a detailed assessment of the risks and opportunities associated with that strategy.

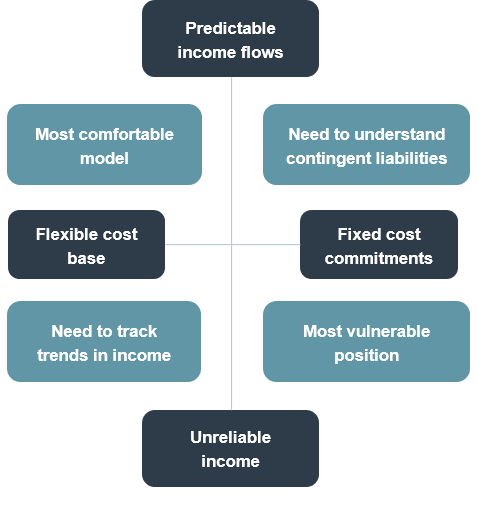

Not-for-profit entities will vary significantly in their risk profiles. It may help to identify where an organisation is on the following chart, by considering the levels, sources, predictability and flexibility of income and expenditure.

Inevitably, the level of sophistication needed in a reserves policy will differ, based partly upon the organisation’s position on this chart.

Whilst there are a number of approaches that can be taken to developing a policy, a probability-based approach is the most sensible. This involves trying to understand the nature and impact of risks, together with their probability of occurrence. It is, of course, not possible to apply a standard formula; rather an analytical review needs to be carried out which focuses on the following key areas:

- The level of existing reserves – care should be taken to identify where reserves are unrestricted and not endowed, restricted or designated;

- Future income streams – their predictability, both as regards extent and timing;

- Future cost commitments – the flexibility of being able to increase and decrease expenditure over what timescale;

- Plans – and how innovative/risk-taking the organisation is;

- All other material risks – in order that all potential contingencies are taken into consideration together with the probability of subsequent costs materialising.

Such an analytical review will result in the need for a level or range of reserves, which may move over time and which require regular review.

In addition to providing a not-for-profit entity with a more robust financial platform, there are many other benefits which flow from a well-structured, supported reserves policy. These include:

- Assisting TCWG to understand how the activities of the organisation relate to its reserve position, which helps enable a more informed view to be taken as to the cost-benefit of each of the activities;

- Helping an organisation meet expectations of accountability and transparency;

- Allowing the organisation to explain to funders that the existence of reserves is not a reason to avoid funding.

For assistance identifying the right level of reserves or developing an appropriately considered and supportable reserves policy for your not-for-profit entity, speak to your adviser or get in touch with the Crowe External Audit team.