More businesses can now qualify for an increased instant asset write-off

The 2019 Budget proposal to increase and expand the instant asset write-off is now law and according to this new law;

-

small business entities (SBEs) (broadly businesses with aggregated turnover of less than $10 million ) can potentially qualify for three types of instant asset write-offs in the 2019 income tax year and a $30,000 instant asset write-off in the 2020 income tax year; and

-

medium sized businesses (MSBs) (broadly businesses with aggregated turnover of $10 million or more but less than $50 million ) can potentially qualify for a $30,000 instant asset write-off in the 2019 or 2020 income tax year.

How does this affect you?

The increase and expansion of the instant asset write-off is great news for SBE or MSB businesses that can qualify for the instant asset write-off when they buy new business assets.

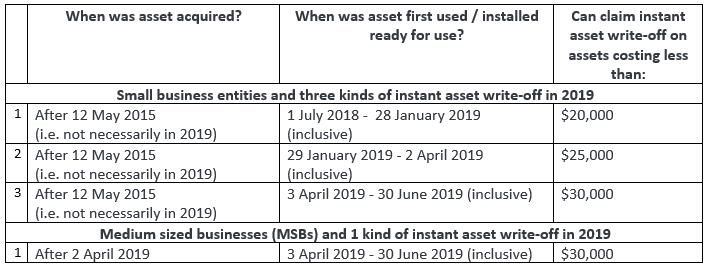

However, as the table below sets out, whether an SBE or MSB will qualify for the instant asset write-off, as well as the amount of the instant asset write-off in the 2019 income tax year, will depend on when the asset was first acquired and first used or installed ready for use in the business.

For example, a MSB that acquired a $29,999 business asset on 2 April 2019 and started using the asset in the business on 3 April 2019 would not qualify for any instant asset write-off. However, if the MSB had acquired the same asset on 3 April 2019 and started using the asset in the business on the same day, the MSB would qualify for an upfront deduction of $29,999 in the 2019 income tax year.

Likewise, if a SBE acquired a $29,999 business asset on 2 April 2019 and started using the asset in the business on the same day, the SBE would not qualify for any instant write-off (because in that period the instant asset write-off is for assets costing less than $25,000). However, if the SBE had acquired the same asset on 2 April 2019 and only started using the asset in the business on 3 April 2019, provided the asset was not installed ready for use earlier than the time of first use, the SBE would qualify for an upfront deduction of $29,999 in the 2019 income tax year.

How can Findex help you?

We trust you found this tax snapshot useful to alert you about some of the most recent changes in the Australian tax landscape affecting the instant asset write-off.

If anything in this tax snapshot triggered your interest or you are a type of taxpayer that is likely to be affected by these changes, please contact your Findex adviser.

We have considerable experience advising on income tax concessions that may be available for your business and look forward to discussing other ways we can help your business.

Through our Tax Advisory team across Australia, we can help you identify potential opportunities that may be available for your business while at the same time help you to manage your exposure to business risks.

Our Family Office Model means regardless of the location or service offering of your key relationship manager, we can access the right Tax Advisory expertise for you.

Reference Footnotes

(1) There are 3 ways to determine whether an entity will satisfy the $10 million threshold (i.e. the threshold will be satisfied if the aggregated turnover in the previous income tax year was less than $10 million, the estimated aggregated turnover for the current year is reasonably expected to be less than $10 million (such an assumption is usually made at the beginning of the year) or if the actual aggregated current year turnover is less than $10 million).

(2) The same methodology that is used to determine whether the $10 million threshold will be satisfied for SBE’s (i.e. 3 different tests), will apply to determine whether the $50 million threshold will be satisfied by MSB’s.