Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Georgia

Germany

Greece

Hungary

Ireland

Italy

Kazakhstan

Kosovo

Latvia

Lithuania

Luxembourg

Malta

Moldova

Netherlands

Norway

Poland

Portugal

Romania

Serbia

Slovakia

Slovenia

Spain

Sweden

Switzerland

Tajikistan

Turkey

Ukraine

United Kingdom

Uzbekistan

UAE: Impact of Expected Transfer Pricing

UAE: Impact of expected transfer pricing on value of supply for VAT

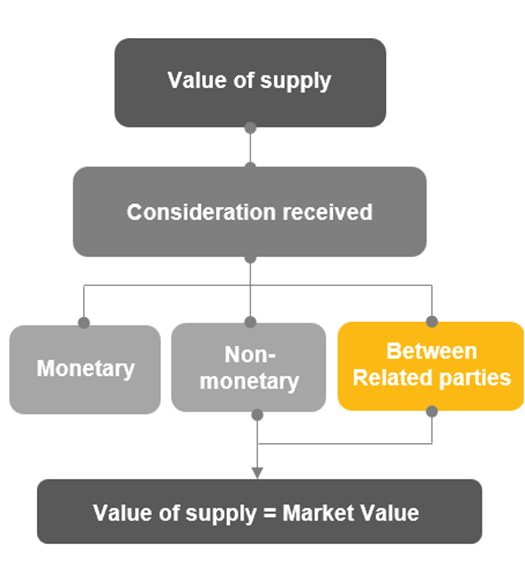

We have highlighted below the impact of the expected Transfer pricing (“TP”) rules, which will follow with the introduction of Corporate Tax in June 2023, on the value of supply

- Impact of Transfer Pricing rules

- As TP legislation will set different methods to determine the arms’ length value, a disparity between the market value for VAT and at arm’s length value for Corporate Tax for a supply might emerge. This may lead to difference in reporting the same transactions from a VAT and Corporate Tax perspective. If the price for related parties are adjusted as per the TP policy, then it must be considered if this adjustment constitutes consideration for a supply of goods or services and whether VAT is to be charged on such adjustment made.

- Value of supply rules under VAT

- Market Value:

- Monetary consideration between third parties not connected with each other for supplies in similar circumstances.

- Replacement cost of goods/service, in case no similar circumstance

- RELATED PARTIES

- Value of supply is the market value of supply or import of goods/services, if the recipient cannot recover the VAT charged to him in full and the agreed price is below the market value.

- How Crowe can help

- It is likely that TP rules may not have an impact solely for Corporate Tax purposes, but on VAT reporting as well. Hence, the companies must be aware of this impact after the implementation of Transfer Pricing in the UAE.

- Crowe would be happy to assist you in identifying the possible impact and support your business with the ongoing challenges and opportunities that will come with the introduction of Corporate Tax in the UAE

Contact Us

Alessandro Valente

International Liaison Partner - International Tax & Transfer Pricing