<p>Behind the scenes of an internal Audit</p>

Just imagine how many different factors need to be considered, because large, complex, interconnected organizations in the modern economy require sophisticated assessment of many diverse risks.

This article takes you behind the scenes of an internal audit review, because how an audit is performed is as important as the final report. To identify information, we have the below 4 criteria:

Sufficient information is factual, adequate, and convincing so that a prudent, informed person would reach the same conclusions as the auditor.

- Reliable:- information is the best attainable information through the use of appropriate engagement techniques.

- Relevant:- information supports engagement observations and recommendations and is consistent with the objectives for the engagement.

-

Useful:- information helps the company meet its goals.

The engagement work program is developed and the internal auditor deep dives into all aspects of sources and nature of information, the checklists, the levels of persuasiveness of evidence, such as physical examination, observation, third party confirmations, and documentary evidence at this information gathering phase.

Next, it is important to Define the population. This step includes defining the sampling unit (an individual item in the population) and considering the completeness of the population.

1) For tests of controls, the period covered is defined.

2) For tests of details, individually significant items may be defined

The spotlight then moves from questionnaires and interviews to ensuring the right way of sampling the population and statistical quality control. The shape, height, and width of a population’s distribution curve are quantified through its measures of central tendency. The mean, median and mode are evaluated. Before Determining acceptable levels of sampling risk (e.g., 5% or 10%) and Calculate the sample size using tables or sample-size formulas.

At all times, the internal auditor has the thinking hat on because he/she needs to decide the best way of sampling. In some cases, it is efficient to divide the population into subpopulations or strata. The primary objective of stratification is to minimize variability. Stratification also allows the auditor to apply more audit effort to larger elements or more risky parts of the population.

Judgmental sampling uses the auditor’s subjective judgment to determine the sample size (number of items examined) and sample selection (which items to examine). This subjectivity is not always a weakness. The auditor, based on his or her experience, is able to select and test only the items (s)he considers to be the most important.

On the other side, Statistical sampling provides an objective method of determining sample size and selecting the items to be examined. Unlike judgmental sampling, it also provides a means of quantitatively assessing precision (how closely the sample represents the population) and confidence level (the percentage of time the sample will adequately represent the population).

There is also Attribute sampling which is used for tests of controls, i.e., when two outcomes are possible (compliance or noncompliance) or variable sampling.

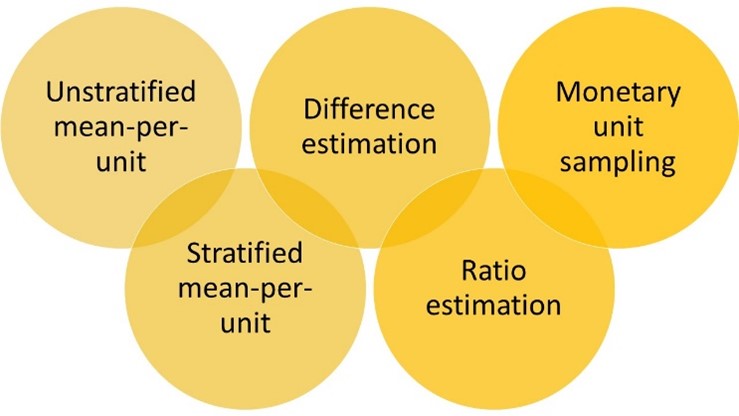

Auditors may employ the following variables sampling techniques:

As a profession we have learned huge amounts from the crisis, and we have moved at a pace no one would have thought possible earlier, coupled with this advancement are the techniques and tools adopted for statistical quality control. We are striving to determine and apply analytical review techniques such as ratio estimation, variance analysis, budget vs.actual, trend analysis, other reasonableness tests, benchmarking, cost-benefit analysis, pareto diagrams, histogram, fishbone to enable better evaluation and analysis.

Finally after two years of unprecedent turbulence, internal auditors are working closely with companies to achieve objectives of 2022 by navigating what do they want to see more of, and what do they want to see less of so internal auditors can add value to the company.