- Americas

- Asia Pacific

- Europe

- Middle East and Africa

Tax Treatment for Rental of Business Premises

Without comprehending the existing tax treatment for rental payments, businesses may inadvertently claim a wrong tax deduction on rental expenses.

Deduction for Rental of Business Premises

Under fundamental tax principles, a lessee is allowed to claim contractual lease payments as deductions against its income in the basis period in which the payments are incurred provided that the lease expenses are wholly and exclusively incurred in the production of income and the operating lease arrangement is not regarded as a sales agreement.

Accordingly, companies can claim tax deductions on rental expenses incurred on premises occupied for business purposes. If only a part of the premises is used for business purposes, the corresponding proportion of the rental expense will be allowed as a tax deduction. Vice-versa, the remaining proportion of the rental expenses neither incurred for business purposes nor in the production of rental income will not be tax deductible.

Misalignment between Accounting Treatment and Tax Treatment for Rental of Business Premises

While lease rental are deductible as and when the expenses are incurred for business purposes, it is crucial to note that the alignment of tax treatment with accounting treatment on rental of business premises may not apply under certain prescribed circumstances, particularly if the landlord or lessor has provided certain types of incentives to induce the lessee to enter into the lease agreements. Such incentives may entail rent-free period within the lease term or reduced rent for the initial period of the lease contract.

In such a situation, the lease payment will generally be recognised on a straight line basis over the contractual lease term from an accounting perspective. That is, the total lease expense due under the contract is spread evenly across the entire lease period under the contractual terms and the lessee is required for accounting purposes to recognise the benefit of the rent-free period over the lease term. As a consequence, the contractual rental payments incurred by the lessee (i.e. actual rental expenses incurred) may not equate to the rental expenses recognised in the lessee’s Statement of Comprehensive Income since the periodic rental expenses will be reduced by either the rent-free or reduced rent incentive over the entire lease term.

Recent Update on Tax Deductibility of Rental Expenses

In light of the mismatch between the accounting and tax treatments for lease payments, the IRAS has provided a recent clarification via its website that the lessee should claim a tax deduction on the rental expenses based on actual rental expenses incurred regardless of how the rental expenses are recognised in the lessee’ accounts.

An example to illustrate the deductibility of rental expenses should a landlord offer a rent-free incentive to the lessee over a 5 years lease term is provided below:

Example

Company A enters into a new lease for an office space for a term of 5 years at a rate of S$1.2 million per annum. As part of the lease agreement, the landlord agrees to grant a rent-free period for the first year.

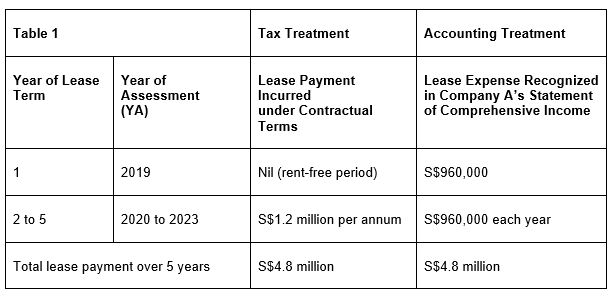

For accounting purposes, the lessee is required to recognise the benefits of the first 12 months rent-free period [i.e. net consideration of S$4.8 million (i.e. S$6,000,000 - S$1,200,000)] over the lease term of 5 years as shown in Table 1 below:

Using the figures in the table above, the rental expenses of S$960,000 recognized in Company A’s Statement of Comprehensive Income during YA2019 will not be tax deductible since no actual rental payment was incurred by Company A due to the rent-free incentive given by the landlord. Thus, tax adjustment is required to be made in Company’s A tax computation to disallow a tax deduction on the rental expenses of S$960,000 in YA2019.

For YA2020 to YA2023, Company A should claim a tax deduction on the actual rental expenses incurred of S$1.2 million per YA.

Conclusion

Businesses should take a more proactive approach to assess whether their existing accounting systems and documentation requirements adequately support the tax deduction since actual rental payments have to be tracked separately if incentives such as rent-free period or reduced rent were granted by the landlord to the lessee.

In addition, companies may also need to account for the current and deferred tax implications arising from possible timing differences on the deductibility of the rental expenses accurately.