- Americas

- Asia Pacific

- Europe

- Middle East and Africa

Mandatory Transfer Pricing Documentation

Mandatory TP Documentation

With effect from YA2019, under Section 34F of the Income Tax Act (ITA), an entity is required to prepare TP documentation in accordance with the Income Tax (Transfer Pricing Documentation) Rules 2018 (“TP Documentation Rules”) if either of the following conditions are met:

i) The annual gross revenue derived from its trade or business for the basis period concerned exceeds S$10 million dollars; or

ii) It was required to prepare TP documentation under Section 34F of the Act for the immediate preceding basis period concerned.

The second condition ensures that taxpayers who were required to prepare TP documentation for a previous basis period will continue to be required to do so for the subsequent basis period. As explained by the Inland Revenue Authority of Singapore (IRAS), this is to provide certainty on taxpayers’ compliance effort. However, where taxpayers who are required to prepare TP documentation experience declining revenue such that their gross revenue is consistently below S$10 million, they will be exempted from preparing TP documentation for their related party transactions undertaken in a basis period if their gross revenue is not more than S$10 million for that basis period and the immediate two preceding basis periods.

Exemption from TP Documentation for Specified Transactions

a) The taxpayer transacts with a related party in Singapore and such local transaction (excluding related party loans) is subject to the same Singapore tax rates for both parties or exempt from Singapore tax for both parties;

b) Domestic loans between Singapore entities that are not in the business of borrowing or lending money;

c) The taxpayer applies the indicative margin for a related party loan not exceeding S$15 million in accordance with the administrative practice;

d) The taxpayer applies the cost plus 5% mark-up for routine support services;

e) The related party has entered into an Advance Pricing Arrangement Agreement; and

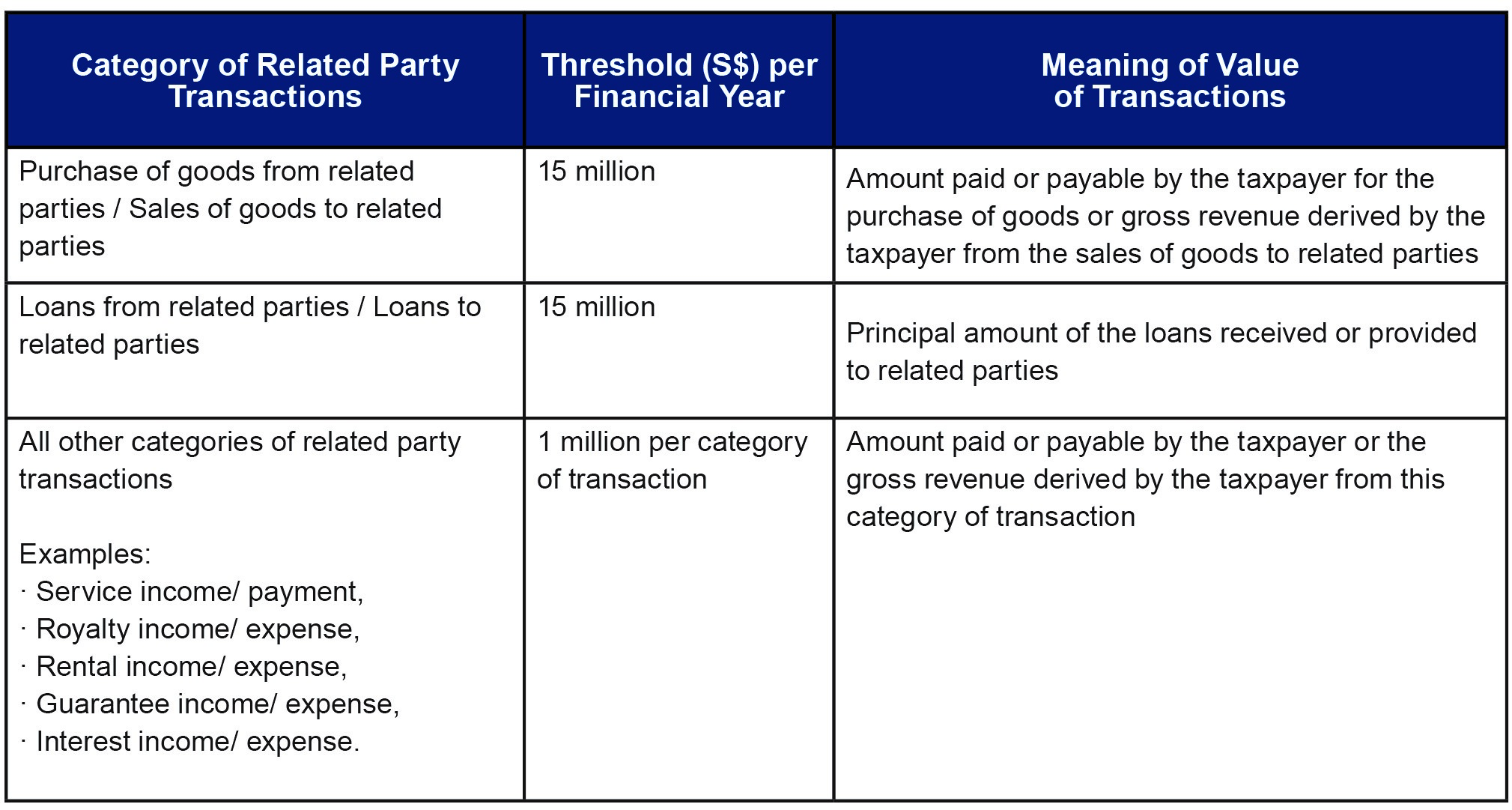

f) The related party transaction comes within a category of transactions and the total value of the aggregated related party transactions in that category in the basis period (excluding the value or amount of (a) to (e) above) does not exceed the threshold for that category. The threshold for each category of transaction is as follows:

Under Section 34F(8) of the ITA, failure to prepare the required TP documentation constitutes an offence and the taxpayer is liable to a penalty of up to S$10,000 per offence.

Specifically, a taxpayer can be liable to the fine for the following non-compliance:

- Not preparing or maintaining TP documentation based on the requirements under the TP documentation Rules 2018;

- Not preparing TP documentation by the time for the making of the tax return;

- Not retaining TP documentation for a period of 5 years from the end of the basis period in which the transaction took place;

- Providing any documentation or information that the taxpayer knows to be false or misleading.

In addition to the penalty for failure to prepare or submit TP documentation on time, the IRAS has also introduced a transfer pricing surcharge, which will be computed as 5% of the adjustment, regardless of whether tax is payable on the adjustments.

How We Can Help

Furthermore, under the TP Documentation Rules, contemporaneous documentation is defined as documentation and information relied on by taxpayers to determine the transfer price at the time of entering into the transactions. Given that contemporaneous TP documentation is not based on hindsight, it is necessary that taxpayers review their transfer prices to ensure compliance with the arm’s length standard before the 2018 financial year end.

- Reviewing the arm’s length nature of the related party transactions for the financial year end;

- Designing the right TP policy, if required, for your related party transactions

- Preparing contemporaneousTP documentation for statutory requirement; and

- Addressing any TP related queries which you may have received from the IRAS.

If you require our assistance on this matter, please do not hesitate to contact us at [email protected].