- Americas

- Asia Pacific

- Europe

- Middle East and Africa

FRS 115 - Revenue from Customer Contracts: Income Tax Implications

Introduction

FRS 115 was issued by the Accounting Standards Council on 19 November 2014. It is effective from annual periods beginning on or after 1 January 2018. This financial reporting standard applies to revenue contracts which an entity has with its customers.

Under FRS 115, an entity is required to recognise revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services, by applying the following steps:

a) Step 1: Identify the contract(s) with a customer;

b) Step 2: Identify the performance obligations in the contract;

c) Step 3: Determine the transaction price;

d) Step 4: Allocate the transaction price to the performance obligations in the contract and

e) Step 5: Recognise revenue when (or as) the entity satisfies a performance obligation.

For tax purposes, the accounting changes under FRS 115 are relevant to taxpayers because the accounting profit is the starting point for the computation of their tax liabilities.

The IRAS issued an e-Tax Guide on 16 November 2018 titled “Tax Treatment Arising from Adoption of FRS 115 or SFRS(I) 15 - Revenue from Contracts with Customers” (hereafter referred to simply as the “e-Tax Guide”) that outlines the tax treatment relating to the adoption of FRS 115 for accounting purposes.

The basic principle laid out in the e-Tax Guide is that, with the adoption of FRS 115, the accounting revenue determined in accordance with these standards would continue to be accepted as the revenue for tax purposes, except in cases where specific tax treatment has been established through case law or where the accounting treatment significantly deviates from the tax principles. Taxpayers are not given a choice to opt in or opt out of the FRS 115 tax treatment.

This article sets out some of the key guidance provided in the e-Tax Guide.

Tax Consequences of Adopting FRS 115

As explained above, the IRAS has indicated that the accounting revenue determined in accordance with FRS 115 principles will be accepted as the revenue for tax purposes in most cases with certain exceptions:

1. Where specific tax treatment has been either established through case law or provided under the law; and

2. In cases where the accounting treatment deviates from tax principles.

An example of specific tax treatment established through case law is profits of property developers are recognised for tax purposes when a property development project is substantially completed (i.e. when the Temporary Occupation Permit is granted) regardless of the accounting method used to recognise the revenue of the development project. With the adoption of FRS 115, this tax treatment shall continue to remain the same.

An example where accounting treatment deviates from tax principles is the case of revenue contracts that involve significant financing components. In determining the transaction price under FRS 115, an entity shall adjust the promised amount of consideration for the effects of the time value of money if the timing of payments agreed to by the parties to the contract (either explicitly or implicitly) provides a significant benefit of financing the transfer of the goods or services to the customer or the entity.

This happens, for example, in a situation where an entity is to sell a particular product to a customer with the promise of cash receipt upfront but delivers the goods in 2 year’s time. The reverse example would be a case whereby an entity is to sell a particular product to a customer (upfront delivery) but receives a deferred cash payment 2 years later.

In both the situations cited above, there is an element of interest income (in the case of deferred receipt of payment upon services rendered upfront) or interest expense (in the case of upfront receipt of payment but where the performance of services are deferred till later) that needs to be separately recorded from the revenue contracts with customers under FRS 115.

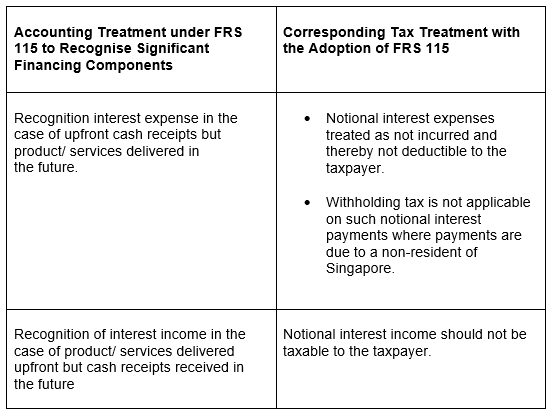

Such interest expense and interest income are treated as notional adjustments made for accounting purposes only and will be disregarded for tax purposes.

The tax treatment of such notional adjustments is summarised in the table below:

Transitional Tax Adjustments in the Year of Assessment when FRS 115 is Adopted

When FRS 115 is adopted in the initial Year of Assessment (hereafter referred to as “initial YA”), there may be a need to make accounting adjustments to the retained earnings to adjust for over-recognition or under recognition of income attributing to the prior years before FRS 115 was in operation.

To avoid the need of revising prior years' tax returns, the IRAS has indicated that any downward transitional adjustment that is revenue in nature would either be deducted from the amount of exempt income (if the adjustment relates to prior YAs’ exempt income) or allowed as a deduction, in the initial YA. The related revenue would be taxed accordingly when it is subsequently recognised under FRS 115 in future YAs.

Similarly, any upward transitional adjustment that is revenue in nature would be subject to tax in the initial YA.

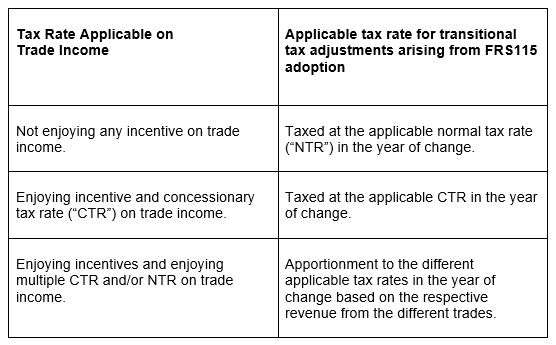

For ease of compliance, the IRAS has stipulated that the transitional adjustments as described above would be taxed or deducted at the rate(s) applicable to trade income being taxed in the initial YA. This approach minimises efforts to trace each adjustment back to the year in which the transaction arose and the applicable tax rate then. In this regard, the tax rates that would apply for each instance in the relevant YA would be as follows:

The transitional tax adjustments made in the initial YA when FRS115 is adopted may result in additional cash flow burden to taxpayers if there are any upward tax adjustments which are subject to tax. The IRAS has indicated that they are prepared to grant instalment plans for payment of taxes arising from this to taxpayers facing financial hardship. This will be on a case by case basis.