Recent advances in data analytics and machine learning are providing banks with powerful new tools for gaining insights into their customers' needs and behaviors.

Through the use of advanced predictive and prescriptive analytics, banks are applying technology in ways that can have a direct and tangible impact on their ability to access and apply useful business intelligence capabilities. The potential benefits of these sweeping new advances can be seen in a variety of areas, including enhanced anticipation and prediction of possible customer churn, improved effectiveness of cross-selling and marketing activities, and greater efficiency and accuracy in anti-money laundering (AML) and other compliance initiatives.

By recognizing the potential offered by advanced analytics and launching a proactive effort to harness the power of transformative technological advances, banks have the opportunity to improve overall performance and efficiency and to achieve a positive return on their technology investment.

Data Science Overview

In the broadest sense, the practices of data science and business intelligence can be traced back to the earliest days of computers, beginning with pioneering data storage and relational database models in the 1960s and 1970s. Over the next several decades, more complex and sophisticated database standards and applications were developed, concurrent with the growing demand for real-time data availability and reporting capabilities.

With the increased use of data visualization and advanced analytics in the past few years, these advances have begun to accelerate rapidly. Today, data science – the process of discovering hidden insights from massive amounts of structured and unstructured data – employs highly sophisticated technology such as data mining, machine learning, and advanced analytics.

These advanced analytical capabilities fall into four general categories:

- Descriptive analytics, which describe what happened. A simple example would be a weather report that describes recent and current conditions.

- Diagnostic analytics, which explain why something happened. These analytics are comparable to a meteorologist’s study of air currents, cold and warm fronts, and other factors that help us understand what caused the weather conditions that were observed.

- Predictive analytics, which tell what to expect next. In the weather analogy, meteorologists apply their understanding of the diagnostic data to provide short- and long-term weather forecasts that describe what conditions will be like in the near future.

- Prescriptive analytics, which tell what to do about something that has happened. These analytics are comparable to weather alerts, watches, and warnings that advise people on how to prepare for a storm, heat wave, or other coming event.

Note, however, that applying prescriptive analytics in banking can take things one step further than this weather-related analogy suggests. After all, no one can actually change the weather – wather alerts can only help people prepare for what’s expected.

In banking, however, prescriptive analytics can be used to do more. In addition to helping banks prepare for coming economic and customer trends, prescriptive analytics can provide management teams with insights that could help them actually alter the expected outcomes through changes in strategy, programs, policies, and practices. Tapping into this capability is how data science and business intelligence can provide genuine value to a banking organization.

The Power and Potential of Advanced Analytics

Many banks already are achieving significant benefits using currently available analytics tools such as machine learning, a type of artificial intelligence that provides computers with the ability to learn without being explicitly programmed.

For example, if a bank is experiencing an unacceptably high level of customer churn, it can draw on data from a variety of inputs – such as customer data, product information, transaction data, and records of customer interactions – to develop a list of behaviors and conditions that indicate a customer’s propensity to discontinue his or her relationship with the bank. Using machine learning and other prescriptive analytics capabilities, the bank can then develop customer relationship strategies that are tailored specifically to retain high-risk customers and build loyalty.

AML programs also offer many promising opportunities for the application of advanced analytics and machine learning to identify customer behaviors and transactions that are most likely to generate suspicious activity reports. In addition to these two clear-cut examples, many banks are applying advanced analytics and achieving comparable benefits across a wide variety of other bank functions, including:

- Customer relationship management. Examples include developing behavior-based customer segmentation models and identifying and targeting high-value customers.

- Marketing and sales. Examples include enhanced channel optimization and improving cross-sell and up-sell initiatives.

- Asset management. Examples include better profitability analyses and using predictive models to optimize ATM cash replenishment schedules.

- Operations. Examples include more accurate default probability analysis, improved lending analysis by branch and product, and better branch budgeting and forecasting.

- Workforce development. Examples include employee churn predictions, predictive staffing schedules, and improved staff utilization.

- Risk management. Examples include more effective stress-testing regimens, improved fraud and AML analytics, and integrated risk and compliance reporting.

The Current State of Data Science in Banking

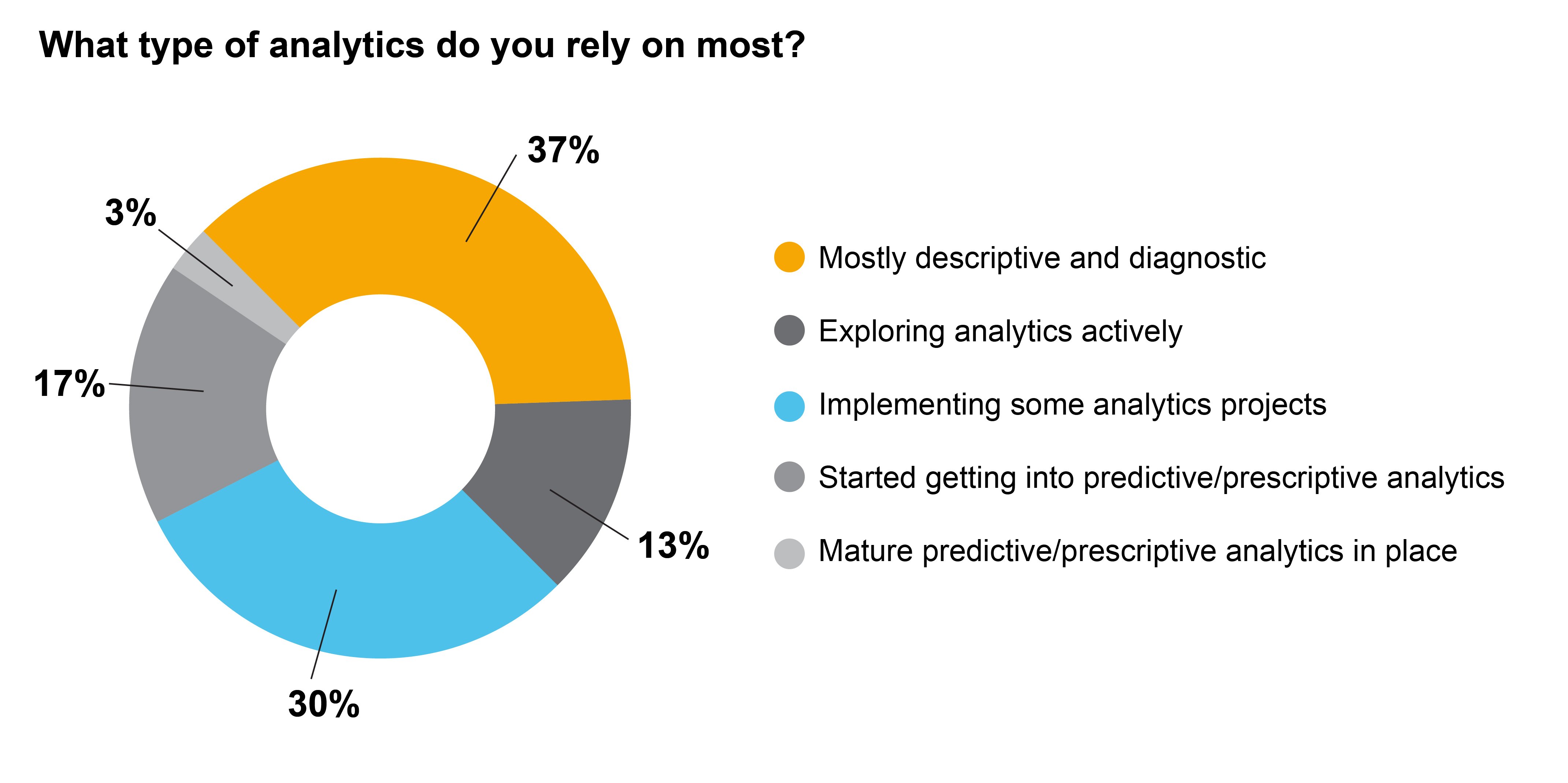

Industry observations suggest a growing number of banks recognize the potential value of advanced analytics and are actively pursuing these capabilities. For example, in a recent Crowe webinar involving bank executives from a broad array of organizations, a majority of participants (63 percent) said they were interested in moving beyond descriptive and diagnostic data studies, and they either were exploring more advanced analytics or already implementing more advanced projects. (See Exhibit 1.)

Exhibit 1: Current State of Analytics Maturity

Source: Crowe webinar survey, June 29, 2017

Source: Crowe webinar survey, June 29, 2017

As their analytics maturity levels increase, banks can expect to achieve even greater value from their investment in data. Many have already achieved some of the benefits of analytics maturity, such as operational cost reductions and the modernization of business intelligence and data warehousing. For most, however, much greater value will be realized in the future as self-service analytics and new insights lead to new business models and transformative change.

Getting Started – a Four-Phase Approach

When making the transition to more advanced analytics, it is not uncommon for banks to encounter some hesitancy and uncertainty regarding whether they have the needed technological capacity, adequate governance, and sufficient resources. These concerns can cause paralysis and greatly delay or diminish the potential benefits.

In many cases, banks can overcome these obstacles by managing the transition to advanced analytics as part of a structured process. One example of such a process – in this case, a process comprising four phases – is illustrated in Exhibit 2. Each of the four phases is executed through the performance of specific tasks, which in turn produce defined outputs and ultimately lead to improved predictive analytics capabilities.

Exhibit 2: A Four-Phase Approach to Advanced Analytics Execution

Phase 1: Data Discovery

| Tasks | Output |

|

|

Phase 2: Data Exploratory Analysis

| Tasks | Output |

|

|

Phase 3: Model Development

| Tasks | Output |

|

|

Phase 4: Finalization

| Tasks | Output |

|

|

Source: Crowe analysis

By employing a defined, phased approach, it can be possible to begin achieving tangible results in a matter of months, providing rapid proof of value and building momentum for additional business intelligence initiatives.

As machine learning capabilities continue to expand, advanced predictive and prescriptive analytics are likely to become even more accessible – and even more effective at generating useful insights and making a positive impact on the bottom line. By harnessing the power of these transformative technological advances, banks have the opportunity to strengthen their competitive position, enhance efficiency, and improve their overall performance.