- Americas

- Asia Pacific

- Europe

- Middle East and Africa

Credit balance management for healthcare

Take care of your credit balances – the easy way.

Credit balance management eats up time and staff resources, so it often ends up on the back burner. Our comprehensive approach uses technology to address and resolve credit balances more efficiently, with minimal impact to your team.

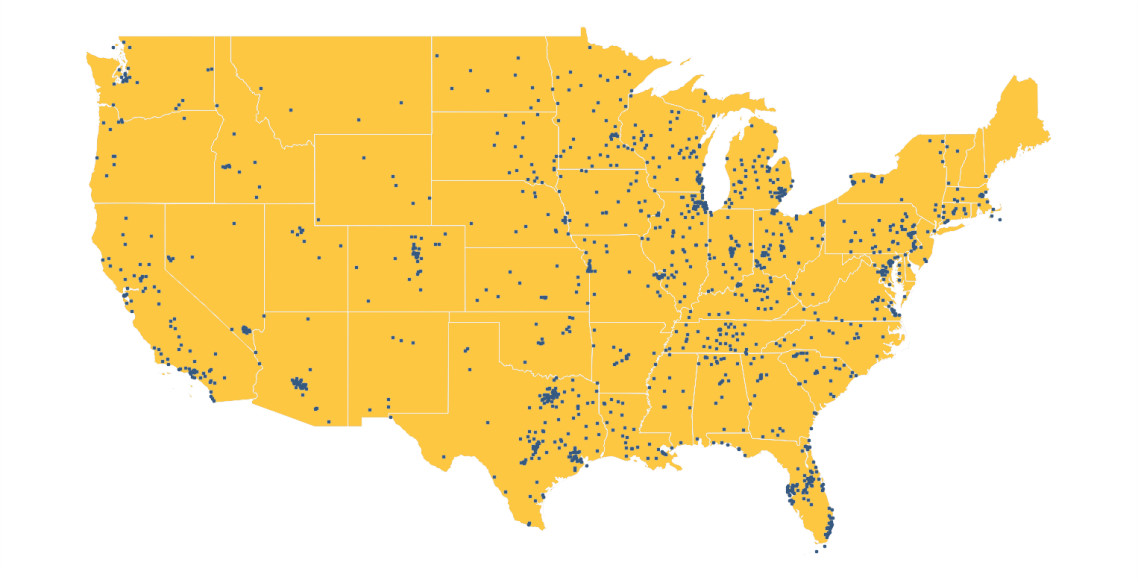

We already manage credits for 2,000+ facilities.1

When you neglect credit balances, there’s risk.

It often feels like revenue cycle resources are better spent bringing money into your facility than sending it out, so it’s easy to prioritize other tasks over healthcare credit balances.

But that means you’re taking your chances with risks, including reputational harm and the cost of audits and penalties.

Crowe can help you take control of your credit balances, so your team can focus on more activities that are critical to your business.

We can help organizations resolve credit balances efficiently and build goodwill with patients at the same time.

Technology is the key to resolving credit balances quickly and reliably.

Quick impact

Using machine learning, we make it easier for you to keep what you can. That adds up, enabling you to turn credit balances from a cost center to a net positive return on investment.

Holistic credit balance approach

Our approach doesn’t just remove nonvalue accounts. We address exemptions, adjustments, patient refunds, unapplied cash, and unclaimed property.

Limited staff involvement

Save your staff the time and energy of resolving credit balances manually. When we do the work of credit balance management, your people can focus on positive cash flow activities.

3 steps to easy credit balance management.

Let’s have a quick conversation.

We can identify savings opportunities.

Make your workforce happy (they don’t want to do it either).

Let’s have a quick conversation.

We can identify savings opportunities.

Make your workforce happy (they don’t want to do it either).

We’ll take credit balance management off your plate.

Your staff will thank you when they’re able to focus on activities that drive business value.

1 Definitive Healthcare, Sept. 14, 2022.

I don’t want to think about credit balances anymore.

Related offerings

Automated reconciliation

Avoid the write-offs that come with unapplied cash using our automated reconciliation solution, the only three-way match tool on the market.

Crowe Account Resolution AI

Our solution steers you away from low-value or no-value accounts to make your cash collections process more efficient.

Outpatient charge capture

Create sound, sustainable documentation, charge capture, and coding practices that can lead to more revenue for your organization.

Avoid the write-offs that come with unapplied cash using our automated reconciliation solution, the only three-way match tool on the market.

Our solution steers you away from low-value or no-value accounts to make your cash collections process more efficient.

Create sound, sustainable documentation, charge capture, and coding practices that can lead to more revenue for your organization.