Successful bankers understand how critical it is to attract new customers and build their loyalty. Nurturing productive customer relationships often starts with core deposits.

Core deposits are a primary source of money for banks and credit unions. In general, core deposits range from smaller sources like consumer savings accounts to larger sources such as business checking and money market accounts. These deposits serve as a source of funds to make loans to depositors.

Building relationships

After attracting core deposits, banks can nurture customer relationships and build loyalty. The goal is for customers to use your bank for all their banking needs and recommend the bank to friends and family. That’s a great way to strengthen the organization.

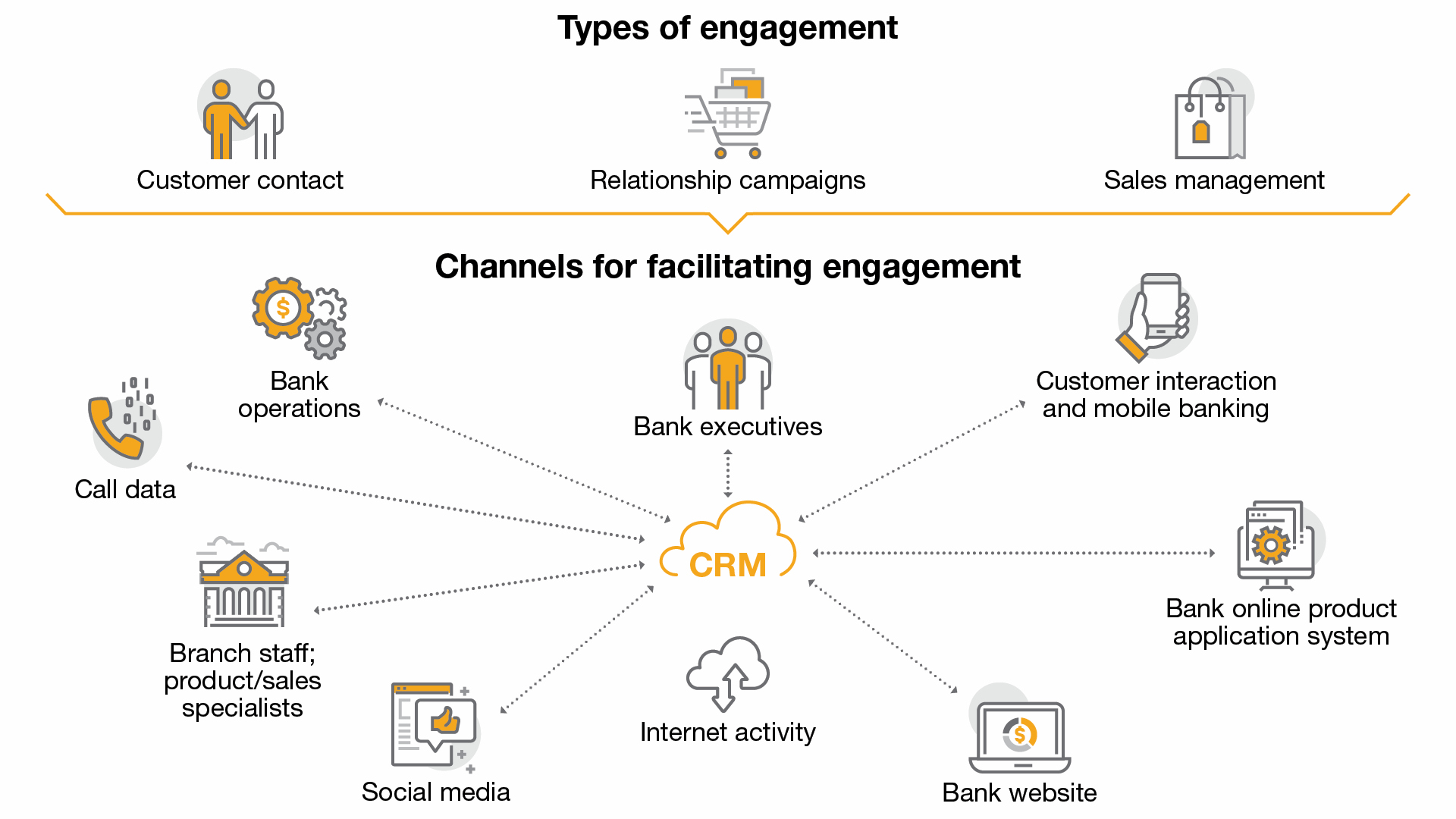

How can banks more effectively grow core deposits and cross-sell to established customers? By building social networks, acquiring additional leads, operating more efficiently, and improving customer loyalty. To meet these challenges, a bank needs a dedicated team and the right CRM software.

Established bankers who have built relationships with their customers help their organizations lead the market. In an environment of extensive digital options and limited face-to-face interaction, personal relationships still matter.

CRM for banking

To accomplish organizational goals, a bank’s marketing, sales, and customer service teams need effective tools. In addition, management must have up-to-date information for making strategic decisions for the entire organization.

Crowe CRM for Banking, powered by Microsoft Dynamics™ 365, is a customer relationship management solution that modernizes and automates bank operations. It is designed to help banks:

- Gain a 360-degree view of the customer by integrating sales, marketing, and customer service functions and enabling users to access and share information across departments and product lines.

- Automate workflows by streamlining processes such as customer onboarding or qualifying a commercial line of credit across functional areas.

- Leverage business intelligence by using predictive analytics to understand and expand the customer lifetime value and help relationship managers recommend appropriate products or services.

- Use activity management to quickly capture call notes and schedule timely follow-up – which can accelerate lead conversion rates, enable a more proactive approach to customer communication, and increase revenue opportunities.

- Improve marketing by prioritizing leads, tracking referrals, monitoring social insights, and recording interactions in one place. This information can inspire more targeted marketing campaigns and customer communications.

- Enhance lead and referral management by automating lead management and the sales qualification process in one central location. The solution creates incoming leads from email messages and uses guided dialogues to streamline the qualification process.

The familiar Microsoft Dynamics interface makes Crowe CRM for Banking straightforward for employees to learn with minimal additional training. The solution works seamlessly with LinkedIn and other Microsoft™ products such as Outlook™ and Word. It also is compatible with advanced analytics tools like the Microsoft Power BI™ application to help expand the reach of customer information to teams and executive decision-makers.

Crowe CRM for Banking integrates marketing, sales, and service functions, providing management and staff with tools and information to build relationships by efficiently delivering high-quality, personalized service across all channels.

Visit CroweCRM.com for more information about Crowe CRM services for Microsoft Dynamics 365 software. Have a question or interested in evaluating the CRM functionality in Dynamics 365? Contact us today.

Microsoft, Microsoft Dynamics, Outlook, and Power BI are either registered trademarks or trademarks of Microsoft Corp. in the United States and/or other countries.