Successful banking requires astute decision-making, streamlined processes, and effective data management. All three contribute to a secure, healthy, and profitable organization.

Crowe works with more than 1,800 financial services organizations across the country, including about two-thirds of the top 100 U.S. banks. We’ve learned a lot about bankers’ concerns and needs. Based on our clients’ feedback, the Crowe team has developed four dashboards – part of the Crowe CRM for Banking solution – that can help bankers and their teams operate more efficiently and productively.

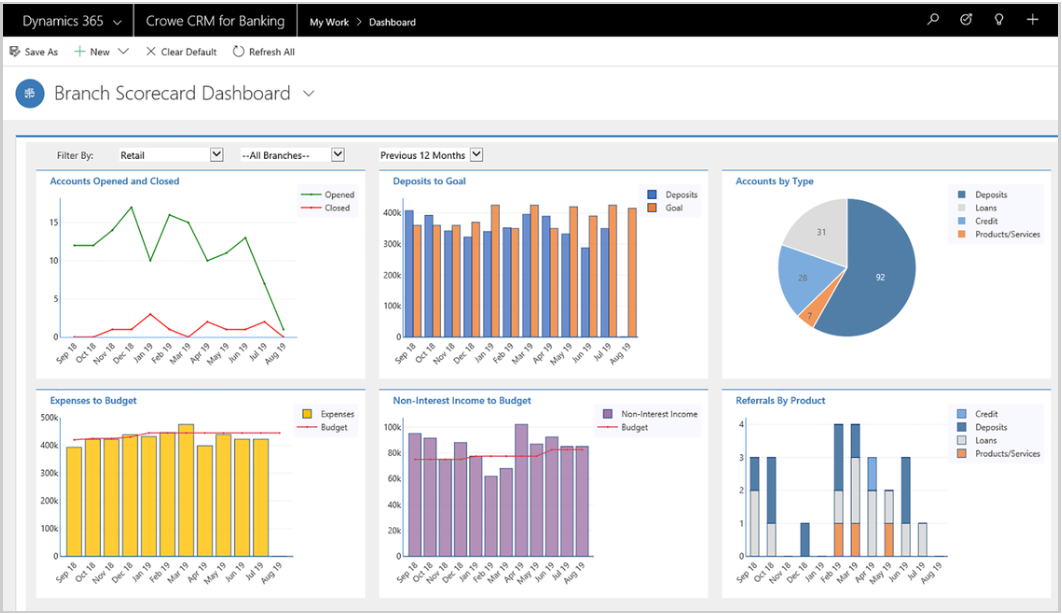

1. Branch scorecard dashboard

The branch scorecard dashboard (Exhibit 1) provides an easy, efficient way to measure key performance indicators (KPIs) and gain an accurate view of a branch’s progress toward performance targets. Although a bank’s overall health may be good, it’s important to know how individual branches are progressing toward their goals.

One dashboard metric shows real-time data of the number of opened or closed accounts for a specified period. This data can help in assessing the success of marketing campaigns and identifying other factors that might be affecting customers.

The dashboard also enables users to apply various filters to:

- Identify opportunities for referrals

- View a graphic display of account totals

- Determine timing for upselling or cross-selling additional products

- Track income and expenses against budgets

- Measure the bank’s overall efficiency and productivity

Exhibit 1: Branch scorecard dashboard

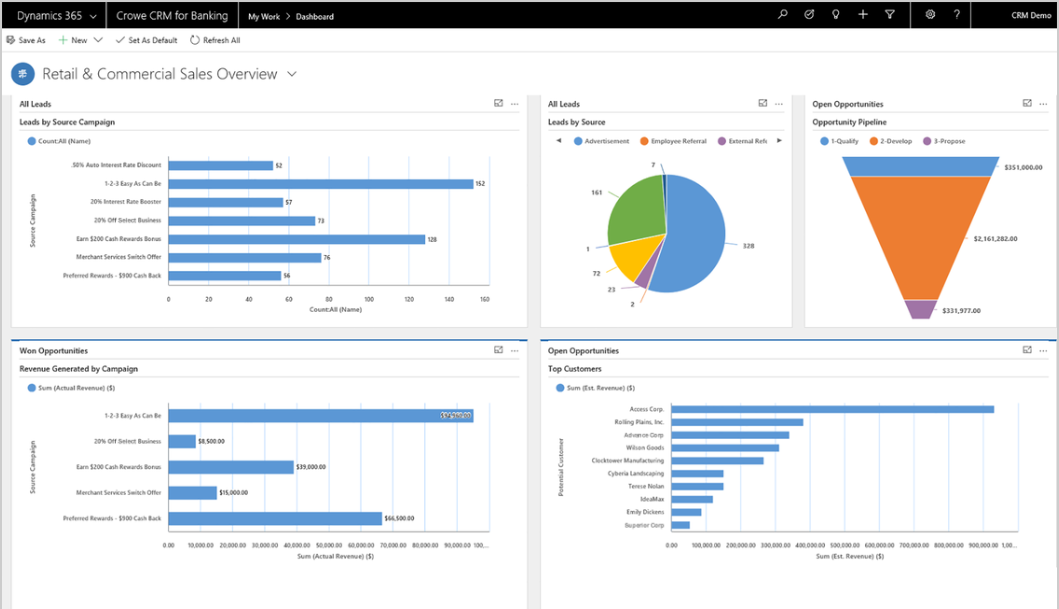

2. Retail and commercial sales overview dashboard

Sometimes, banks judge their success in terms of a credit culture but might not take their deposits as seriously. A strong deposit culture is important in building sales leadership, reaching marketing goals, supporting sales governance, and measuring success compared with leading performance indicators.

The sales overview dashboard (Exhibit 2) provides the closed loop marketing insight necessary for measuring the effectiveness of marketing – from the release of a campaign to the leads generated, pipeline impact, and revenue created.

Exhibit 2: Retail and commercial sales overview dashboard

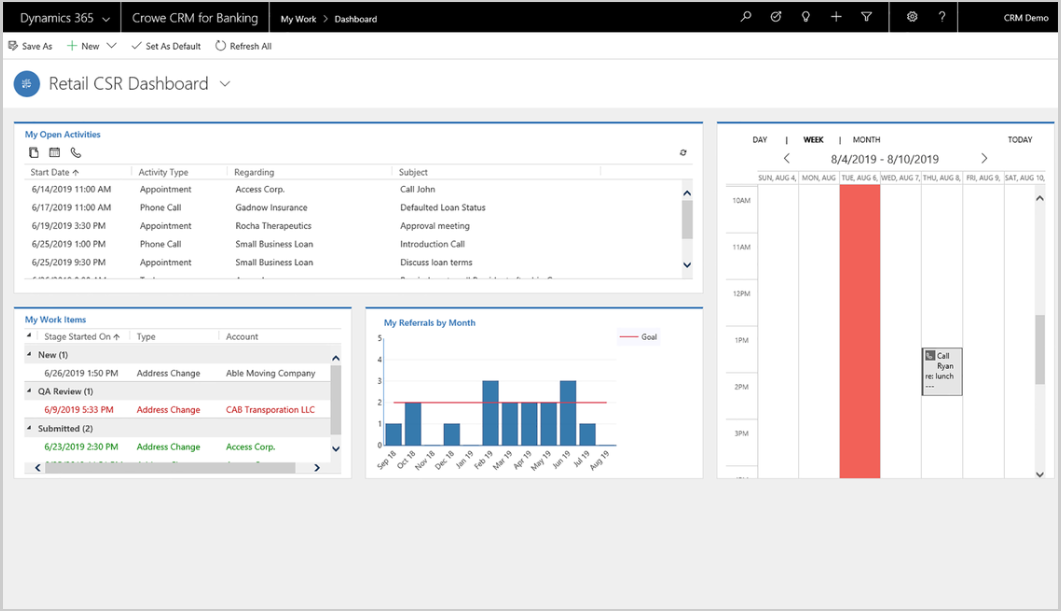

3. Retail customer service representative dashboard

Customers are a bank’s most important asset. When customer information is scattered throughout various departments and systems, it’s difficult to get a complete picture of customer relationships and the products and services customers have been offered.

The customer service representative (CSR) dashboard (Exhibit 3) is designed to provide a 360-degree, real-time view of customer data. Because relevant information is easily accessible, the dashboard can serve as a CSR’s command central. A segmented list of work items requiring attention helps with organizing and prioritizing, while the calendar enables CSRs to determine availability and quickly schedule new activities.

Exhibit 3: Retail CSR dashboard

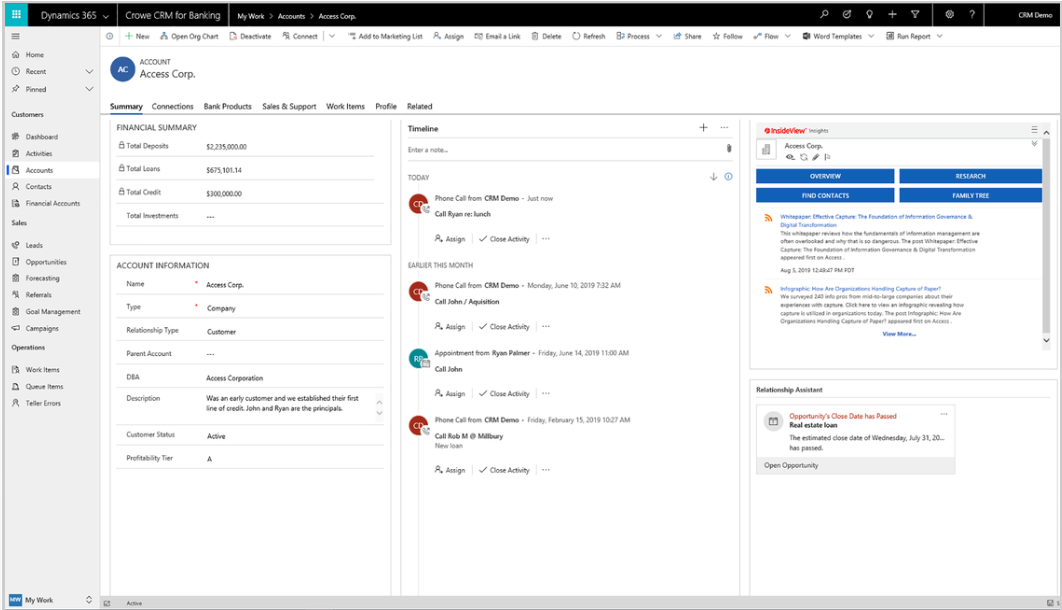

4. Customer account overview dashboard

Banks need to move from siloed customer data to an integrated, single view of the customer. The customer account overview dashboard (Exhibit 4) provides a wide variety of information, including a:

- Consolidated customer profile including contact history

- Financial summary including total volume and type of accounts

- Field for entering notes upon each contact with the customer and ideas for next steps

Each consolidated customer profile can illuminate new opportunities for strengthening customer relationships. It also can help CSRs improve efficiency, provide decision-makers with more comprehensive information for assessing risk, and enable marketers to more effectively develop and target products and services.

Exhibit 4: Customer account overview dashboard

Crowe CRM for Banking

These four dashboards and others are available in Crowe CRM for Banking, an add-on solution powered by the Microsoft Dynamics™ 365 platform. Crowe CRM for Banking equips banking teams with tools and information to more efficiently deliver high-quality, personalized service for interactions across all communication channels. It gives managers and team members access to the data they need and want.

By using the many tools in Crowe CRM for Banking and Dynamics 365, banks and credit unions can increase customer satisfaction, expand customer relationships, and improve efficiency and revenue.

Visit CroweCRM.com for more information about Crowe CRM services for Microsoft Dynamics 365 software. Have a question or interested in evaluating the CRM functionality in Dynamics 365? Contact us today.

Microsoft and Microsoft Dynamics are either registered trademarks or trademarks of Microsoft Corp. in the United States and/or other countries.