menu

close

Newsletters Sign-UpEventsNewsContact Us

search

close

- Americas

- Asia Pacific

- Europe

- Middle East and Africa

AlbaniaAndorraArmeniaAustriaAzerbaijanBelgiumBulgariaCroatiaCyprusCzech RepublicDenmarkEstoniaFinlandFranceGeorgiaGermanyGreeceHungaryIrelandItalyKazakhstanLatviaLiechtensteinLithuaniaLuxembourgMaltaMoldovaNetherlandsNorwayPolandPortugalRomaniaSerbiaSlovakiaSloveniaSpainSwedenSwitzerlandTajikistanTurkeyUkraineUnited KingdomUzbekistan

Global Mobility Services

- Company Restructuring in the UAE

Company restructuring in the UAE may involve the change of company’s domicile - e.g. from UAE onshore to a Free Zone or vice versa, from one free zone to another-, company name, type of entity, merger and acquisition. Such changes have significant impact on the work permit/residence permit of the employees and their dependents. Depending on the size of the companies, if not planned well, this can put both the companies and the employees in the non-compliance position, which may lead to financial penalties, blacklisting of the companies, and deportation of the employees. In order to guide our clients during this restructuring stages, Crowe UAE team is usually involved prior to, during, and post restructuring. With this approach, the non-compliance risks can be identified in the early stages so that necessary mitigative measures can be implemented in time.

- Outbound Employment

Being situated in one of the world’s business hubs, companies in the UAE, whether part of multinational groups or local UAE groupos, are by default involved in international businesses. Apart from inbound movement of employees from outside the UAE, there are also significant movement of employees moving out of the UAE either to work with affiliated entities or to work on their clients’ site. In the absence of tax and social security for most of the employees in the UAE, UAE entities tend to overlook their impact on the employees’ net salary, especially when they are on short term secondment outside the UAE. In coordination with the Crowe Global network, we not only can support such entities in assessing the risks but also optimize the social security and tax structure of the employees’ salaries, so that there is no unnecessary loss of tax, social security, or caused by non-compliance penalties. - UAE-Inbound Employment

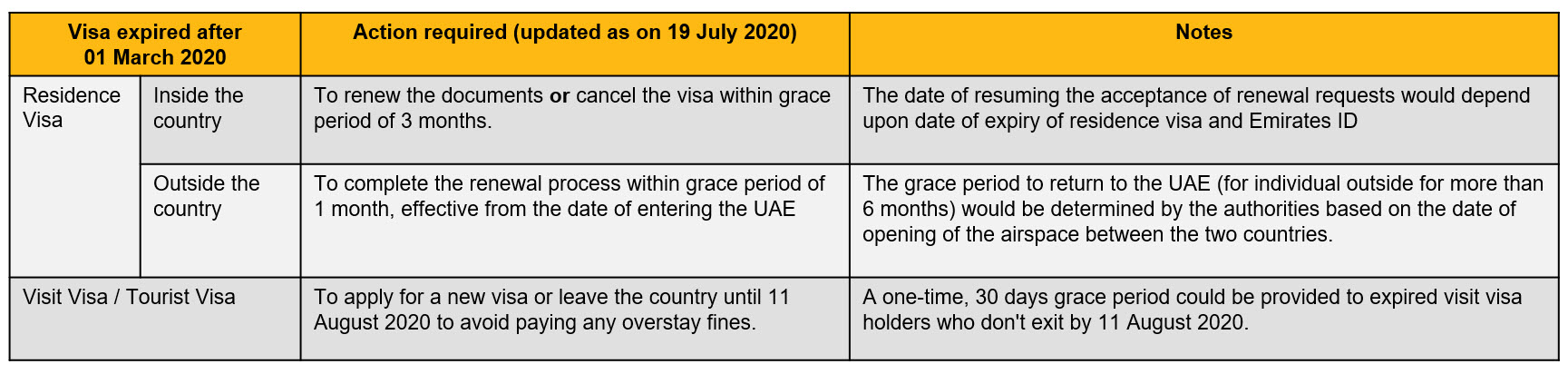

The workforce in the UAE is still dominated by the non-UAE Nationals and thus, UAE companies have major burden that the employees in compliance with the work permit/residence permit in the UAE prior to employment. Although the changes of the UAE labor laws are not frequent, the procedures for obtaining the work permit/residence permit may vary from time to time. Allocating a full-time staff to handle such administration can be tedious and frustrating for the staff as well as a non-value-added HR activity for the company. This case has been seen when the turnover of the entities’ employees are low so that the dedicated staff is not in frequent communication with the relevant authorities for this matter. As Crowe UAE, we are in frequent contact with the authorities and we provide an end-to-end work permit/residence permit support for the new joiners. Whilst planning for the immigration procedures of the inbound employees, Crowe UAE will also take the similar cases handled into consideration. Upon request, our support can be extended to the family members of the client’s employees.

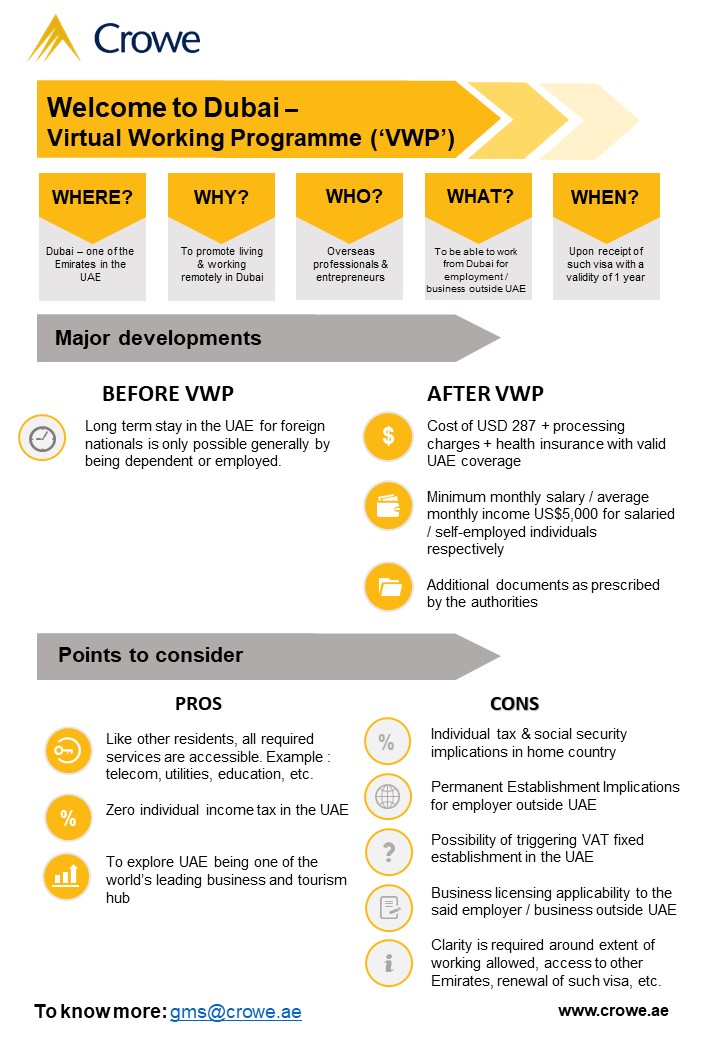

Virtual Working Programme

In line with the new norm of ‘Remote Working’, Dubai has launched the Virtual Working Programme. It enables overseas remote working professionals to live in Dubai while continuing to serve their employers outside UAE.

Related Details

Global Payroll Solution

With Crowe Global outreach, we are able to not only provide you with the assurance to keep your payroll administration in compliance with the local laws and regulations

Global Payroll Solution

With Crowe Global outreach, we are able to not only provide you with the assurance to keep your payroll administration in compliance with the local laws and regulations